Investors betting against Warren Buffett

At the recent Berkshire Hathaway annual shareholders’ meeting, Warren Buffett virtually announced he was selling all of his airline positions stating, “The world changed for airlines.” Although usually a long-term investor, he projects the airline industry will not turn around for at least the next four years. “Our airlines position was a mistake” he stated. The coronavirus pandemic has hit the airline industry the hardest. Airlines are operating at 90% less capacity. They have accepted government bailouts in order to avoid potential bankruptcies and there is even talk of government equity in certain companies to keep them afloat. However, some investors are betting against the “Oracle of Omaha”.

As I mentioned in a recent article on the recovery of the economy, recovery depends on consumer behavior as much as company fundamentals moving forward. In order for the economy to thrive, people will need to be comfortable traveling again. Some investors are seeing the value in the stocks, but do not understand the length of the recovery that Buffett sees for the industry. They are betting the airline industry will once again thrive and that is shown by their increased interest in the ETF JETS.

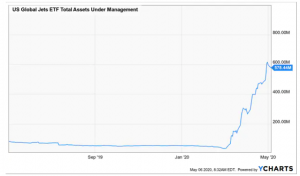

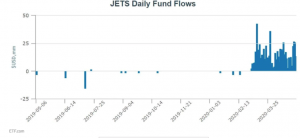

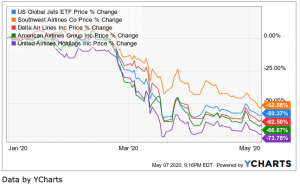

According to ETF.com “JETS invests in companies within the airline industry, which spans passenger airlines, manufacturers, airports and terminal services. Small-, mid- and large-cap companies are included from both the US and internationally. The fund puts about 70% of its weight in US large-cap passenger airlines.” Delta, American, United, and Southwest account for over 40% of the fund’s holdings. Although the airlines’ balance sheets and stock prices are falling, the ETF JETS has taken off over the last month. Over $600 million flooded into the fund over the past few months. AUM at the beginning of the year was just $64 million.

JETS also has over 40 straight days on inflows. What is interesting is the behavior shift from what we normally see. Usually investors are following recency biases and want to buy the latest hot stock at the top right before it pulls back. What they are anticipating now is that this could be the bottom and there will be a sharp turnaround due to pent up demand.

Although the fund is down almost 60% YTD, investors are taking a contrarian view on the fund. According to Robinhood, in February only 250 accounts held the JETS fund while currently over 20,000 investors do today. The price of the fund is going down while the number of investors increases.

Investors are not looking at the falling price of the stocks. They are betting on the intrinsic value of the companies. They believe that airlines would be thriving if it were not for this pandemic. At Wiser Wealth Management we do not invest in individual securities, even industry specific ETFs. However, we believe in diversification across various sectors and asset classes through low cost ETFs. JETS investors are betting on the recovery of the airline industry, nevertheless we at Wiser do not invest in speculative industry specific funds. We invest in healthy core long-term asset classes.

Matthews Barnett, CFP®, ChFC®, CLU®, Financial Planning Specialist

Posted 5/15/2020

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.