Financial Literacy Month

As 2021 continues to fly by, it is easy to miss that April is Financial Literacy Month. So, what exactly is Financial Literacy Month? It is a national campaign for both students and adults to bring awareness to financial education. It was first started as the Youth Financial Literacy Day over 20 years ago, but in 2000 was taken over by Jump$tart Coalition where it became a more detailed month-long campaign. In early 2004, the Senate passed Resolution 316 declaring April to be Financial Literacy Month for the purpose of “raising awareness about the importance of financial literacy and the need for effective financial education” because everyone benefits from learning the basics like credit cards, debts, savings, loans, credit scores, and basic investment planning.

Continuing to raise the profile of Financial literacy is important due to the gap in financial education experienced by most students in the US. As shown in the graph below, there are many states that have personal finance education as part of their standards for K-12 students. However, very few then mandate students to take a standalone personal finance class before graduation. Squeezing a few financial concepts into an already jam-packed set of standards does not seem to be doing enough to properly prepare students for healthy financial responsibility in adulthood.

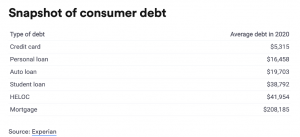

The Standard & Poor’s Global Financial Literacy Survey recently ranked the United States No. 14 in the world when measuring the proportion of adults in the country who are financially literate. For a shocking comparison, the U.S. adult financial literacy level of 57% is only slightly higher than that of Botswana. When this information is presented, it is no wonder that Americans are struggling with large amounts of debt. According to an Experian consumer report, as of November 2020, consumer debt was at $14.2 trillion and the average personal debt was $92,727. Also, studies found that 2 in 3 families lack any emergency savings at all and 78% are living paycheck to paycheck.

Limited financial education in school mixed with increased costs in higher education, healthcare, and “keeping up with the Joneses” have played a part in the growth of personal debt. However, large personal debt does not have to end all hope of a financially healthy future. Regardless of whether or not you are buried with student loan debt, personal loan debt, or credit card debt, it is never too late to start to plan for your financial future. The first step is to write down your goals and commit to a process of attaining financial success.

The 5 pillars toward financial freedom are a good place to start when setting financial goals:

- Pay off debt (mortgage by retirement)

- Emergency savings of 3-6 months of expenses

- Max out 401k

- Contribute to a Roth IRA

- Establish opportunity fund

As shown above, most Americans carry a mortgage debt. While we want these paid off by retirement to help free up cash flow and provide peace of mind, we are really talking about the other “bad” debts when we think about the dangers of carrying debt. If you are struggling with credit cards, personal loans, car loans, etc., you should make a budget showing what your expenses are for the month and look for ways that you can cut back. Doing so will give yourself an additional amount to pay beyond the monthly minimum, because paying down debt is always a good first financial goal. Additionally, it is a good idea to analyze your debt to see if it makes more sense to pay off the smallest amounts first or to attack the highest interest rates first, regardless of debt amount. We do realize that focusing on some debts first might be unavoidable like certain student loans.

After debts are paid down, ensuring a healthy emergency reserve is a good next goal. This means building toward having at least 3-6 months of living expenses in a savings account for unexpected events like car repair, home repairs, health concerns and any other events life throws at you. Once that is taken care of, any extra money should be used for retirement. If you employer provides a retirement plan like a 401k, you should aim to contribute at least up to the matching limit. If you are able to contribute more, work toward contributing up to 20% or the maximum limit of $19,500. If your income is within Roth limits, you can also max out a Roth IRA of $6,000. If your income is above the threshold, you can look at doing a backdoor Roth contribution where you contribute after-tax dollars to an IRA and then convert it to a Roth IRA.

If you are fortunate enough to be able to tackle these first goals, then you should move on to the after-tax account or “opportunity fund” as we like to call it. This can be an investment account that may not be allocated as aggressive as your other accounts earmarked for retirement. Or it may be a more balanced account meaning maybe 30-50% stocks with a time horizon of at least 5 years. This could be used for future real estate purchases like a rental home or vacation home or another venture you would like to pursue.

As we move through Financial Literacy month, consider your own literacy level. There are a lot of resources out there nowadays for increasing financial literacy. If you want to learn about tackling debt and the baby step method to living a debt free life, we believe in Dave Ramsey’s approach. There are also learning opportunities with the Council for Economic Education through their social media and virtual events. NextGen Personal Finance is another resource with a mission to “revolutionize the teaching of personal finance in all schools, to improve the financial lives of the next generation of Americans.” There are also some helpful budgeting apps like Mint and YNAB as well as ones like Acorns which help you save with everyday purchases and eventually provide for future investing options of funds. Various books and podcasts exist to provide a wealth of knowledge such as blocking and tackling, planning with protection of assets, and basic investing principles. And, of course, you can always contact Wiser Wealth Management for more information on any of the topics above or for help in achieving your financial goals.

Wiser Wealth Management is a fiduciary, fee-only financial planning firm and is part of only 2% of the industry. Whether you are in debt or have millions of dollars to invest, we are here to help you achieve financial freedom. The market is flooded with financial advisors that take advantage of clients for their own self-interest. We work in the best interest of our clients, have transparent fees, and do not sell products or earn commissions. This allows our clients to live with less stress and greater peace of mind. We believe everyone should have a trusted financial advisor working in their best interest, so we have created a financial planning and portfolio management process designed to help our clients achieve financial freedom.

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Planning Specialist

Brad Lyons, CFP®

Investment Manager

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.