Wealth Preservation

Lifestyle Planning

Elevated Expertise

Wealth Preservation

Lifestyle Planning

Elevated Expertise

Wealth is complex. We can help you simplify it.

As a high net worth individual, your financial needs are unique and require a tailored approach. Our team of seasoned financial advisors excel in crafting personalized wealth management strategies that align with your long-term goals, risk tolerance, and lifestyle aspirations. We understand that your time is valuable, and we aim to streamline your financial affairs, allowing you to focus on what truly matters to you.

At Wiser Wealth Management, our advisory services go beyond mere investment management. We take a comprehensive approach to wealth management, considering all aspects of your financial life. This includes tax planning, estate planning, risk management, charitable giving, and generational wealth transfer strategies. We aim to optimize your financial position in every facet, partnering with you for the long-term.

Unlock Your Wealth Potential with Our Elite Financial Advisory Services

Entrusting your wealth to an expert financial advisor that has a fiduciary obligation to act in your best interest offers peace of mind. By partnering with Wiser, you can focus on your core passions, family, and personal endeavors, knowing that your financial affairs are in capable hands. We will act as your financial steward, working diligently to protect and grow your wealth, so you can enjoy the fruits of your labor without undue stress.

Click here to learn more about awards we have received as well as our firm’s ratings, advisor designations and associations.

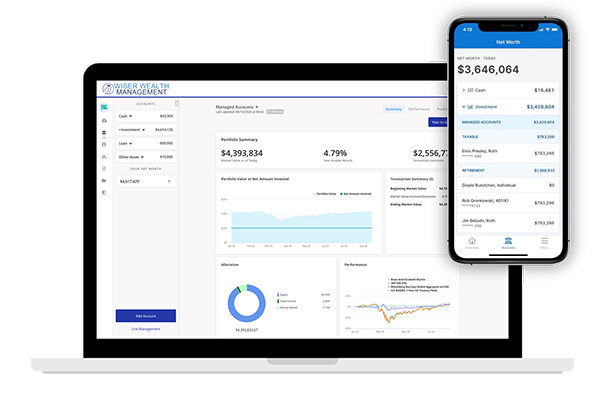

All of your financial planning needs in one place.

We help you determine which path is best for you.

Are you looking for portfolio management with comprehensive financial planning?

Wiser offers a unique and total wealth management experience including portfolio management and comprehensive financial planning that is tailored to your specific needs. We have a team of financial advisors and a network of trusted CPAs and attorneys to guide you through every aspect of life, so you can achieve financial freedom.

We’ll develop a portfolio that is aligned with your financial plan, so you can focus on what matters. With our services, you will be able to relax and enjoy life knowing that your finances are in good hands.

Do you manage your own finances but want professional advice on a specific topic?

Financial planning is a necessary and important part of life, but it doesn’t have to be hard. You can get advice from someone who has done this for over 20 years! We’re here to provide the expertise and support you need to stay on the path to achieve financial freedom.

Working with a financial planner can seem like a daunting task, but it doesn’t have to be. We’ll take the time to get to know you and understand your unique needs so that we can provide tailored advice to help you meet your specific goals.

How Wiser Delivers White-Glove Service

We’ll take the time to gain a deep understanding of your needs and goals. We want to learn your communication style and which values are most important to you. By tailoring our services to your specific needs, we can help you achieve your financial goals with confidence.

You are unique. Your wealth should be managed that way as well.

With over 20 years of experience in the financial industry, we possess a deep understanding of the intricacies of managing wealth in dynamic markets. Our expertise allows us to navigate through complex financial landscapes, identifying opportunities that are most advantageous for your unique financial situation.

We understand that managing wealth can be a complex and time-consuming task. However, Wiser is here to alleviate that burden and ensure that you have a robust financial strategy in place to preserve and grow your wealth, ultimately securing a legacy for generations to come.