Why You Should Retire Mortgage Free

Often one of a client’s biggest assets, as well as expenses, is their home. Whether they decide to move during retirement by “downsizing” or stay put in their current home, they need to make sure that they are mortgage free when they enter retirement. At Wiser Wealth Management, we advise our clients who are retiring to have all liabilities paid off and be mortgage free. This can be accomplished early on, as we have discussed in the past, by only taking out a 15-year mortgage or if a client is younger, a 30-year and making additional payments to the principal on the home.

If you are close to retirement and not in a position to refinance, then you should allocate additional money monthly or a lump sum preferably with non-qualified assets to have the mortgage paid off by retirement. This not only frees up thousands of dollars per month, but also provides peace of mind knowing you no longer have the obligation of sending money to someone else and can spend your hard-earned money on yourself and your family instead. Fewer obligations mean more peace of mind.

Recently, though, we hear a lot of people saying “well the rate is so low. If I’m only paying 2.5%, why would I want to pay it off?” It is true that rates are historically low, but your payment is still usually over a thousand dollars. In retirement, you are no longer investing the money and return on your cash with the low rates is less than 0.5%. Rather than making banks wealthy and paying them interest, you could be keeping that amount invested and allowing it to give you more to live on down the road. Also, mortgage interest is still technically tax deductible, but fewer people itemized it after 2017, when Congress doubled the standard deduction. According to the IRS, only 13.9 million tax returns claimed the mortgage interest deduction in 2018, compared to nearly 34 million in 2017.

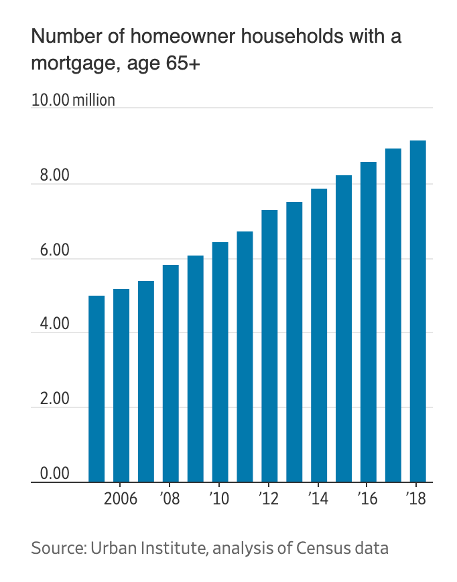

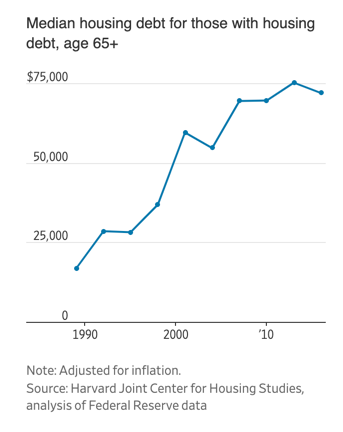

Also, state and local taxes (SALT) deduction now caps out at $10,000 so a big mortgage does not provide the benefit it once did. Unfortunately, in the U.S., over 9 million homeowners over age 65 have mortgage debt, according to federal data analyzed by the Urban Institute. That number is up almost 60% from a decade ago. Homeowners age 65 and over who have mortgage debt owe a median of $72,000 and about 26% of homeowners age 80 and over have mortgage debt, up from about 11% roughly a decade before. They owe a median of $43,000.

This is certainly not the trend we are striving for or want you to be part of. Last year was a perfect example of the mortgage issue. We received many calls during the COVID sell off in March last year, not because of concerns that the market was down over 30%, but because retirees were happy to not have a mortgage payment and other liability payments due when the market was down. They were able to ride out the down turn without debt hanging over their head. Living mortgage free in retirement is one of the best steps you can take to achieve financial success and enjoy withdrawals for expenses and travel, and not for bills.

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.