Retail stores continue to struggle

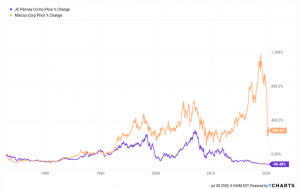

Brooks Brothers declared bankruptcy Wednesday after filing for Chapter 11. It was a sad day because the company was founded in 1818 and was the longest standing operations retail company in the United States. It currently has over 200 stores in North America and over 500 across the world. The company did over $990 million in sales in 2019 and employed over 4,000 people. However, like Neiman Marcus, J. Crew, J.C. Penney, Dean & DeLuca and many other retailers, it has struggled through the pandemic.

Brooks Brothers furloughed 80% of their staff and closed over 50 stores at the beginning of the pandemic, while stating they would be able to survive the shutdown. However, their brick-and-mortar retail stores have been struggling over the last decade since the growth of online shopping, even though they had a good online presence with over 20% of their sales taking place online. But now, retail-and-apparel businesses have more problems as customers are not spending money in stores because they are afraid of the virus, nor are they spending money online because they are afraid of future unforeseen circumstances.

Companies like Brooks Brothers and J.C. Penney made it through the Great Depression, numerous wars and the Great Recession, but could not survive the changing landscape of online shopping mixed with the issues that presented themselves with the coronavirus pandemic and shutdown of the economy.

It is important to realize that the stocks that have fared well in the past may not be the ones to do so in the future. At Wiser Wealth Management, we maintain portfolios of diversified, low-cost ETFs. We are not trying to time the markets or speculate on which stocks might perform best or which sectors could improve based on cyclicality of the markets. We focus on healthy, long-term assets classes based on clients’ risk tolerances and manage portfolios as a part of the overall financial plan to help increase probability for future financial success.

Matthews Barnett, CFP®, ChFC®, CLU® Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.