Is the 60/40 investment portfolio dead?

Mark Twain is credited as saying, “The reports of my death are greatly exaggerated.” This phrase came to mind as I was researching articles on the continued viability of the traditionally managed 60/40 investment portfolio. Type into your search engine, “Is the 60/40 portfolio dead,” and it will generate over half a million results. Following a difficult year for both stocks and bonds, a growing interest in the viability of traditional portfolio construction is understandable. But should we throw it out just yet? Is the 60/40 investment portfolio dead?

What is the 60/40 investment portfolio?

The 60/40 portfolio — shorthand for a diversified portfolio built with 60% equities and 40% fixed income — is intended to generate solid returns while minimizing risk. And yet, this did not happen in 2022, as stocks and bonds declined in tandem. According to Vanguard, the typical 60% stock/40% bond portfolio declined about 16% in 2022—a painful reality for advocates of balanced investments.

What happened to the market in 2022?

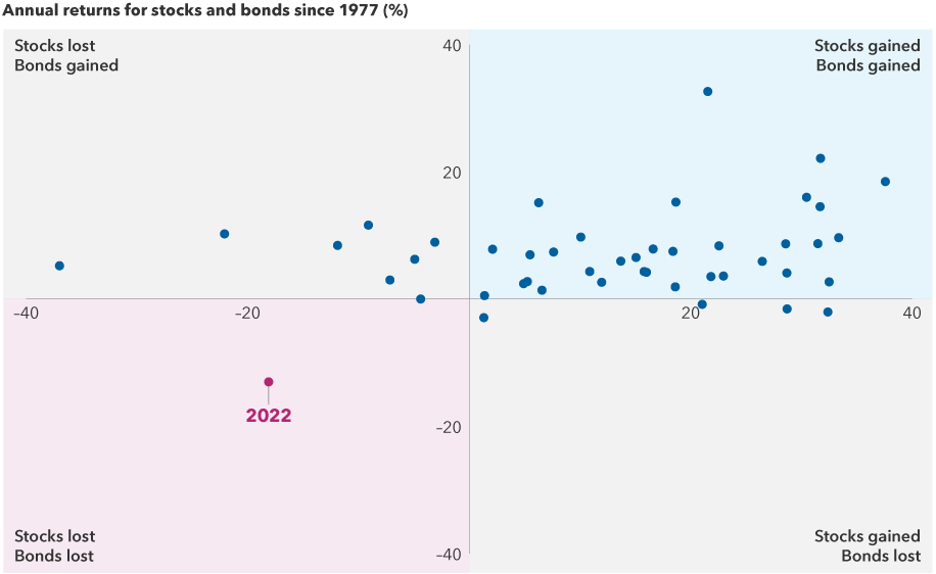

However, last year stands out as the only time in the past 45 years that both stocks and bonds declined in tandem for a full calendar year – indicated in the chart below. The culprit for the chaos in both stocks and bonds last year was the Federal Reserve’s aggressive rate hikes, making 2022 an anomaly. That correlation between the two asset classes of stocks and bonds won’t likely repeat itself again any time soon. We have every expectation that bonds will go back to offering diversification benefits as we near the end of the Fed’s interest rate tightening cycle.

Sources: Standard & Poor’s. Each dot represents an annual stock and bond market return from 1977 through 2022. Stock returns represented by the S&P 500 Index. Bond returns represented by the Bloomberg U.S. Aggregate Index. Past results are not predictive of results in future periods.

Long-Term Strategies

While there is a lot of wisdom to gain from market investors, there can also be a herd mentality on Wall Street. I believe many investors have become skeptical of balanced portfolios at just the wrong time. Going forward, a balanced portfolio should continue to be a successful investment strategy over the long term. In other words, the reports on the death of the 60/40 portfolio have been greatly exaggerated indeed.

Have more questions? Contact Us

Brad Lyons, CFP®

Investment Manager

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.