Medicaid & Nursing Homes

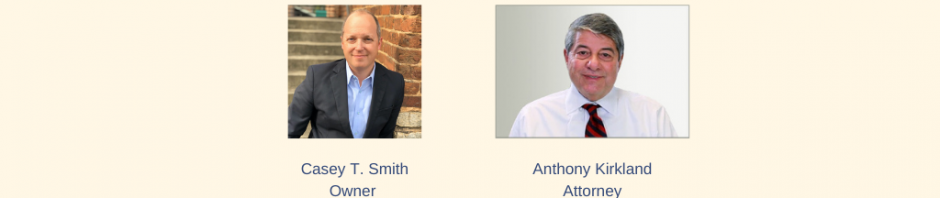

On today’s episode of the Wiser Roundtable podcast, the team welcomes attorney Anthony Kirkland to the studio to discuss Medicaid, Medicare and nursing homes. Anthony has been practicing law for 38 years and focuses on the areas of elder law, estate planning, probate and estate administration.

Listen on Apple Podcasts or watch on YouTube:

SUMMARY

How do families prepare for the eventual cost of assisted living or nursing home facilities? The average nursing home in Cobb County costs around $6,700-$7,000 a month. The first question to ask is how can the person living in a nursing home qualify for Medicaid? To qualify, the maximum the patient can have is $2,000 in assets and an income of no more than $2,349 a month. If the patient has income or assets greater than that, the patient and family must find a way to spend down the assets. The first thing to do is if the patient and spouse own a home together, transfer the deed on the home to the spouse that is not in the nursing home. The family is allowed one car under Medicaid rules. If the couple own a second car, they will need to get rid of the asset. The couple can have up to $10,000 in cash value for life insurance and this money is typically used to buy a burial policy. The couple can also move up to $128,640 to the spouse not going into a nursing home and purchase a Medicaid compliant annuity.

When it comes to income, most patients are receiving between $1,300 to $2,000 in monthly social security income. In order for persons whose income exceeds the Maximum Income Limit to become eligible for Medicaid long-term care services, they can create a Qualified Income Trust, commonly known as a “Miller Trust,” for the excess income. To become eligible, the state must be named beneficiary on the Miller Trust. The trust pays the money to Medicaid. The trust is managed by a family member, the spouse or an adult child. These strategies are often employed to allow for the surviving spouse to still have assets to live on.

In the case where there is only one surviving spouse, if the person has less than $2,000 in assets and less than $2,349 in monthly income, they will automatically qualify for Medicaid. If the person is single and has assets and income greater than that allowed by Medicaid, the assets must be spent down 30 days prior to the time they qualifying for Medicaid.

In order to do this, Anthony recommends buying a burial policy and paying off any debts. Other ways to spend down the money are to pay elder care attorney fees and/or buy an annuity that sends the income to the Miller trust. If an individual receives more than $2,000 a month in income, they must spend down those additional funds within the month they are received.

What are some things people should do prior to retirement or while they are in good health? Long-term care insurance is important. The longer the person waits to purchase a long-term care plan, the greater the premium. Another option is to create a Medicaid asset protection trust. This must be in place and funded five years before a person qualifies and begins using Medicaid. It is a legal defective trust; the person who creates the trust retains the right to change the beneficiary.

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.