Planning Opportunities During a Bear Market

A bear market provides planning opportunities to add value to our client’s financial lives. With the most recent market selloff and constant bad news surrounding us, it can be easy to get distracted from our long-term investment objectives and become pessimistic. Investors are frustrated and scared, struggling to watch their retirement accounts values drop daily with the volatile swings. However, we cannot let this distract us from the fact that there can be some good through this bad. A bear market provides opportunities to add value to our client’s financial lives. There are three strategies that come to mind to take advantage of during stock market losses:

Roth Conversions

If a client is nearing retirement, or in a lower tax bracket than in retirement, this year could be a good time to discuss Roth conversions. This is a strategy that needs to be discussed, not just with a financial advisor, but also with the investor’s accountant. It is the process that allows clients the opportunity to convert an IRA into a Roth IRA. The investor pays taxes on the initial transfer but would then have access to the funds tax-free later in retirement.

In addition to the preferential tax treatment a Roth provides there also are also no Required Minimum Distributions (RMD) required. This can also be an efficient and beneficial estate transfer strategy if investors are interested in legacy planning. Due to the recent SECURE Act (Setting Every Community Up for Retirement Enhancement), non-spousal beneficiaries will need to withdraw the funds from a retirement account during a 10-year period following the death of the investor. This could cause a significant tax bill for the beneficiary. However, if taxes have been paid on a ROTH IRA, the beneficiary would be able to receive the funds tax-free. Also, with the market down over 20% from its intra-year highs, now could be a good time to pay the lower taxes upfront and invest in the new retirement account at the discounted valuations.

Tax Loss Harvesting

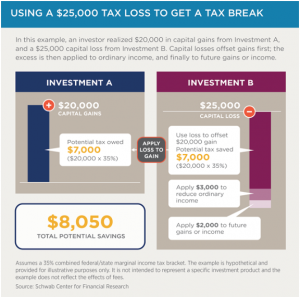

Another strategy where an advisor can add value is by selling a security, or a fund, at a loss and “harvesting” it to offset potential gains. The investor can repurchase one that is similar, but not substantially identical in order to avoid the wash sale and maintain preferential tax treatment. After offsetting the capital gains due to the losses, the investor can even use up to $3,000 annually against their ordinary income with the extra losses carried over into future years.

In the example below from Charles Schwab, an investor in the 35% combined federal/state tax bracket might take advantage of a $25,000 loss of a security or fund, on an account with a $20,000 capital gain. They could apply $20,000 at their tax rate for $7,000 in potential taxes on the capital gains and then use $3,000 against ordinary income for the potential $8,050 in savings. The remaining could be applied to offset future gains.

(Source: Charles Schwab article “Reap the Benefits of Tax Loss Harvesting to Lower Your Tax Bill”, Schwab Center for Financial Research)

Rebalancing

Many investment accounts have drifted from their optimal allocation based on their individual risk tolerance. For example, if a client going into 2020 was invested for a 60/40 portfolio, meaning 60 percent in risk assets or equities and 40 percent in fixed income, the account most likely has drifted somewhere closer to 55/45 due to the losses in the stock market. This is a great example of “Investing 101”, where we “buy low and sell high.” The investor should sell a portion of the bonds that have outperformed relative to equities and buy more stocks at the lower valuations.

Investors don’t have to go through these turbulent times alone. If you handle your own investments, now can be a good time to speak with an advisor or get a second opinion to help incorporate them into your overall financial plan. We are advising clients that as long as their goals have not changed, we will continue to monitor accounts while keeping a long-term diversified strategy. Use this time to assess your risk tolerance and how much market volatility you can stomach in your portfolio. During these dark times, we can find a once-in-a-decade opportunity to invest for the future.

Matthews Barnett, CFP®, ChFC®, CLU® Financial Planning Specialist

Posted 4/7/2020

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.