Shape of the economic recovery

Now that shelter in place restrictions are lifted and Americans are going back to work, what will the economic recovery look like moving forward? Economists and analysts alike use the proverbial alphabet soup of letters to describe it. V shaped, U shape, L shaped, W shaped? There has even been the advent of the “Nike Swoosh!” In the best-case scenario, we hope for a V-shaped recovery. This means we are close to bottoming out and we can recover quickly due to pent-up demand. In this scenario, the timeframe for recovery would be the end of 2020. This would require a vaccine or reduction in severity of cases in the very near term.

The consumer, who makes up 70% of United States GDP, would then need to begin spending money on goods and services. It assumes we would return to pre-crisis levels and begin to see economic growth by 2021. Unfortunately, it does not seem like this is the most likely scenario, regardless of if Remdesivir is able to be mass produced and we are able to have antibody testing widely available.

The virus has crippled businesses and the consumer alike and will reshape the world as we know it. There have not been unemployment numbers and GDP projections like this since the Great Depression, far surpassing the Great Recession. The Federal Reserve and Congress have tried to bridge this gap on the hope things can be better on the other side. The Federal Reserve stepped up to the plate in an unprecedented way with their monetary response through the purchase of securities. The Fed is buying not just treasuries, but also corporate bonds and for the first-time ever, high-yield bonds. The only item not discussed by the Fed is the purchase of equities.

The government has also stepped up with their fiscal response. Despite some issues with the implementation of the programs and the coming together of Congress to agree, the government’s response has been swift, staying ahead of and addressing the problem far faster and more aggressively than in 2008. This has been accomplished through the PPP and similar lending programs for small businesses and stimulus checks for individuals. Currently, the spending is well over 6 trillion dollars, equating to over a quarter of U.S. economic output.

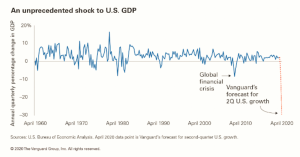

The Unites States GDP was -4.8% in the first quarter for the first time since the Great Recession. However, the virus has yet to really hit the supply chain and ripple down through the economy. How can 30 million people be unemployed in a matter of six weeks while a services portion of the economy is completely shut down for almost two months and it not have an effect? As shown in the chart below from Vanguard, economists and analysts believe the change in GDP in the second quarter to be closer to -30%. This is a significant drop and will take time to recover in the third and fourth quarter.

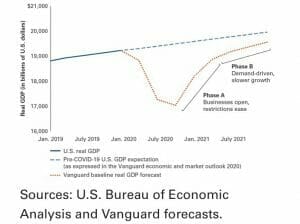

If small businesses and restaurants are able to bridge the gap and survive these struggles, it will not happen overnight. It will be a gradual progression. We will most likely see a slow, uneven curve. Even if the consumer is ready, companies will return at reduced capacity. We will continue to practice social distancing and avoid mass gatherings. The psyche of consumers has been altered. Will we be inclined to hop on a plane and book a trip, travel for leisure, or go to sporting events and concerts? Will we be willing to stay in public places and be around others at restaurants? The coronavirus will change the way businesses operate and how Americans adapt moving forward. The opening of the economy will happen through various stages.

Whether the economy is able to recover in the third and fourth quarter is still too early to tell. It depends on the spread of the virus and the behavior of consumers. A topic that is uncomfortable to discuss is what happens if the virus comes back in the fall or winter? Would we again have to shut down the economy and quarantine? Or will we be prepared to weather the storm? Business would need to have sufficient cash in reserves and hospitals would need more testing, supplies and equipment.

It is also important to note that the market is not the economy and the economy is not the market. The market prices in events and is forward looking. The economy looks at numbers like GDP and unemployment and is a backward-looking indicator. This is why the stock market usually recovers about 6 months before the economy. The market currently seems to be pricing in a V-shaped recovery. With all of the stimulus and buyback programs from the government, stocks were up 13% in April. This is industry specific at the moment. Information technology is up 16%, while the energy sector is down over 44%.

We could once again test the lows from March. However, we do not advocate becoming too conservative and trying to time the market. As I wrote in a previous blog, when this was unraveling in March, market cycles occur frequently but over the long run, the stock market is up over 70% of the time. Among many things, Warren Buffett is known for saying “Never bet against America” and in his recent annual shareholder meeting he reiterated that sentiment, “Nothing can stop America.” Americans are resilient and our perseverance allows us as a nation to find a way to pull forward. Although the second quarter and especially the third quarter will struggle, we will learn to adapt and change the way we move forward.

We will not let the coronavirus define us. At Wiser Wealth Management we are not stock pickers or market timers. We believe it is important to remain invested. If there is a pullback, it will be brief and once we have tested the bottoms, we will be invested for the turn around.

Matthews Barnett, CFP®, ChFC®, CLU®, Financial Planning Specialist

Posted 5/8/2020

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.