Fear is NOT an Investment Strategy

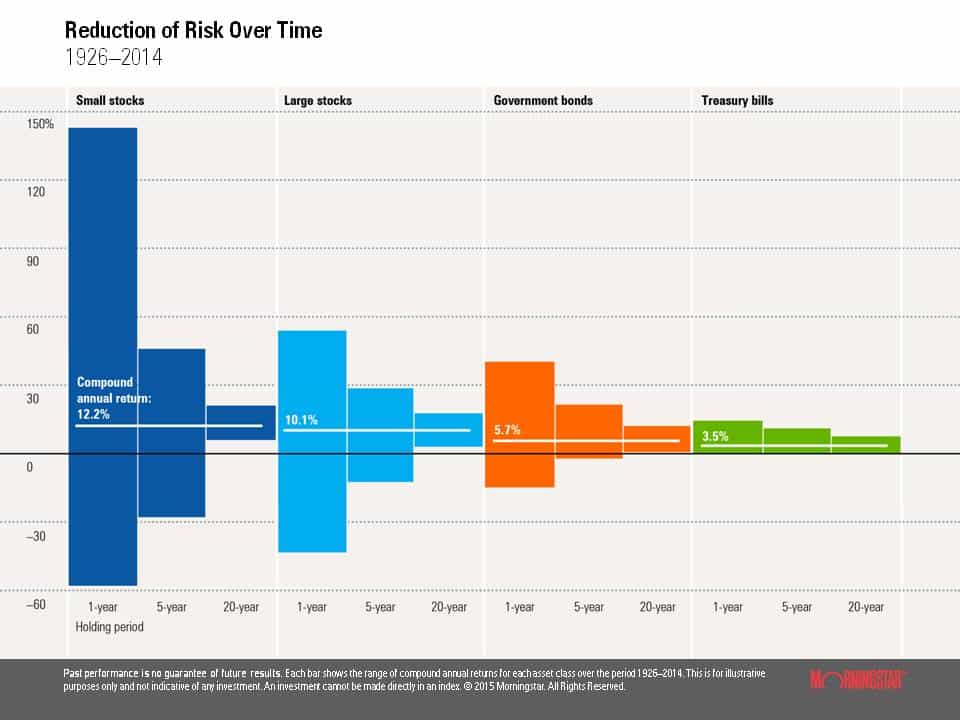

The stock market has been jumpy over the last few months. Greece, the Federal Reserve looking to raise interest rates, China’s Stock market plunge and some weak corporate earnings have all contributed to recent volatility. We must also acknowledge that the stock market has been on a good run since March 2009 with only a few setbacks. When I see the market behaving in this manner, I remember a quote from William Bernstein, a financial theorist and best-selling author, “In the short-term the stock market is a voting machine, in the long-term it is a weighing machine.” We don’t want to respond to the emotional part of the market, we only want to invest in the long-term gains. Unfortunately, we must endure short-term volatility in order to participate in the profits that we all are looking for. The chart below depicts the short-term risks in investing in US Stocks.

The chart covers a lot of ground looking at one-year returns from 1926 to 2014. In this time period, US large-cap stocks had a gain of nearly 60% or a loss of 45%. Most of our clients, if presented with investing over this time period would be too risk-adverse to participate. Over a 5-year period, the gain-to-loss percentage shrinks to 30% up vs. 20% down. Over a 20-year period, all US Stocks have posted gains. I will also note that US Treasuries in this graph show no losses, which is why we use short-term treasuries in our portfolios to lower portfolio volatility. The lesson here is that time does heal all wounds as well as lowers high short-term gains. This is why one of our fundamental investment principles is to always invest for the long term.

2008

It seems since the 2008 credit crisis that commentators of various sorts are trying to predict the next one. Eventually, maybe they are right; maybe there is a 20% correction or worse. Every doomsday forwarded email sent by a client or the request to “watch this video” that is 20 minutes of half-truths to scare the reader into buying the writer’s monthly newsletter subscription plays to one of the oldest sales tactics, fear. Fear is caused by the potential for pain or an unrecognizable event. It is a part of our natural instinct to survive. The writers know this and prey on the reader’s natural instinct for self-benefit. I have seen this same tactic used in the sale of annuities and other insurance products.

Fear

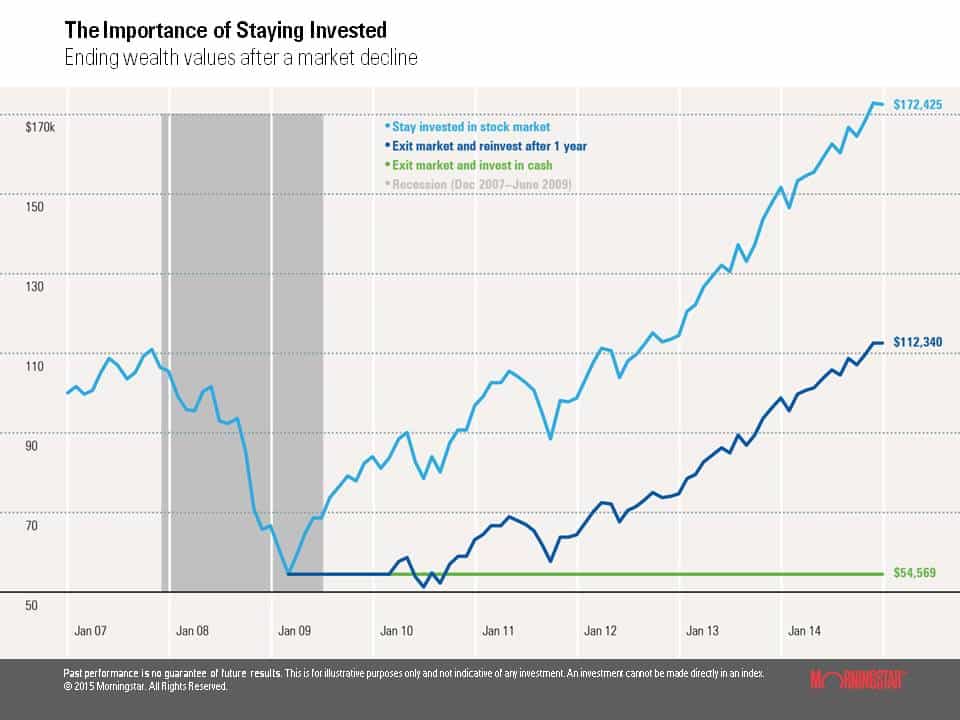

Fear causes people to do some crazy things, especially in the world of finance, but it can be overcome with education. In 2008, as it seemed the world was falling around us, I kept looking at past crises and what the market did over the long term. In every situation, if an investor had the resources, it was a time to be buying, not selling. No one at our firm actually sold anything out of fear, however, a few years into the recovery we did have new clients come aboard that did. The result was taking one million dollar portfolios to half a million with no recovery opportunity. The chart below shows what the net result was if you had sold your portfolio at the bottom of the market crash in March 2009. The chart clearly shows that staying the course was the best option, however at the time, fear took over for many and their portfolios never recovered. Some investors I have spoken with did stay the course but were not using index funds. Instead, they were invested in small companies that went out of business. So, to be successful you also have to be smart in which asset classes you invest in. We like long-term healthy asset classes that always show a positive return over a 10+ year time span.

The US Stock Market has always shown a long-term positive rate of return. More recently there have been temper tantrums in the short term. However, history indicates that for the patient investor who keeps costs low, maintains diversification, and focuses long-term, fear can be overcome and your financial goals can be realized.

Have more questions? Email me at info@wiserinvestor.com or use the Contact Us page.

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.