GAIN FINANCIAL CLARITY

GAIN PEACE OF MIND

GAIN FINANCIAL CONFIDENCE

GAIN FINANCIAL CLARITY

GAIN PEACE OF MIND

GAIN FINANCIAL CONFIDENCE

Click here for important disclosure information and to learn more about awards we have received and our firm’s ratings, advisor designations, and associations.

Are you worried about making the wrong financial decision that may cost you in retirement?

Trying to find the time to navigate the complexities of planning for retirement can feel overwhelming. Most people over the age of 50 are worried about not having enough money in retirement. Many pre-retirees also don’t know who to trust. How do you hire a retirement planner in Marietta, GA that you know is working in your best interest and not their own?

Lack of financial clarity can be costly, especially when it comes to something as important as planning for retirement and managing your investment portfolio. It’s hard to make informed decisions when you don’t know what you don’t know. Wiser Wealth Management in Marietta, Georgia specializes in investment management and financial planning with no product sales or commissions, so you can reach your retirement goals with confidence.

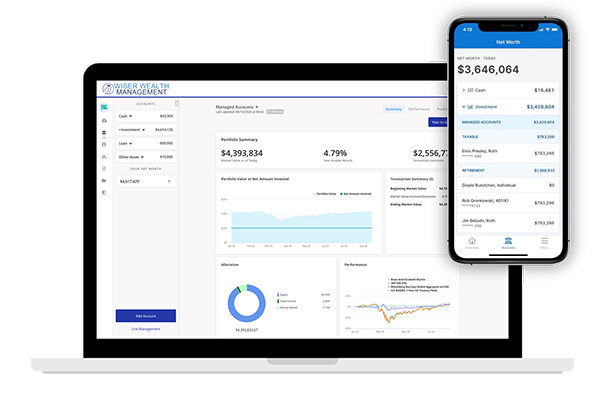

All of your retirement planning needs in one place.

We help you determine which path is best for you.

Are you looking for portfolio management with comprehensive financial planning?

Wiser offers a unique and total wealth management experience including portfolio management and comprehensive financial planning that is tailored to your specific needs. We have a team of financial advisors, a network of trusted CPAs, and attorneys to guide you through every aspect of life, so you can achieve financial freedom. With unlimited access to your dedicated financial advisor, you’ll always have guidance when you need it most.

We’ll develop a portfolio that is aligned with your financial plan, so you can focus on what matters. With our services, you will be able to relax and enjoy life knowing that your finances are in good hands.

Do you manage your own finances but want professional advice on a specific topic?

Financial planning is a necessary and important part of life, but it doesn’t have to be hard. You can get advice from a financial advisor who knows how to guide you toward your goals. We’re here to provide the support you need to stay on the path to achieve financial freedom.

Working with a financial advisor can seem like a daunting task, but it doesn’t have to be. We’ll take the time to get to know you and understand your unique needs so that we can provide tailored advice to help you meet your specific goals. With our flat fee financial planning, we equip you to make confident decisions about your financial future.

Meet the team that will help you achieve your retirement goals.

Michaela Dowdy

Financial Advisor

3 Simple Steps to Gain Confidence in Your Retirement

1.

Meet with us

We want to get a sense of who you are, where you are on your financial journey and what your goals are for retirement.

2.

Design a financial plan

We create a personalized financial plan covering everything from social security, investments, insurance, taxes, and more.

3.

Enjoy your retirement

Our team is available for anything that may arise during your journey with us! Now you get to focus on what’s important in life.

We help clients write their own stories of success. Yours could be next!

Important Disclosure: The above reviews feed directly in real time and are sorted by newest to oldest. These reviews are from our business page on Google, a third-party review aggregator. We do not control or curate the content, although we do respond to new reviews. All reviews appear to be client testimonials, although reviews could be posted by non-clients who want to endorse our services. We are not able to confirm the identities of reviewers and we do not compensate anyone for their review.

Resources

Keeping you informed on important financial topics related to personal finance, investing, and more!

In these short educational videos, the Wiser team discusses a different financial topic each week.

Our podcast covers retirement planning, tax planning, investing, insurance, and estate planning.