Dollar Cost Average or Lump Sum Investing – Here’s our Take

Do you dream about the day you win the lottery or inherit a large sum of cash from a long-lost relative you didn’t know you had? Or, are you planning to contribute to your child’s college 529 plan? Should I contribute a lump sum today or contribute monthly to the plan? Although we’ve never had a client win the lottery, we do have clients who have inherited or have a larger sum of money they want to invest. At this point, I often ask the question, should we invest it all now or dollar cost average the investment over time?

Tradeoffs

The tradeoffs to consider between investing the funds immediately vs over time are many. Vanguard recently released a research paper comparing the historical performance of the two methods across three markets, the United States, the United Kingdom, and Australia. The results proved that a lump sum investing approach outperformed the dollar cost-averaging approach approximately two-thirds of the time.

The research concludes that if you, as the investor, expect market trends to continue, are satisfied with your target asset allocation, and are comfortable with the risk/return of your portfolio, the wise move is to invest the lump sum immediately. This strategy allows you to gain exposure to the markets as soon as possible. But, if you are primarily concerned with lowering your downside risk and the potential regret if the market took a downturn after you invested a lump sum, then dollar cost averaging may be best for you. However, any emotionally based concerns should be weighed carefully against both the lower expected long-run returns of cash compared with stocks and bonds, and the fact that delaying investment is itself a form of market-timing, something few investors succeed at.

Closer Look at the Research:

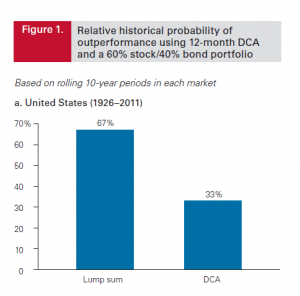

Figure 1 displays the historical probability of outperformance for lump sum vs dollar cost averaging when the assets are invested into a 60% stock/40% bond portfolio in the US.

As you can see, lump sum investing led to higher portfolio values in approximately two-thirds of the periods analyzed, since the average returns of stocks and bonds exceeded that of cash over the full span in each market. These results were consistent in both the UK and Australian data analyzed. If markets are going up, it’s better to put your money to work right away to take full advantage of the market growth. The research found that any factors unrelated to market trends had a minimal impact on the results.

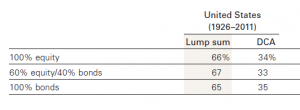

Figure 2 shows the findings were consistent when looking at portfolios that were 100% equities or 100% fixed income during the same time period.

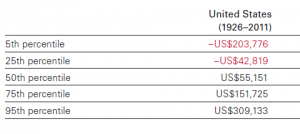

Now you may be asking yourself, but what about risk? It is important to look at the level of risk relative to dollar cost averaging. To do this, the researchers subtracted the ending portfolio values of a lump sum investment strategy from the ending portfolio value of a dollar-cost averaging strategy and compared them by percentile rank. In this analysis, there was a wide distribution of outcomes, as seen in Figure 3. It was possible for either strategy to underperform the other over a given period.

However, when looking at the risk-adjusted returns, Vanguard concluded that lump sum investing still had a better return and risk-adjusted returns, on average.

Despite this, some investors may still be concerned with investing a large sum right before a market downturn. Vanguard found that dollar cost averaging performed better during market downturns, so dollar cost averaging may be a logical option for investors who prefer some short-term downside protection.

In conclusion, if markets are trending upward, it’s logical to implement your asset allocation as soon as possible to maximize returns. But if you are concerned with reducing your short-term downside risk and the potential for regret, then dollar cost averaging may be your best choice. Historical averages are only a guide, and it’s possible for either strategy to lose money in any given period.

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.