What is ESG Investing?

If you keep up with financial media, you have probably read about or heard about ESG investing. It has gained traction over the years and recently been a frequent topic of discussion. But what exactly is ESG investing? It originated from a desire to create socially responsible investment opportunities where investors could restrict certain entities from portfolios like guns, liquor, etc. It has now grown more extensive and gets broken down into categories of Environmental, Social, and Governance. While there are a lot of different criteria and nuances within the categories, they can each be summed up with fairly broad definitions.

ESG: Environmental, Social, and Governance

Environmental explains how a business performs as a steward of the natural environment. It includes categories of waste, pollution, resource depletion, greenhouse gas emissions, deforestation, and climate change. Social looks at how a company treats their people. In general, social consciousness has become an important aspect of large corporate structures. It includes employee relations, diversity, working conditions, local communities, health and safety of company, and their response to dealing with conflict. Governance explains how a corporation polices itself and how it is governed. This includes tax strategies, executive structures, donations, political lobbying, corruption, bribery, and board diversity.

Does ESG investing outperform regular investing?

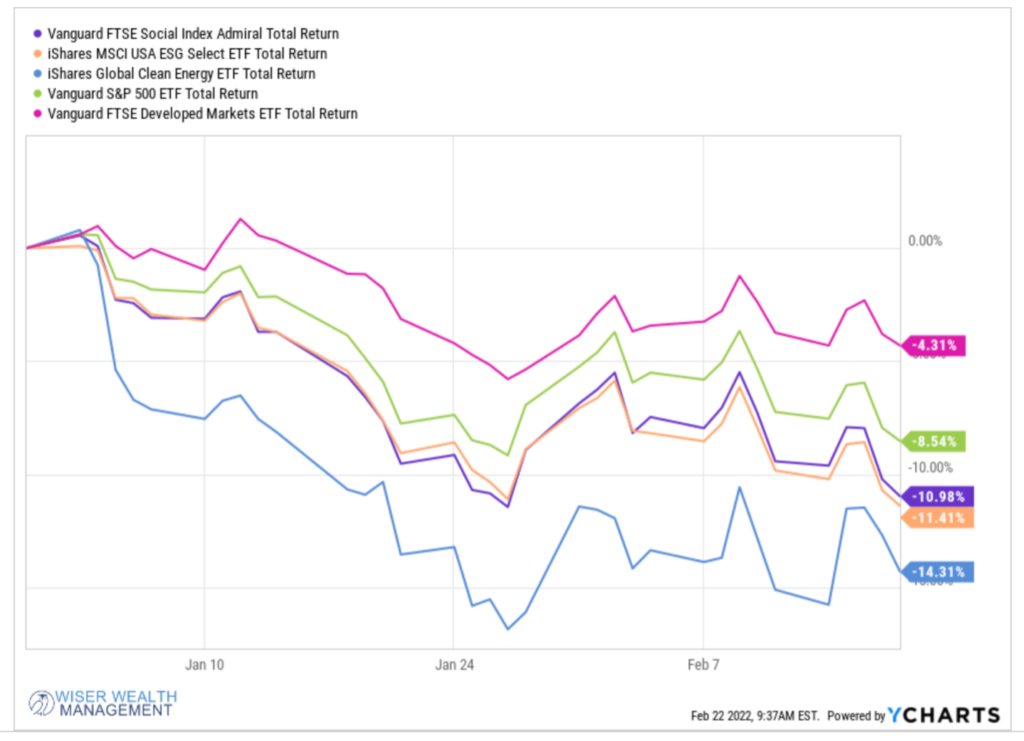

You may have also read or seen that ESG investing outperforms regular investing. However, there is not enough data to back up that claim. When reporting on ESG, people tend to cherry-pick the data, and make it say what they want it to say. ESG investing simply has not been around long enough to have significant data to compare its performance to regular investing. It also usually comes at a cost with higher expense ratios for the funds than similar indexes. As you can see below, they have similar to less returns YTD, and over the last few years, comparatively.

Is ESG investing considered a fad?

This is a tough question to definitively quantify at this time, but, yes, ESG funds could be considered a fad. From a performance perspective, the major indexes are more diversified than ESG portfolios. Therefore, it is likely that ESG investing will not perform as well over the long term. However, if you find the idea behind ESG investing compelling, you should probably find an active fund manager, like a traditional mutual fund, that is doing activist type work to make this kind of investing worthwhile. Conscientious investing or socially responsible financial plans can also include giving back to your community through local charities or volunteering opportunities that can make a positive impact as well.

Remove Politics from Your Portfolio

At the end of the day, ESG investing can become very political. And when it comes to indexing, we find it is best if you remove politics from your portfolio. We believe you should instead focus on long term healthy asset classes for diversification through low-cost broad based index funds.

Have more questions? Contact Us

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Advisor

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.