Delay Social Security if You Can

Social Security. You’ve been diligently paying into the system for years. Now, you are about to turn 62. It makes sense to go ahead and apply as soon as possible, right? The answer is . . . maybe.

In the world of financial planning, there is a ton of information out there about how to maximize Social Security. Some of the information is great and some not so much. The most essential element to consider when devising your Social Security strategy is to make the payments only one part of your overall long-term financial plan. When we at Wiser Wealth Management plan for our clients, we use social security optimization tools to help us analyze their complete financial situation, in order to give them the best advice as it fits with their overall plan and goals. Due to the fact that Social Security can be applied for and received in many different ways, the best option is often made only by looking at the individual’s whole financial picture.

According to a study by Vanguard, an estimated 91% of Americans aged 65 or older receive Social Security benefits1 with the average annual benefit for a retiree numbering about $16,000.2 For most of these retirees (64%), Social Security represents a significant portion of their income. Even for affluent retirees (those aged 60–79 with at least $100,000 in financial assets), Social Security accounts for 29% of total retirement income, on average.3

By Delaying Social Security, Retirees Can Stretch Their Savings

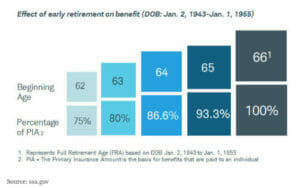

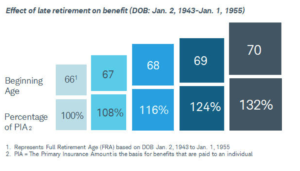

There are three different stages when a person can apply for Social Security: Age 62, Full Retirement Age, (FRA is listed above and varies from 66-67 based on year you were born), or age 70. From 62 to FRA, benefits are increased by average of over 6% per year until you reach your FRA. Also, if you wait past full retirement age, benefits would begin to increase an additional 8%. The maximum amount one individual could receive today on a max of 35-years of earnings and claiming at age 70 would be $3,790 per month.

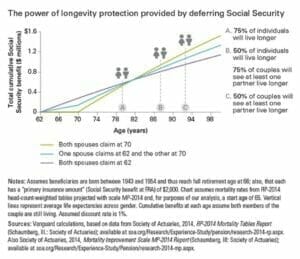

As shown in the hypothetical example below, using our MoneyGuide Pro software, the clients in the simulation would receive more money in total lifetime benefits by waiting until age 70 to draw Social Security. Waiting also gives them a higher probability of success in reaching their overall financial goals. While this might be the best-case scenario option for maximizing benefits, we understand that not everyone’s situation fits this model. However, there several reasons why waiting as long as possible to apply for Social Security makes the most sense for the vast majority of people.

In the past, the decision as to the “right” time to claim Social Security was often based on a break-even analysis of a retiree’s expected benefits versus his or her life expectancy. That approach, however, ignores two key features of Social Security—namely, once you start receiving it, it’s paid for the rest of your life. No matter how long you live, you get paid. Also, it is usually adjusted upward for inflation. A big concern for most retirees in general is outliving their savings. For many retirees who can afford to do so, deferring Social Security for a few years (even past their “full retirement age”) greatly increases their lifetime monthly benefit. Given that at age 65, more than 50% of women can expect to live past age 88 (and 50% of men past 85), delaying Social Security can provide powerful longevity protection.

A careful review of Social Security regulations should always be conducted in light of your overall financial situation. When considering a Social Security strategy, don’t forget to take into account pensions that can also affect your social security benefits. The Windfall Elimination Provision or WEP, as well as The Government Pension offset or GPO, reduce both individuals and their spouses’ benefits:

- The Windfall Elimination Provision (WEP) applies when you have a pension from a job for which you did not pay Social Security taxes, such as certain teachers, and it could lower your retirement benefits.

- The Government Pension Offset (GPO) affects benefits as a spouse, widower, or widow if you have a pension from a government job that you did not pay Social Security taxes on.

What if Social Security is No Longer Around?

Over the last few years, Americans entering retirement have feared reductions in Social Security benefits, and those new to the workforce fear the dissolution of it altogether. The coronavirus pandemic amplified these fears, but the United States has been in jeopardy of depleting the Old-Age and Survivors Insurance (OASI) Trust Fund for quite a while. It is anticipated that the fund will become insolvent by 2035. After that point, income and payroll taxes would only cover 78% of the benefits. There are many reasons for the decline. One factor is the longer life expectancy for people today than in previous generations.

Also, due to the aging baby boomer generation, the Trust will be distributing more revenue in income than it will be receiving from the workforce. Congress would be able to hold off the decline by reducing benefits, means testing, increasing revenues through additional taxes or even raising beneficiary ages. However, these measures have been seen as political footballs that no one so far has wanted to touch. Eventually, Social Security will have to be addressed. In the meantime, though, we still include Social Security income when creating long term financial plans.

In addition to the primary considerations discussed above, there are also some other tertiary considerations to take into account when thinking about Social Security:

1. Not Checking Earnings Record

The primary insurance amount (or PIA) is based on a wage history of 35 years of earnings maximum. It is important to double check that those amounts are correct, and that each year you worked is counted accurately. Years with no earning history will be recorded as $0. Your PIA once you reach your Full Retirement age (or FRA) needs to be accurate so you can make the most informed decisions about claiming social security benefits. Anyone can go online to ssa.gov to log in or set up an account and verify your earnings record.

2. Decreasing Wages

Business owners can have lower W-2 incomes as a way to reduce taxes upfront. While this is important and usually discussed with a CPA, it’s still good to make sure that you are thinking through how this impacts the amount you’re paying into social security. Not maximizing social security benefits on the front end can be a costly mistake when it is too late to prepare closer to retirement. Again, an increased social security amount in perpetuity throughout retirement can be beneficial to supplementing retirement goals.

3. Not Maximizing Survivor Benefits

If one spouse passes away earlier than expected, many times the surviving spouse does not understand the options available to them through social security. Surviving spouses can claim social security as early as age 60. If they can go ahead and apply for survivor benefits, they can still wait until 70 to claim their own benefits if this amount is larger. Usually, it will be anywhere from 71.5% to 99% of the FRA amount. However, if the surviving spouse’s benefits are less, then they would first claim their own benefits at 62 and then switch to the higher amount in survivor benefits later on at FRA or age 70.

4. Claiming While Still Working

If you were still working in 2021 and earned more than $18,960, but you also claimed benefits before your FRA of 67, your benefits could be reduced by $1 for every $2 of income. If you wait to claim, it could jump up to $1 for every $3 once you reach FRA. While you can eventually get some money back and your benefits are adjusted once you reach full retirement age, usually the best method is to rely solely on your income while you’re still earning a wage and claim later once you stop earning, to allow your benefits to increase in the future.

5. Waiting Past 70 Years Old to Claim

Many times, people decide either they need to keep working to supplement their lifestyle or to keep saving for their future retirement goals. But they also might be unaware that they still need to at least apply for social security by age 70. The result is that some people end up filing for social security after age 70. If this is the case for you, you need to file as soon as possible. Social security will pay up to six months’ worth of retroactive benefits, but filing asap can also help you avoid losing out on money simply because you did not file within the designated time frame.

6. Delaying to Age 70 for Spousal Benefit

Spouses should wait until FRA to get their full benefit amounts and avoid reduced payments. However, spousal benefits do not apply additional credits from age 67-70. If you claim them at 62, the amount will be just 32% of your spouse’s benefit as opposed to 50% for spousal benefit if wait until FRA.

When and How Should I Apply?

Once you determine your “right age” for claiming Social Security, you can start thinking through the logistics of actually applying. According to the Social Security Administration, you should apply for benefits 4 months before you wish to have them begin. You can sit in line at the SS office or call by phone, but like most things today, applications can be completed much more easily online at ssa.gov. No matter how you plan to file, be prepared to block out some time and be able to provide identifiable information listed on this checklist.

Contact Us

At Wiser Wealth Management, we focus on social security optimization as a cornerstone to planning and increasing cash flow for the effectiveness of future financial plans. Should you have any questions, please reach out to us at wiserinvestor.com or by calling 678-905-4450.

Have more questions? Contact Us

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Advisor

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.