Active vs Passive Asset Management

The debate is over. Period. Passively managed index funds outperform actively managed funds. In 15 out of 18 categories of domestic equity funds, the majority of actively managed funds underperformed their benchmarks in the past 12 months. The performance was particularly underwhelming in the small-cap space, as 78% of all small-cap funds lagged the S&P SmallCap 600. The news is even worse for active managers over longer time periods. 84% of active small-cap managers lagged the index over the past 10 years and 94% lagged over the past 20 years.

Active vs Passive Asset Management

This is conclusive evidence that active management at all levels in the market cap structure are unable to simply beat their benchmark index. For a long time, active small-cap managers were given a pass on this debate because small-cap stocks had less Wall Street analysts coverage therefore an active manager could theoretically find small cap companies that were less known in the analysts world and exploit any information they found that the rest of Wall Street was unaware of. The theory was that as analysts reviewed companies as published their findings for investors to digest all information of any company was made public, therefore the ability of one investor to exploit good news about a company was less. Small cap companies simply had fewer analysts following them so an active could have discovered good news about a company that no one else knew and exploit that information by profiting from an investment decision relative to that news.

Do Active Managers Outperform their Benchmark?

This capability is becoming less so as there is more analyst coverage in small-caps and therefore less non-public information about any given small cap company. With access to software programs that can gather company financials and keep up with day-to-day activities at any company there is very little non-public information anymore and for any active manager to consistently outperform their benchmark over any time period has always been difficult and going forward will be almost impossible. Among those active managers that did outperform their benchmarks, 60% of them underperformed their benchmarks at some point by at least 20 percentage points.

Which Fund has a Higher Fee Structure?

Actively managed small-cap funds have another headwind to overcome as well. Actively managed small cap funds generally have a higher fee structure than mid and large cap funds. Their higher fee structure means managers have to overcome a higher hurdle than the passively managed index funds with their low cost structure. Based on Morningstar research, the average expense ratio for a small-cap fund with assets greater than $5 million is 1.61% compared to 0.06% fee for the iShares Core S&P Small-Cap ETF, symbol IJR that replicates the return of the S&P SmallCap 600 Index.

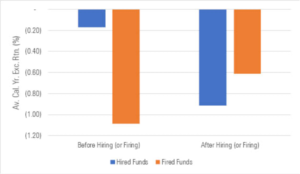

Exhibit 1: Active U.S. Equity Funds: Average Annual Excess Return Before Versus After Hiring/Firing (1/1/96-12/31/18; Versus Category Benchmark Index)

Have more questions? Contact Us

Brad Lyons, CFP®

Investment Manager

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.