The election and your portfolio

The first half of 2020 felt particularly unstable and unpredictable with the pandemic, protests, hurricanes and wildfires. As we move further into the fall, the fact that 2020 is also an election year may give rise to a new set of concerns. During the coming weeks, the presidential campaigns will only increase in momentum as they prepare for November and investors might be wondering how to prepare as well.

The months surrounding major elections are typically thought to be times of heightened market volatility. This is understandable as the news and social media outlets tend to highlight the differences in each candidate’s vision for the future of the economy, therefore it would seem that the uncertainty and potential for change in policies would result in major fluctuations in the market.

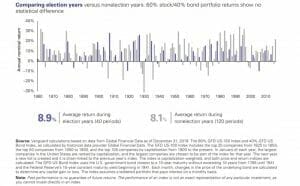

However, a new report from Vanguard reveals that there is no major increase in market instability during election years compared to non-election years. The study shows that although elections are major events for the country, “their impact on market returns has historically proven to be negligible, as shown in the chart below.”

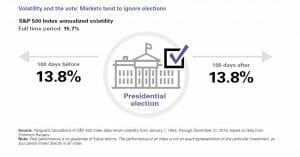

Vanguard’s report then focuses specifically on the time period immediately surrounding presidential elections. The data reveals that although investors may expect market instability, in actuality, the opposite has been true. “From January 1, 1964, to December 31, 2019, the Standard & Poor’s 500 Index’s annualized volatility was 13.8% in the 100 days both before and after a presidential election, which was lower than the 15.7% annualized volatility for the full time period.” In other words, markets tend to ignore elections.

The thought of going through an election during an already tempestuous year may raise some concerns, however, the report out of Vanguard is clear that, “Elections are another one of those events that generate lots of headlines but that should not sway you from following the financial plan [you and your advisor] created. It’s understandable to have concerns about the election. But as far as your portfolio and the markets are concerned, history suggests it will be a nonissue.”

This does not mean that the markets won’t be volatile, it just means you have to stay focused on the months ahead, and not make irrational decisions in an irrational market.

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.