Sell in May and Go Away?

A common phrase when investing in the stock market is, “Sell in May and Go Away.” The adage is said to have originated from an old English saying: “Sell in May and go away and come back on St. Leger’s Day.” St. Leger’s Day refers to the day of the St. Leger Stakes, a popular horse race, held in September. Americans eventually adopted it based on the increase in vacation time taken during summer months, and then applied it to an investment approach.

It implies that the months from May to October are the worst performing time periods for the markets, and suggests it’s advantageous to your portfolio to sell the risk assets or equities in your portfolio in May and then reinvest in November. However, this is not a good idea as it requires timing the market and the numbers don’t always work out on your side.

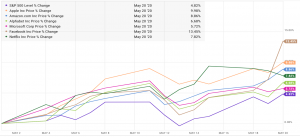

The chart below shows the returns in May over the last decade. As you see, there have been only three negative months with most others outpacing inflation.

Bank of America Merrill Lynch conducted a study in April 2017 and found that going back to 1928 the June-August time period was actually the second-best time period with gains over 63% of the time with an average return of 2.97%. So, the bulk of returns may not come from May, but are better over the long term than staying or moving to cash.

Currently the S&P 500 is up over 5% in May and down only 8% for the year. It is a market cap-weighted index that measures the stock performance of the largest 500 companies in the United States. It is currently comprised of Communication Services, Consumer Discretionary, Consumer Staples, Energy, Financials, Health Care, Industrials, Information Technology, Materials, Real Estate, and the Utilities sectors.

Technology accounts for over 25% of the index, and it is leading the charge to pull the market back from the low set in March when the coronavirus pandemic became a reality.

At Wiser Wealth Management we do not advocate market timing. We are long term investors focused on healthy asset classes. We currently have a tilt towards technology outside of our S&P500 funds through various low-cost ETFs.

The adage “Sell in May and Go Away” may be catchy, but it holds little value or accuracy. Enjoy your summer traveling and spending time with family and friends, but put little faith in this old saying. If interested in learning more about Wiser and our model portfolios, please visit our website to schedule a complementary consultation or by calling 678-905-4450.

Matthews Barnett, CFP®,ChFC®, CLU®, Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.