When should you take Social Security?

A common question posed by retirees and those nearing retirement is when should I apply for Social Security? Many Americans want to claim as soon as they are eligible at age 62. They feel like they have paid into the system and deserve to reap the benefits. Also, some are not sure how long benefits may be around or if they will live long enough to see the breakeven on deferring their payments.

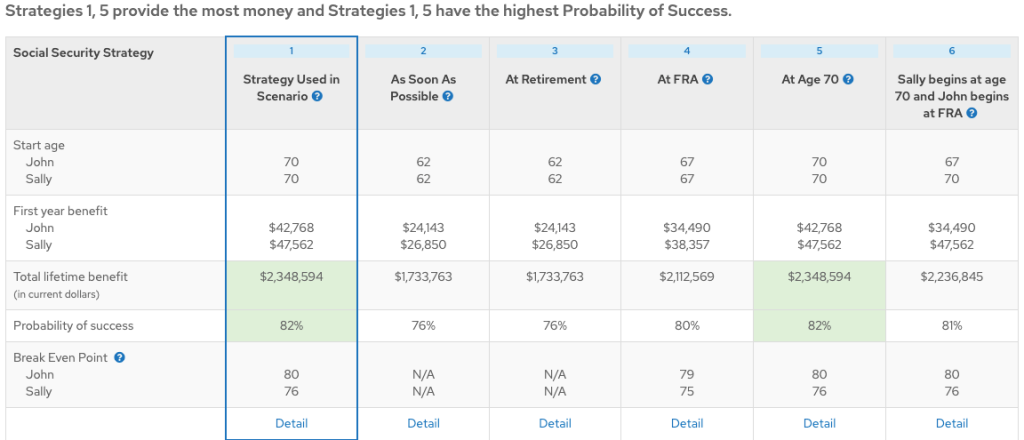

There are varying thoughts and strategies to social security optimization. When planning for our clients, we at Wiser Wealth Management use social security optimization tools to help us analyze their situation and give the best advice. Many clients initially think that taking SS at age 62 or at Full Retirement Age (FRA) is the best strategy. However, this is not always the case.

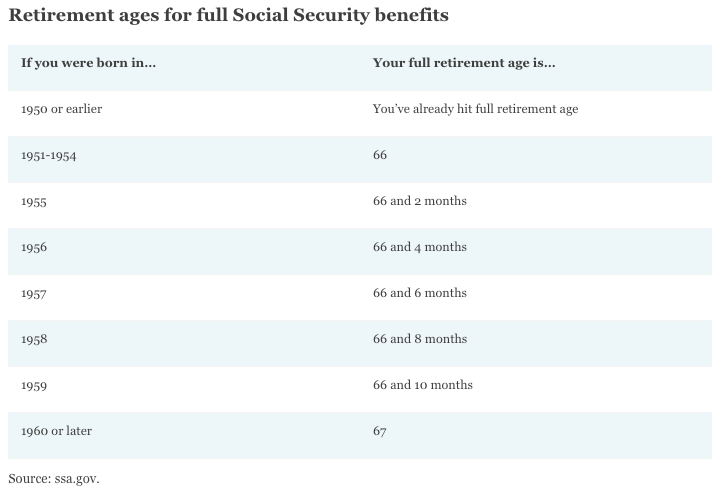

Social Security can be applied for and received in many different ways. Clients can apply at age 62, Full Retirement Age (FRA is listed above and varies from 66-67 based on year you were born), or age 70. As shown in the hypothetical example below, using our MoneyGuide Pro software, the clients would receive more of a total lifetime benefit and higher probability for success in their plan by waiting until age 70.

This strategy would not only provide more lifetime income benefits in retirement, but also increase the probability of success of their financial plan.

A common technique for a couple in the past was called the file and suspend method. The “file and suspend” or “claim and suspend” technique worked like this:

A client, Bill, files at his full retirement age of 66, but suspends actually taking the benefit. At his full retirement age his benefit is $2,000 a month, but by delaying to age 70, it increases by 8% per year. Since he filed, however, his wife, Betty, who is also at her full retirement age of 66, is eligible to claim a spousal benefit of $1,000 per month (50% of Bill’s benefit). She would collect this money for four years until she turned 70, and then take the greater of her spousal benefit or her own benefit.

This strategy of claiming Social Security came about in 2000 when Congress passed the Senior Citizens Freedom to Work Act. The purpose of this Act was to allow those still working to be able to stop benefits and delay retirement credits. Our example scenario was an unintended loophole, but Section 831 of the Bipartisan Budget Act of 2015 took that away. In the example above, Bill can still defer his social security payments and defer credits, but no payment can be paid out to his spouse or dependents until he takes his benefits unless the client was born before January 2, 1954, he/she has reached full retirement age, and the spouse is already collecting his or her own social security retirement benefit.

Social Security is a Big Part of Most Americans’ Retirement Income

According to a study by Vanguard, an estimated 91% of Americans aged 65 or older receive Social Security benefits1—the average annual benefit for a retiree is about $16,000.2 For most of these retirees (64%), Social Security represents a significant portion of their income. Even for affluent retirees (those aged 60–79 with at least $100,000 in financial assets), Social Security accounts for 29% of total retirement income, on average.3 Given that Social Security provides a base level of guaranteed income for most retirees, it’s an important benefit for investors and their advisors to consider when designing a comprehensive plan for retirement income especially since only 23 percent of workers say they considered how to maximize it when claiming.

By Delaying Social Security, Retirees Can Stretch Their Savings

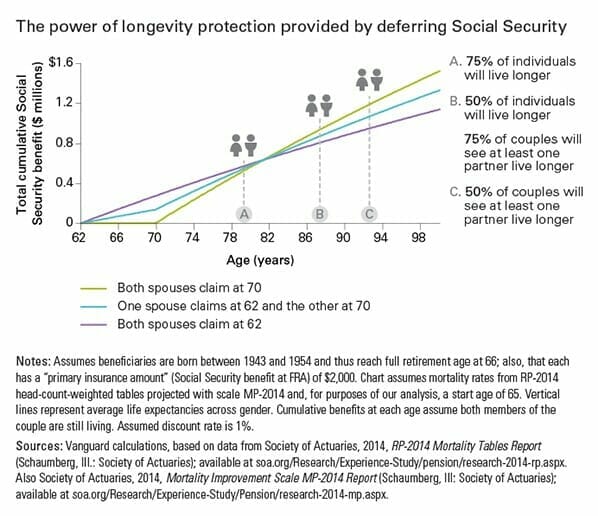

In the past, the decision as to the “right” time to claim Social Security has often been based on a break-even analysis of a retiree’s expected benefits versus his or her life expectancy. That approach, however, ignores two key features of Social Security, namely: Once you start receiving it, it’s paid for the rest of your life, no matter how long you live, and it is usually adjusted upward for inflation. A big concern for most retirees is the risk of outliving their savings. For many retirees who can afford to do so, deferring Social Security for a few years (even past their “full retirement age”) greatly increases their lifetime monthly benefit. Given that at age 65, more than 50% of women can expect to live past age 88 (and 50% of men past 85), delaying Social Security can provide powerful longevity protection.

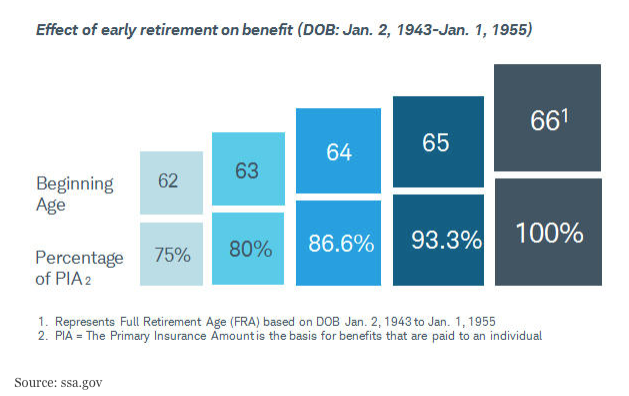

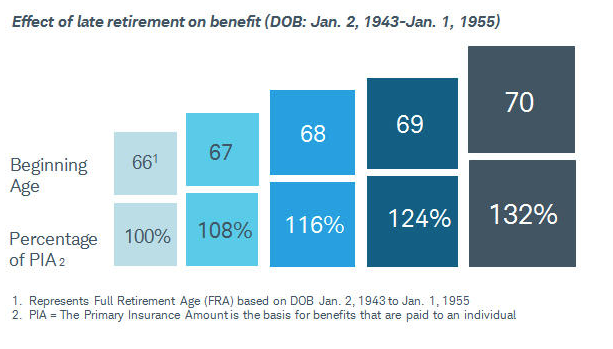

From 62 to FRA, benefits are increased by average of over 6% per year until you reach your FRA. FRA depends on the year in which you were born. If you were born between 1943-1954 it is 66, and it is 67 if you were born after 1960. Also, if you waited past full retirement age, benefits would begin to increase an additional 8% a year as shown above. The maximum amount one individual could receive today on max 35-years of earnings and claiming at age 70 would be $3,790.

Thoughtful claiming strategies can help retirees make the most of their benefits

A careful review of Social Security regulations, your financial situation, and any health considerations you may have are crucial to developing a strategy to maximize income during retirement. (Note that the regulations can be complex, and you may benefit from seeking professional advice.) For individuals in poor health or with little to no other financial resources, early Social Security claiming may be appropriate, but for most retirees, the increase in guaranteed income gained by deferring Social Security makes waiting to start benefits an appropriate strategy. The accompanying chart shows the potential impact on a couple’s lifetime Social Security income of three different approaches: both spouses claiming at 62 (the earliest possible age), a hybrid strategy where one spouse claims at age 62 while the other delays until age 70, or both spouses delaying until age 70 to accumulate the maximum amount of delayed retirement credits.

Pensions and Other Factors

Pensions and taxes can also affect your social security benefits. The Windfall Elimination Provision, or WEP, as well as The Government Pension offset, GPO, reduce individuals and their spouses’ benefits:

- The Windfall Elimination Provision (WEP) applies when you have a pension from a job for which you did not pay Social Security taxes, such as certain teachers, and it could lower your retirement benefits.

- The Government Pension Offset (GPO) affects benefits as a spouse, widower, or widow if you have a pension from a government job that you did not pay Social Security taxes on.

What if Social Security is No Longer Around?

Over the last few years, Americans entering retirement have feared reductions in Social Security benefits and those new to the workforce have feared the dissolution of it altogether. The coronavirus pandemic has only amplified these fears. The United States has been in jeopardy of depleting the Old-Age and Survivors Insurance (OASI) Trust Fund for quite a while. It is anticipated the fund will become insolvent by 2035. After that point, income and payroll taxes would only cover 75% of the benefits. There are many reasons for the decline, and some have to do with longer life expectancy than previous generations.

Due to the aging population of the baby boomer generation, the Trust will be distributing more in the form of income than it will be receiving from revenues. Unfortunately, coronavirus has also helped intensify this issue, and some believe the benefits could be depleted by this decade because of the record levels of unemployment. However, Congress would be able to hold off the decline by reducing benefits, means testing, increasing revenues through payroll taxes or even raising beneficiary ages.

When and How Should I Apply?

According to Social Security Administration, you should apply for benefits 4 months before you wish to have them begin. You can sit in line at the SS office or call by phone, but like most things today, it can be done much more easily online at ssa.gov by following the prompted instructions and providing identifiable information.

Contact Us

At Wiser Wealth Management, we focus on social security optimization as a cornerstone to planning and increasing cash flow for the effectiveness of future financial plans. Should you have any questions, please reach out to us at wiserinvestor.com or by calling 678-905-4450.

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.