Market Commentary Q4 2019

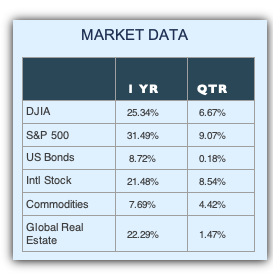

Our market commentary begins with a review of how we entered 2019 with news headlines claiming that the year would be a horrible recession with TV pundits predicting doom and gloom. It only seems fitting that the market would then gain 31% on the year. Specifically, the S&P 500 was up 31%, other asset classes such as foreign, small cap US and real estate were up over 20% on the year. 2019 was a good case for why you should never try to time market ups and downs, and just focus on the long-term results.

Portfolios

BlackRock analysts are optimistic about stocks in 2020. This is due to the de-escalation of the US China trade war, allowing companies to deploy capital that they were otherwise holding on to. During this quarter’s rebalance, we will maintain overweight in US stocks vs foreign developed holdings while adding to our emerging market stock. The Federal Reserve mishandled interest rates in 2018 and had to make up for it in 2019. In 2020, the Feds have indicated a more neutral approach, thus we are adjusting bond holdings to add more short-term corporate high yield bonds and reducing our US Treasury holdings.

In August of 2019, after an in-depth review, we elected to follow BlackRock research in the building of our portfolios. This added research has proven to help build more efficient portfolios. In the fourth quarter of 2019, TD Ameritrade announced all stock trades would be commission free. This greatly opens our investment possibilities and will improve our portfolio even more with no trading costs and access to low cost index funds. During this quarter’s rebalance, we will be substituting some funds for those that will drive down the costs of the portfolios, perform better compared to its benchmark and have the liquidity that we need to conduct more efficient trading.

Quarterly Reports

Each quarter we generate a detailed performance report looking back one year through our Morningstar portfolio accounting software. You can access this report by logging in here.

If you need login assistance, please use the forgot password feature on the Morningstar login page. Should you need help with your username, please contact our client service manager, Tiffany Spino at 678.905.4450 or tiffany@wiserinvestor.com.

Published January 17, 2020

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.