Banks will be stress tested

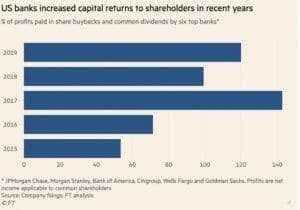

Last week, the Federal Reserve continued to make noise when it put temporary restrictions on thirty-four of the largest banks. This is the first time since the Great Recession that the new bank stress test procedures will be put into effect after the Federal Reserve voted 4-1 to restrict buybacks and cap dividends for the 3rd quarter. This comes in the midst of continuing tough economic conditions and the unknowns surrounding the future of the reopening. In the past few years, buybacks and dividends have been a significant part of the attractiveness of US banks.

Data was based on two studies, one initially conducted back in February before the coronavirus pandemic shut down the United States and another recently revealing three possible shapes of the recovery. Will the economic comeback be V-shaped, U-shaped or W-shaped? With the best-case scenario V-shaped recovery, most bank’s capital reserves were well above the 4.5 % minimum amount required. However, certain banks were close to the needed minimum capital requirements in the worst-case W double dip recession scenario that unfortunately could play out. According to Fed Vice Chairman for Supervision Randal Quarles, “The banking system remains well capitalized under the harshest of these downside scenarios.”

Still, economists anticipated unemployment to reach almost 20%, with over 30 million individuals unemployed, and banks have struggled this year as shown below. With the uptick in coronavirus cases since the reopening, investors and regulators worry that the ideal turnaround might not play out. Although like most stocks, there has been a slight recovery over the last couple of months.

Banks will be required to resubmit their capital plans this year and their plans for surviving another anticipated downturn. If it is a slow recovery, banks could lose up to $700 billion according to the Fed. Almost all banks have already committed to stopping buybacks for the year, but now they will have capped dividends that cannot be more than their last quarter or the average of the previous four quarters. Fed Governor Lael Brainard stated, “This is a time for large banks to preserve capital, so they can be a source of strength in a robust recovery…I do not support giving the green light for large banks to deplete capital, which raises the risk they will need to tighten credit or rebuild capital during the recovery. This policy fails to learn a key lesson of the financial crisis.”

Unfortunately, all this could still be bad news for Wells Fargo due to their recent struggles in the 1st quarter. Their projected dividend cut could be at least 25% with most analysts anticipating a 50% reduction in the 3rd quarter. Also, Goldman Sachs and Morgan Stanley could struggle regardless of the scenario due to their heavy reliance on capital markets.

Although rough times may continue both economically and within the stock market, Wiser Wealth Management maintains a positive outlook and remains committed to our principles of investing in long-term, healthy asset classes. As we have mentioned in the past, the stock market is not the economy and historically, the stock market recovers about six months before the bottoming of the economy. The NASDAQ just had one of the best quarters since 1999 and Dow Jones Industrial Average since 1987. Also, the S&P 500 is up over 20% for last quarter. Whether this will be a deep downturn with a quick recovery or a continued downturn into the third quarter, we will have to wait and see, but the Fed is doing everything in its power to keep us moving ahead to ensure a strong recovery.

Matthews Barnett, CFP®, ChFC®, CLU® Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.