Fear versus Data

No one likes losing. It is in our human nature to suppress our losses and focus on our wins or even to just avoid losing all together. When looking at stock market performance, investors are frequently motivated by fear versus data. It is a known fact that investor behavior can erode as much as 4% annually from market return versus personal returns. People often ask me, how do I “Trump proof” or “Bernie proof” my portfolio? Or, how do I avoid a 2008 again? The answer is fairly simple, the long-term data shows that there should be no fear, only buying opportunities based on data.

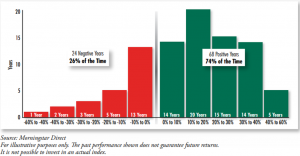

The chart below, from Morningstar Direct, provides the different ranges of calendar year returns for the S&P 500 Index – which consists of 500 stocks of generally large US based companies. For the 92-year period shown, the S&P 500 Index posted positive calendar year returns 74% of the time and negative calendar year returns 26% of the time, with an average calendar year return of 21% over the positive years and -14% over the negative years.

So why is everyone so fearful? When you are going through the 26% chance of a down year, it is hard to stay focused on the long-term. This causes many investors to sell at the worst times, never to recover the loss. For those that can hold out through market volatility, there historically has been greater rewards. My advice during stock market ups and downs remains the same: keep your investing cost low, maintain a diversified portfolio and focus on the long-term.

Posted March 4, 2020

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.