Is there a link between GDP growth and forward equity returns?

Why GDP Growth Expectations Matter

GDP growth expectations are an important economic factor. The data is heavily scrutinized by economists and analysts alike, and this metric generally determines if a country is in a contractionary or expansionary period. With that said, should asset managers and investors be concerned when the U.S. posted a negative GDP growth quarter recently? Or put another way, can we associate a link between GDP growth and forward equity returns?

What Is GDP?

Let’s back up and define GDP. Gross Domestic Product represents the total monetary or market value of all finished goods and services produced within a country’s borders. There are a few methods to calculate GDP, but the most common formula that you would read in an Economics textbook is the expenditure approach (formula below). This is also known as the spending approach. It calculates GDP by segmenting spending by different groups that participate in the economy.

A Look at Recent GDP Contraction

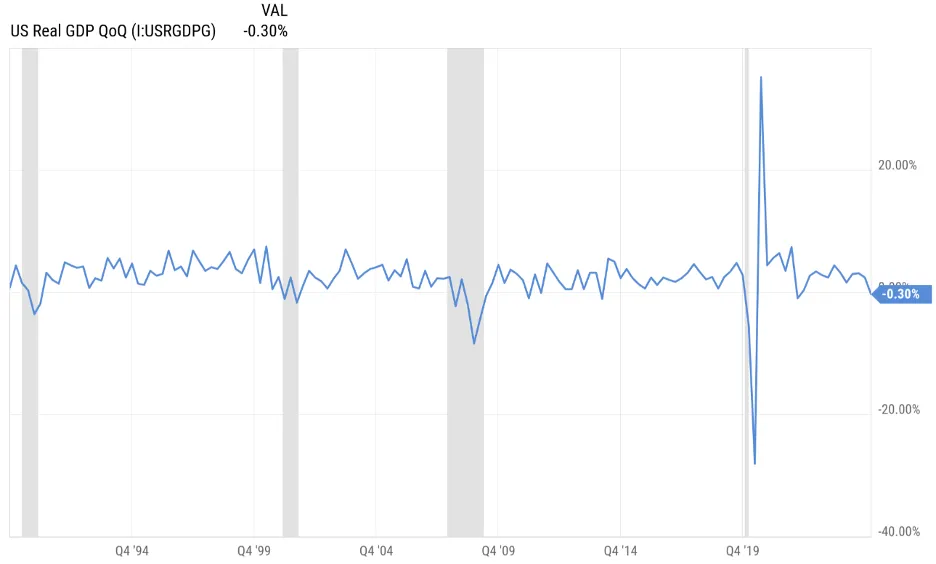

Now that we have had a nostalgic trip down memory lane to our high school economics class, let’s jump back to present day. It was recently reported that U.S. quarterly GDP growth, inflation-adjusted, contracted -0.3% in the first quarter. A common heuristic used by economists is that when there are two consecutive quarters of declining GDP growth, this identifies a recession. So, should we sound the alarm bells if the next quarter’s GDP growth also declines? Let’s look at some historical examples.

Historical GDP Trends vs. Recession Periods

The chart below shows real quarterly GDP growth (blue line) mapped against past recession periods (shaded gray areas). For our data set example, we are going back to the recession that occurred in December 1990. Visually, we can see GDP growth trending lower around recession periods, which makes sense, right? But, how impactful is this in relation to forward equity returns?

How Often Does GDP Decline Twice in a Row?

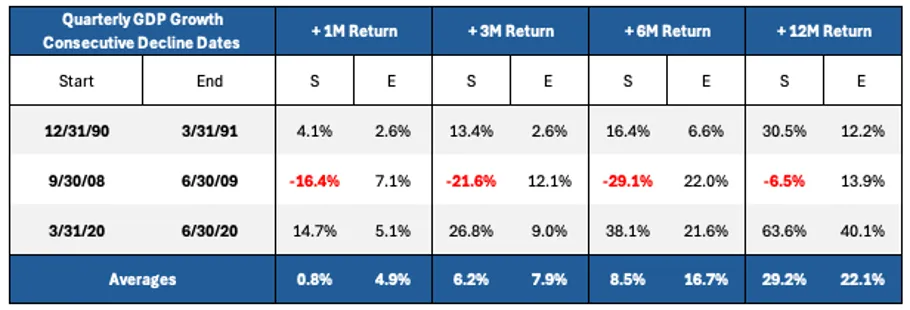

Taking the analysis one step further, let’s look at how many times there were two consecutive quarters or more with negative GDP growth. Dating back to December 31, 1990, out of 138 quarters, there were 16 instances with negative GDP growth, and only 3 occurrences that had at least two consecutive declining quarters:

- 12/30/1990 to 3/31/1991

- 9/30/2008 to 6/30/2009

- 3/31/2020 to 6/30/2020

The graphic below shows the forward 1, 3, 6, and 12-month S&P 500 index total returns. These are taken from the start (S) and the end (E) of each GDP contractionary period.

What Does the Data Show About Equity Returns?

Even though we do not have many sample periods, we can draw a few conclusions from the data:

- The average S&P 500 returns for each time period generally increase the further out from each return time period (e.g. average +1 month return end of period is 4.9% and +12 month is 22.1%)

- The 2008–2009 recession period had negative forward returns across all time periods when measured from the first negative GDP growth date. However, the returns were all positive if measured from the end of the recession

- Outside of the Great Financial Crisis, every forward time period saw positive equity returns

Why the Great Financial Crisis Was Different

The GFC was a different kind of recession animal as it was caused by systemic risks that shocked the entire global macroeconomy, which, in my opinion, we had not experienced since the Great Depression.

Stay Focused on the Long-Term

U.S. equities are resilient and seem to recover fairly quickly after most corrections and technical GDP quarterly recession periods. As long-term investors, we should do our best to tune out the noise and remember our long-term financial goals. Therefore, if we experience a second negative GDP growth result in a few months, I wouldn’t necessarily sell your equity portfolio, as your cash on the sidelines may be left behind.

Andrew Pratt, CFA, CBDA

Investment Manager, Wiser Wealth Management

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.