Will you receive a child tax credit check?

Starting July 15th through the end of the year, certain households will receive increased checks for their child tax credit. Letters were sent out June 7th notifying those eligible for this tax credit, and another letter will go out soon explaining each payment. Before that, though, here’s a little information on this significant change.

What is the Enhanced Child Tax Credit?

The new enhanced child tax credit is part of the American Rescue Plan signed by President Biden back in March. While there have been credits in the past, the newest credit provides increased payments as well as never before seen upfront payments for half of the credit. The total credit increased from $2,000 to $3,000 per child under 17 and also provides an additional $600 for those under 6 or $3,600 overall per child under 6. As we have mentioned in the past, these credits are usually applied when you file your taxes. However, the American Rescue Plan changed the timeframe and half the credit will now be given upfront in actual cash payments. Families will receive approximately six checks in 2021 and then one in 2022 if requested.

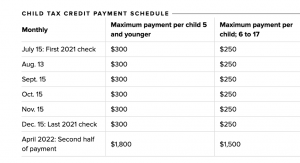

As shown, Americans will receive up to $1,800 for each qualifying child aged 5 or younger and $1,500 for those aged 6 to 17 as of April 2022. The other payments will start July 15th and end December 15th and will range from $300 per child under 5 and $250 for those 6 to 17.

Families can choose to opt out, or unenroll, from the advance payments and instead receive the money as a lump sum or a tax credit on their filing next year. You may be wondering why anyone would consider turning down the money. Well, the opt-out would be beneficial for anyone eligible for the credit based on their 2020 return, but not their 2021 income. Receiving the advance payments could cause them to become ineligible if their 2021 income increases past the qualifying cut off. This then would lead to the unfortunate situation of having to pay back those early disbursements when they file their 2021 return.

If you think you might be in this category and would like to opt out, this can be done under the new Child Tax Credit Update Portal on the IRS website. Otherwise, the payments will most likely be automatically deposited to your account if you filed your 2020 tax returns with direct deposit.

For those families that have not yet filed but would still like to receive these payments, you should either file as soon as you can or use the “Non-filer Sign-up tool” which will provide the IRS with your income and number of eligible dependents.

Does your income qualify you?

How do you know if your income qualifies you for this increased upfront credit? Single earners with $75,000 per year in income, heads of households with $112,500, or married earners with less than $150,000 jointly will all receive full payments. The payment amount will phase out $50 for every $1,000 above these thresholds and will not apply to individuals with $95,000 or more in income, or married couples with $170,000 or more of joint income. If you’re not currently eligible for this increase, the regular tax credit of $2,000 per child under 17 for families making less than $200,000 or $400,000 jointly still exists.

Who will this plan impact?

While the American Families Plan is currently expected to remain in effect through December, Biden has proposed extending it through 2025. These payments are significant and seen as a means for getting families through these trying times. For example, a family of four making less than $150,000 could expect to see over $14,000 in relief from tax credits and stimulus checks this year. According to the Institute on Taxation and Economic Policy, this plan will impact over 39 million households and the poorest 20% of families would see increases of over 37% this year. It’s important to understand that these funds are intended to get us through tough times, therefore, it is essential to be prudent when considering how to spend the increased influx of capital. Our recommendation is to focus first on paying off any debts, then building back any emergency funds you may have needed to deplete, and then invest the money towards your future financial and retirement goals.

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.