What is the Georgia 529 Plan?

What is the Georgia 529 plan?

We all want good things for our kids’ futures. For many of us, that includes giving them the opportunity to attend a college or university of their choosing. Seeing your child rise to the challenge of meeting certain GPA, test score, or extra-curricular expectations for the school of their dreams is so rewarding, and the last thing you’d want to have to do is say, “sorry, it’s not going to be possible to go because of money.” But the money aspect of higher education is very real. Getting a degree these days comes with a steep price tag. According to Justin Song at ValuePenguin.com, the average cost for in-state tuition at a four-year college is $25,000. That number jumps to $40,000 if your son wants to go out of state, or $50,000 if your daughter’s dream school is a private institution. And those numbers represent only ONE year and are increasing at rate significantly higher than average inflation. Multiply all that by four for the grand total. So, how can we prepare our families for the financial commitment of higher education? The Georgia Path2College 529 Plan is one of the most popular investment vehicles for saving for college, and the one we at Wiser Wealth Management see our clients use most often.

Originating in 2002, the Georgia 529 plans are tax efficient growth vehicles. Contributions are invested (and deductible in some cases), grown and distributed tax free if used for certain qualifying expenses, such as tuition and certain fees. Families can also access up to $10,000 annually for K-12 school tuition. There are no contribution limits, but the maximum account size allowed for Georgia is currently $235,000. Parents, grandparents, other relatives or family friends can gift up to the annual exclusion of $16,000 or up to 5 years prorated at once of $80,000 per filer or $160,000 for married filers.

The Georgia Path2College Plan, is a TIAA-managed 529 savings program featuring a year of enrollment track age-based accounts. These accounts consist of 10 portfolios, and six static investment options including four multi-fund portfolios, one individual fund, and also a Principal Plus Interest Portfolio. Minimum contributions are $25.

What changes to the Georgia 529 Plan have been made?

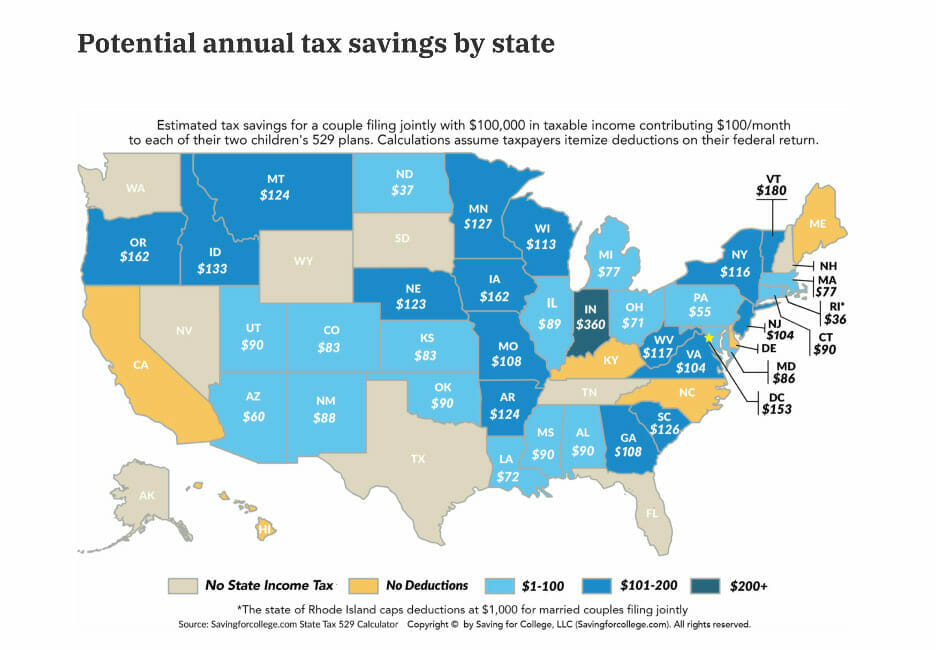

For 2021, Georgia allowed an increased deductible contribution of up to $8,000 per year per beneficiary for joint filers, and $4,000 for single filers for the Path2College plan. For example, if you contribute the maximum allowable deductible amount of $8,000 this year, it could result in tax savings of around $460. If you instead contribute $100 monthly, this results in around $69 in state tax savings.

The plan recently surpassed the $4 billion mark in assets, and at their annual meeting in March 2021, the Georgia Higher Education Savings Plan Board approved lowering program fees by nearly 70%. The board also decided to waive the state’s administrative fee and approved a new lower cost contract with TIAA-CREF Tuition Financing, Inc. who manages the plan.

This means the program management and administrative fees will fall significantly from 0.13% to 0.04%. With the recent increase in deductions and these new improvements in the fund, the Georgia Path2College Plan could become one of the most attractive college savings plans in the country.

What if my child doesn’t need the funds?

What if I invest in the plan, but then I don’t end up using the funds because my child receives a scholarship or chooses not to attend college? There are a couple options should this happen. You could use the funds for non-qualified expenses, but the earnings would then be counted as income and taxed along with an additional 10% penalty. There are, however, certain reimbursements for scholarships. If this still does not fit your situation, you can always transfer the beneficiary to another family member or go back to school yourself.

At Wiser Wealth Management, we do not personally manage Georgia 529 funds; therefore, we usually suggest Georgia residents invest through this plan. Georgia 529 plans can be great low cost, tax efficient vehicles to help supplement planning for college costs. If you have any questions regarding this plan or college financial planning in general, please let us know.

Have more questions? Contact Us

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Advisor

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.