Buyer Beware: Life insurance targeting college parents

A recurring and concerning theme we have heard about recently at Wiser Wealth Management is college prep “counselors” and insurance agents pushing whole life insurance as the miracle college savings strategy. These so-called counselors are targeting high school parents by glorifying whole life insurance and stating the pitfalls of 529 college savings plans.

If you are not familiar with both, let me briefly explain each. Whole life insurance is a type of permanent life insurance policy that has a cash value savings component built in. The cash value of whole life policies grows tax deferred based on interest rates, but the internal rate of return (IRR) is usually in the low single digits. Not to mention there is typically at least a 10-year breakeven on when the funds are put to work for you. This is due to the cost of the insurance, as well as the initial commissions for the agent. In order to access the funds, you can take a partial withdrawal, which will also reduce the death benefit, or you can take a loan out against your policy.

529 plans are investment vehicles that provide tax benefits used specifically for college. The plans are invested in certain individual mutual funds or managed as age-based funds by large investment companies. 529 plans grow tax free and distributions are tax free if used for certain qualifying expenses, such as tuition and fees.

These “counselors” and life insurance agents are pushing that the cash value of life insurance is not disclosed on Free Application for Federal Student Aid (FAFSA) forms. 529 assets are included and can reduce expected family contribution (EFC) by as much as 5.64% of the asset value. While this may be true, it does not provide a substantial benefit based on the opportunity cost of socking away large sums of money into a whole life insurance policy.

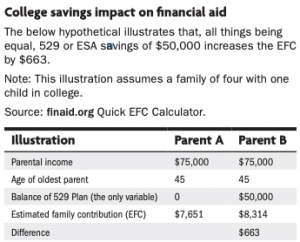

For example, the illustration below is from the TIAA website on 529 plans and the savings impact on financial aid. It shows, all things being equal, 529 or ESA savings of $50,000 only increases the EFC by $663.

Source: TIAA

This whole life insurance strategy is often pushed towards parents whose income would not allow their children to apply for need based grants in the first place, and it barely reduces eligibility for other loans as well. We have seen some life insurance illustrations presented that show the policy becoming a Modified Endowment Contract (MEC) due to the large initial premium payments. If a policy becomes a MEC, it will lose its preferential tax treatment and can be taxed as income and even have 10% penalties if under age 59 ½.

I understand the value of life insurance as I have previously worked at some of the biggest mutual life insurance companies in the country. The agents are using this as a tactic for big upfront commissions and not what is in the best interest of the parents and students. At Wiser Wealth Management, we are a fiduciary, fee-only firm and do not push or sell any products. If you would like to speak with us about college planning or any other financial planning goals, please feel free to reach out to us for a free consultation.

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Planning Specialist

Posted: April 15, 2020

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.