Important Tax Filing Reminders for 2020

Everyone has heard the saying that nothing is certain in this world except for death and taxes. Tax season is upon us again as filings were first allowed on February 12th, sixteen days later than last year. In light of this, I thought it would be a good time to address important tax filing reminders since 2020 was such a crazy year.

As we approach the April 15, 2021 deadline, it is important to remember to button up everything from last year and get your taxes filed. 2020 was an interesting year and everyone’s situation was affected differently, but you should still try to file your taxes as soon as possible. Also, pay attention to filing dates. Due to current weather situations, the Texas and Oklahoma deadlines were recently extended to June 15th. Last year in 2020 amid the pandemic, the 2019 deadline was also extended to July 15th. The fact that the dates can change is important. But the most important date to remember is the deadline for your area. Individuals who miss the deadline pay 5% of taxes owed each month that is late, up to 25%.

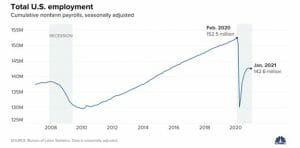

What are some of the best ways to prepare filings? Start early by gathering important tax documents. These documents may include your 2019 tax return, 2020 W-2s, and any 1099 statements. Also, collect mortgage interest or rental income statements. And if you were among the 40+ million who received unemployment income during 2020, you should receive a Form 1099-G.

If for some reason you were eligible but did not receive a stimulus check or received less than the allowed amount, you can claim a credit in what is called the Recovery Rebate Credit. It is also worth noting that unlike the unemployment amounts which are taxable benefits, the stimulus checks are not. Low to moderate income families are also able to receive an Earned Income Tax Credit (EITC) or Child Tax Credit which could reduce taxes by a maximum of up to $6,660 based on income and number of dependents.

As we have discussed in the past, many households no longer itemize their taxes with the recent increase in standard deductions. Last year, even if they didn’t itemize, many were still allowed a $300 above the line deduction for any cash contributions to charity. However, if you are someone who does itemize deductions for the year, there are a few additional opportunities to minimize your tax bill. There were some additions with the charitable deductions and medical expense deductions. For 2020, you can deduct 100% of cash donations up from the previous 60% usually allowed. Also, if you were eligible, you could get up to a 30% deduction of Adjusted Gross Income (AGI) for gifts of appreciated securities.

Last year, retirees were not required to take RMDs if they were not needed for living expenses. And if someone took a loan from their 401k or made a withdrawal, there was no 10% penalty and they can also spread-out the income tax payments over the next 3 years. Also, it is important to remember that you can still make Roth and IRA contributions for 2020 up until the tax deadline.

There are many options and variables when it comes to taxes. You should start at the beginning of every year proactively finding ways with your CPA and financial advisor to minimize taxes and optimize retirement planning. Saving just a little money can make a huge impact on paying off debts, building up reserves and investing in your retirement.

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.