Is Enron is still relevant?

Among many speculative crazes in the early 2000s, New Economy mania was characterized by speculation of “up and coming” stocks that investors believed would rule the market in the future. Perhaps one of the largest accounting scandals in history stems from one of these New Economy companies: Enron Corporation. The rise and fall of this stock market beast was due to fraud committed by its executives. Let’s take a look at how one of the largest scandals in financial history took place. This blog is a part of a series written by our summer intern, Makenna. This series is based off excerpts from the well-known book, A Random Walk Down Wall Street.

The Height of Enron

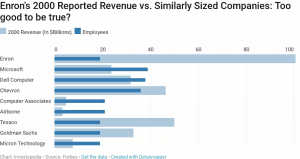

In the early 2000s, the energy company Enron Corporation was the seventh largest corporation in America. Malkiel describes it as “the perfect New Economy stock that could dominate the market not just for energy but also for broadband communications, widespread electronic trading, and commerce.” Enron reached a share price of $90.75 at its height and plummeted to $0.26 before declaring bankruptcy. Enron reported revenues of roughly five times that of the tech giant Microsoft in 2000. Energy stock was a popular New Economy choice because the industry was growing rapidly with promising innovations. Enron led the New Economy mania with its massive growth, but it soon collapsed when fraud was uncovered and the company went bankrupt.

The Collapse of Enron

For years, Enron executives Ken Lay and Jeff Skilling got away with “cooking the books” and inflating Enron’s earnings. One of their tactics was creating fake partnerships with companies in order to record higher earnings than what they were truly making. For example, Enron’s joint venture with Blockbuster. The two companies made a deal to rent movies out online, and a Canadian bank lent Enron $115 million in return for future profits from the deal. The deal fell through, yet Enron recorded the $115 million as revenue. This was one of many partnership scams Enron created, and because no one was aware of the fraud, Enron was seen as an extremely profitable company which lured in investors. There were fake trading rooms that the executives of Enron helped create. They put on a show for Wall Street analysts to prove their success by fabricating a trading room with actors, fancy phones, and expensive equipment. In 2006, however, Lay and Skilling were convicted of conspiracy and fraud, and Enron went bankrupt soon after. $65 billion of market share was lost because the company tried to deceive investors.

Making and Sustaining Profits

Malkiel offers a great perspective on investments by stating that, “the key to investing is not how much an industry will affect society or even how much it will grow, but rather its ability to make and sustain profits.” Some investors today may invest in current New Economy stocks with the belief that they will grow quickly and produce high profits. However, it is important to consider the sustainability of companies you invest in because while they may skyrocket the value of your portfolio, they could collapse just as fast. While Enron’s collapse was mainly due to fraud, part of the magnitude of Enron’s height was due to the fact that investors had too much confidence in the stock. Technological innovations can produce great profits, but when speculation drives prices to an unreasonable height, it is best to take a step back and consider the realistic sustainability of a company.

Makenna Cooper

Summer Intern / Berry College Student

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.