PEACE OF MIND

TRUSTWORTHY ADVICE

FINANCIAL CLARITY

PEACE OF MIND

TRUSTWORTHY ADVICE

FINANCIAL CLARITY

Click here for important disclosure information and to learn more about awards we have received and our firm’s ratings, advisor designations, and associations.

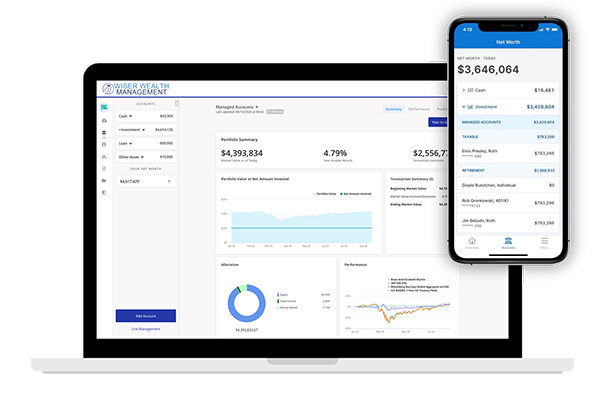

Are your investments aligned with your financial goals?

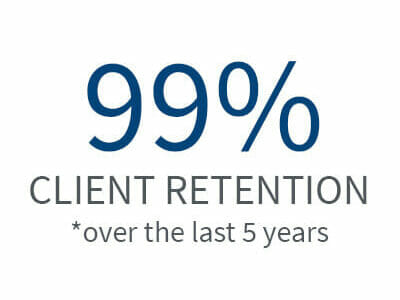

You work hard to achieve your financial goals, but managing every aspect on your own can be challenging. That’s where we come in. Making wise financial decisions is crucial, and having a team of advisors can help you navigate your options and make the best choices for your future. With unlimited access to your dedicated financial advisor, you’ll always have guidance when you need it most.

At Wiser Wealth Management, our services extend beyond investment management. We take a comprehensive approach, considering all aspects of your financial life, including retirement planning, tax strategies, estate planning, risk management, charitable giving, and more. Our goal is to optimize your financial position in every area, partnering with you for the long term.

Unlock Your Wealth Potential

Entrusting your wealth to a financial advisor with a fiduciary duty ensures that your best interests are always the top priority. As your dedicated financial steward, we work diligently to protect and grow your wealth, allowing you to enjoy the rewards of your hard work with confidence and peace of mind.

Meet the Marietta Financial Advisors who will guide you through every stage of your financial journey.

We help clients write their own stories of success. Yours could be next!

Important Disclosure: The above reviews feed directly in real time and are sorted by newest to oldest. These reviews are from our business page on Google, a third-party review aggregator. We do not control or curate the content, although we do respond to new reviews. All reviews appear to be client testimonials, although reviews could be posted by non-clients who want to endorse our services. We are not able to confirm the identities of reviewers and we do not compensate anyone for their review.

Resources

Keeping you informed on important financial topics related to personal finance, investing, and more!

In these short educational videos, the Wiser team discusses a different financial topic each week.

Our podcast covers retirement planning, tax planning, investing, insurance, and estate planning.