Should Investors Worry About a Weakening U.S. Dollar?

The U.S. dollar (USD) has been weakening against several major global currencies over the past few quarters. Many large institutions and market commentators are now questioning whether “U.S. exceptionalism” is over, or at least on pause. So, should investors be concerned that this is the beginning of a long-term trend? In short, I’m not concerned about the recent USD underperformance. I believe U.S. equities are still well-positioned to outperform international equities over the long term. Here’s why:

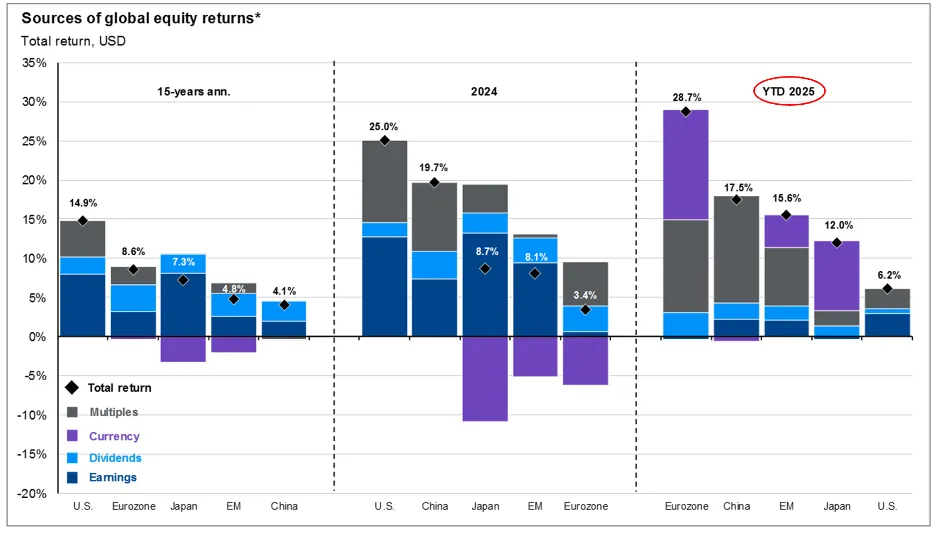

Understanding the Components of Equity Returns

To evaluate what’s driving returns in different regions, it’s helpful to break equity returns into four key components:

- Earnings Growth

- Dividends

- Multiple Expansion

- Currency Effects

A stock’s total return typically comes from two main sources: earnings growth and dividends paid to shareholders. Of the four return components, earnings, dividends, multiple expansion, and currency effects, earnings growth is the most important driver of long-term equity performance and also the most sustainable.

Multiple expansion refers to changes in a stock’s valuation, most often measured by the price-to-earnings (P/E) ratio. If the stock’s price (the numerator) increases more than its earnings (the denominator), the valuation multiple is expanding. Conversely, if the price declines more than earnings, the multiple is contracting.

Currency effects result from the relative strength or weakness of one currency versus another. For example, the Euro has recently appreciated against the U.S. dollar, creating a positive currency return effect for European equities when measured in USD terms.

What’s Driving Returns Outside the U.S. in 2025?

Looking at 2025, much of the recent outperformance from international equities has come from short-term or unsustainable sources:

- Eurozone and Emerging Markets: Primarily driven by multiple expansion and currency appreciation

- China: Mostly from multiple expansions

- Japan: Benefiting from currency appreciation

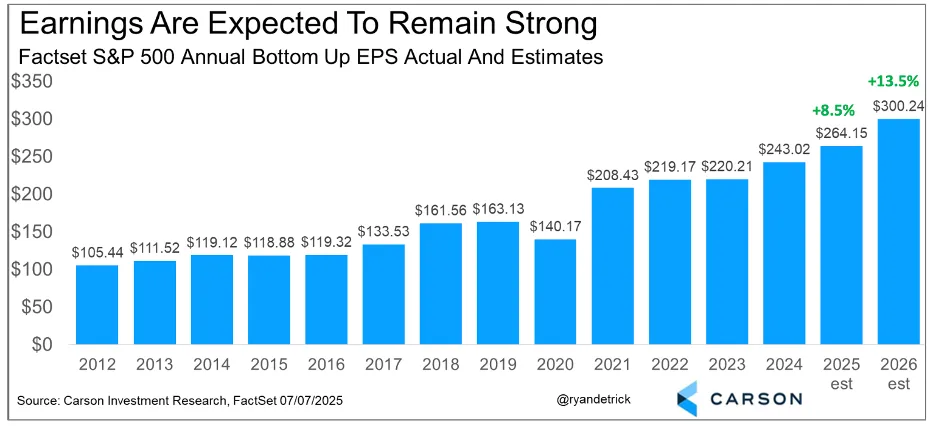

U.S. Earnings Remain a Key Driver of Returns

While U.S. earnings growth has cooled somewhat, it still makes up a significant portion of the total return for U.S. equities in 2025. Looking ahead, I believe this earnings resilience will continue, largely due to the U.S. market’s strong concentration in technology companies. We’re still in the early stages of the artificial intelligence (AI) growth cycle, and U.S. markets are well-positioned to benefit as this trend accelerates. In contrast, most international markets lack the same level of tech exposure and innovation focus, which may limit their long-term growth potential.

As the chart below illustrates, S&P 500 consensus earnings per share (EPS) are projected to grow by approximately:

- 8.5% from 2024 to 2025

- 13.5% from 2025 to 2026

That kind of earnings growth is a strong foundation for long-term returns, and one that many international markets with less tech exposure may struggle to match.

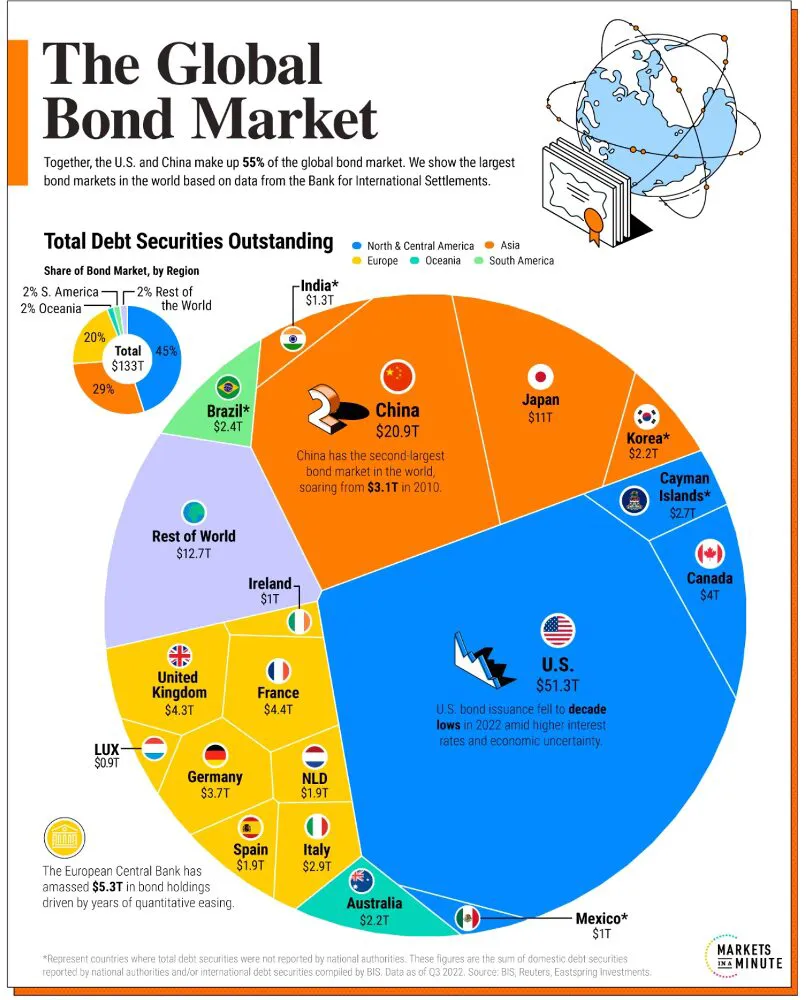

The U.S. Dollar Isn’t Going Anywhere

Despite recent fluctuations, the U.S. dollar remains the world’s dominant reserve currency, and for good reason. The U.S. has the largest and most liquid bond market globally, accounting for more than twice the size of the next biggest (China), according to 2022 data. While slightly dated, the takeaway remains: U.S. debt markets continue to lead. Beyond sheer size, the USD is preferred over alternatives like the Yuan because of China’s tight capital controls, regulatory restrictions, and limited transparency.

A New Tailwind: The GENIUS Act

Looking ahead, the U.S. dollar may get an additional boost from the recently passed GENIUS Act, which ties USD-based stablecoins to U.S. dollar reserves. This connection is expected to increase global demand for U.S. Treasuries and reinforce the dollar’s role in global financial transactions.

Our Investment Philosophy

At Wiser, we believe that trying to time asset class leadership is a losing game. Leadership rotations between U.S. and international equities happen frequently and unpredictably. That’s why we advocate for a diversified, multi-asset portfolio built for long-term trends, not short-term guesses. While international markets may experience brief periods of outperformance, I believe their recent momentum is unsustainable based on the data we’ve explored.

What’s Next?

The weakening dollar doesn’t signal the end of U.S. market dominance. If anything, it highlights the importance of looking beyond headlines and focusing on fundamentals, like earnings growth, innovation, and long-term strategy. Want to make sure your portfolio is positioned for what’s next? Schedule a consultation with our team today.

Andrew Pratt, CFA, CBDA

Investment Manager, Wiser Wealth Management

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.