Real Estate Investment Trust (REITs) for Your Portfolio

A real estate investment trust (“REIT”) is a company that owns, operates, or finances income-producing real estate across a range of property sectors. REITs provide an investment opportunity for everyday Americans—not just Wall Street, banks, and hedge funds—to benefit from valuable real estate, access dividend-based income and total returns, and help communities grow, thrive, and revitalize.

What are REITs?

REITs allow anyone to invest in portfolios of real estate assets the same way they invest in other industries – through the purchase of individual company stock or through a mutual fund or exchange-traded fund (ETF). The stockholders of a REIT earn a share of the income produced – without having to go out and buy, manage, or finance property.

REITs Historical Returns

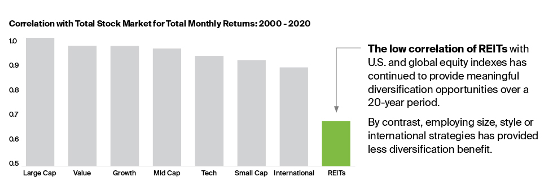

REITs historically have delivered competitive total returns based on high, steady dividend income and long-term capital appreciation. Their comparatively low correlation with other assets also makes them an excellent portfolio diversifier that can help reduce overall portfolio risk. Over the past few decades, assets have become increasingly correlated. This has challenged investors to identify investments to diversify their portfolios. Fortunately, REITs provide access to meaningful diversification opportunities.

REITs are total return investments with the potential for moderate, long-term capital appreciation. Long-term total returns of REIT stocks tend to look like those of value stocks and yield more than the returns of lower-risk bonds. From 2004 through 2021, equity REITs averaged 11.88% return and now yield 2.8% – over twice that of the S&P 500.

Who should invest in REITs?

Because of the strong dividend income REITs provide, they are an important investment both for retirement savers and for retirees who require a continuing income stream to meet their living expenses. REITs dividends are substantial because they are required to distribute at least 90 percent of their taxable income to their shareholders annually. Their dividends are fueled by the stable stream of contractual rents paid by the tenants of their properties. The relatively low correlation of listed REIT stock returns with the returns of other equities and fixed-income investments also makes REITs a good portfolio diversifier. REIT returns tend to “zig” when those of other investments “zag,” helping to reduce a portfolio’s overall volatility and improve its returns for a given level of risk.

REITs Historically Offer Investors:

- Competitive Long-Term Performance: REITs have provided long-term total returns similar to those of other stocks.

- Substantial, Stable Dividend Yields: REITs’ dividend yields historically have produced a steady stream of income through a variety of market conditions.

- Liquidity: Shares of publicly listed REITs are readily traded on the major stock exchanges.

- Transparency: Independent directors, analysts, and auditors, as well as the business and financial media monitor listed REITs’ performances and outlooks. This oversight provides investors with a measure of protection and more than one barometer of a REIT’s financial condition.

- Portfolio Diversification: REITs offer access to the real estate market typically with low correlation with other stocks and bonds.

- Hedge Against Inflation: REITs outperformed the S&P 500 in 56% of twelve-month periods with high inflation and over 80% of the twelve-month periods when inflation is high and rising.

Returns During the COVID-19 Pandemic

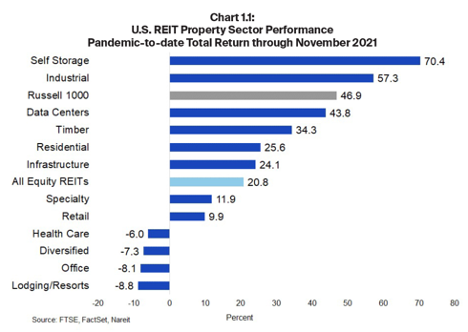

After posting initial declines early in the pandemic, REIT share prices have recovered as the real estate sector has proven to be resilient. REIT sectors that support the digital economy—data centers, infrastructure, and industrial REITs—rebounded most rapidly in the summer of 2020 as online communications and e-commerce purchases replaced in-person interactions during the period of most stringent social distancing requirements. Other sectors recovered more fully after vaccines against COVID-19 were introduced in November 2020.

Some sectors remain below pre-pandemic levels, including lodging/resorts, office, diversified, and health care REITs. Other sectors, however, have had double-digit returns. Some sectors have delivered exceptional returns, including industrial REITs, with total returns of 57% through November 2021, and self-storage REITs—which have had a surge of demand due to strong housing markets and home sales, plus additional need for space during the pandemic—with investment returns exceeding 70%.

REITs in 2022

Overall, the year ahead is likely to build on the recovery that is already underway in the macro economy and in commercial real estate markets. REITs are likely to perform well in this growth environment.

Have more questions? Contact Us

Brad Lyons, CFP®

Investment Manager

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.