What is a Donor Advised Fund?

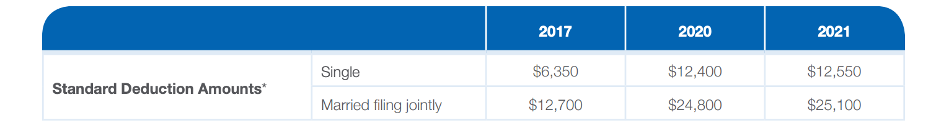

When the tax code changed in 2017 and the standard deduction was almost doubled, many households began taking the standard deduction rather than itemizing their deductions. The Tax Cuts and Jobs Act (TCJA) signed into law December 2017 and implemented in 2018 is currently set to sunset after 2025. As shown below, deductions nearly doubled. In 2021, single filers can claim up to $12,550 or married couples filing jointly can claim a whopping $25,100.

Donor Advised Fund Strategy

If you are a high-income earner or have received an anticipated windfall, you may need additional deductions and there are various strategies for going about this that you should discuss with your financial planner and CPA. One such strategy is to set up a Donor Advised Fund or DAF. These are offered through various brokerage firms or even through community foundations if you want to use some of your funds to give back to local community. Here in Marietta, the Cobb Community Foundation is one such fund.

Why might this be necessary?

A big bonus or the sale of a business can create a much larger tax liability that one would desire. This is where the heart and the pocketbook can work together to lower your tax liability. Charitable donations normally lower your tax liability at the rate of your highest taxed dollar. You might be looking at giving $20,000 or $100,000 or perhaps even more, but you may not know yet exactly which charities you want to support. But, again, you also don’t want to face a larger tax liability. One option is to form your own 501c3, but this is a large task, especially last minute. This is where Donor Advised Funds come in. DAFs allow you to move cash, stocks or a non-publicly traded asset into an account and take a tax deduction in the same year. This also allows you to issue funds to IRS approved organizations in the future. Plus, the funds can grow tax free. This is a great way to build a legacy that can keep giving for generations to come. According to the National Philanthropic Trust, the number of DAFs rose over 16.2% in last year for a total of over $142 billion in assets.

How to Make the Donations

When you make the donations, you are eligible for an immediate tax deduction. However, this does not mean you have to distribute the actual grants within that year. You’re allowed to decide over the following years what you wish to do with the money. Also, there are different rules with certain donations. For cash donations, investors are eligible for an income tax deduction of up to 60% adjusted gross income or AGI. For appreciated securities, you’d want to donate those directly to funds rather than liquidate them and pay the long-term capital gains rate taxes. It also allows for deductions of the full market value of security up to 30% of AGI.

Donor Advised Funds Can Be Simple

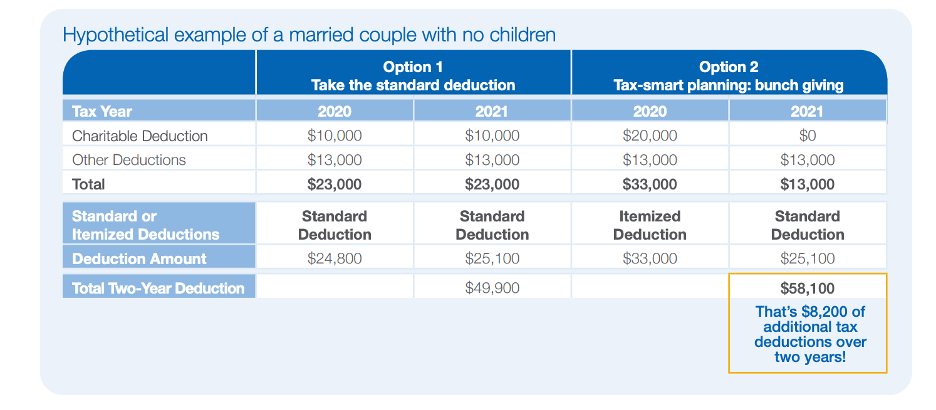

DAFs are also simple to administer once they’ve been established. When you’re ready to support a charity of your choice, you can simply log in to your account and recommend a grant to any IRS-qualified public charity. Let’s say you’re not sure if you should take the standard deduction or if you need additional itemized deductions with the charitable contribution listed. In the example shown below, the married couple in Option 1 has $23,000 of annual deductions including a $10,000 gift to charity. However, if it is below the $25,100, you could take the deduction each year and while the charitable donations went to a good cause, it did help in the reduction of your taxes. This is where strategy or Option 2 comes into play. This is where you could look into the “bunching” of donations. This approach puts multiple years of donations bunched into one creating a bigger lump amount for the current year. For example, you could have two years of charitable donations of $10,000 each for $20,00o as well as other various deductions. This $33,000 in itemized deductions is over the standard deduction and can help save in additional taxes as well as plan accordingly for years when income might be higher than anticipated.

Donor Advised Funds allow you to be charitably inclined while also providing additional tax benefits to reduce income taxes for the year seamlessly and easily. If you have additional questions, please speak to your financial planner or CPA, or feel free to reach out to us at Wiser Wealth Management to discuss in more detail strategies for tax efficient planning.

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.