Should You Have ETFs In Your Portfolio?

Should you have ETFs in your portfolio?

The short answer is yes! But why? ETF stands for Exchange Traded Fund. It can be somewhat similar to a mutual fund in that it is a “basket of securities.” However, unlike mutual funds, there is not an active manager to track various passive indexes. At Wiser Wealth Management, our strategic portfolios are comprised solely of ETFs because they have a few distinct advantages over mutual funds. First, they are more tax efficient. They very rarely distribute capital gains in December like mutual funds, which over the last few years could have significantly impacted tax liabilities. Also, they are much more cost efficient.

Investment Account Fees: Are you paying too much?

Investors frequently overlook or misunderstand how much they pay in fees for their investment accounts. Some firms neglect to discuss fees with their clients upfront, and they continue to gloss over them by not providing readily available information in their statements. According to a survey by Rebalance IRA published in a recent Forbes Article, 46% of a sample size of baby boomers believe that they do not pay any fees at all in their retirement accounts. In addition, another 20% believe their fees are less than 0.5%. However, these are inaccurate assumptions. Most firms have some type of management fee based on their assets under management, or AUM, outside of 401(k) accounts. Also, the costs usually do not stop there and additional fees can easily be overlooked.

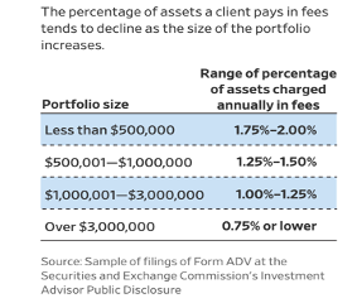

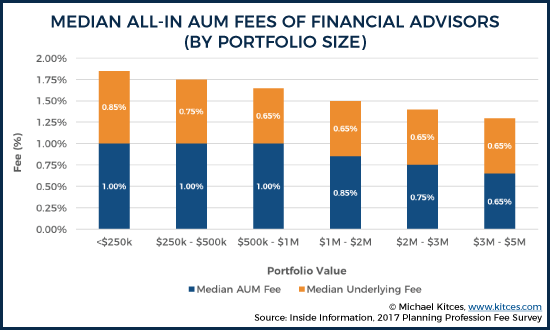

So, how are fees usually calculated and what are the different structures? According to a WSJ article, average asset management fees are usually billed quarterly and are scaled as seen in the following chart:

Source: WallStreetJournal

If the advisor is using mutual funds, there are Expense Ratios, or Internal Expenses, that get billed outside of the initial management fee. Also, most 401(k) platforms usually have some higher cost mutual funds within their platforms. So, even if you are not paying an advisor for any management, you could still be paying other fees from certain funds used by your plan.

For example, many mutual funds have expense ratios of at least 0.70% meaning that for every $1,000 invested, $7 is for the expenses. Unlike the management fees, these are not deducted from the account and their return is the net of these fees. These fees are usually institution type shares, but some commissioned advisors still use A-shares. A-Shares are significantly higher than other mutual funds and can have a 5+% front load, meaning that the whole amount is not invested and 5% is initially deducted as the sales charge. They could also be B or even C shares if older and they may include additional 12b-1 fees annually to pay for the fund’s marketing and other promotional costs. Administrative fees and operating costs can also be included to pay for the fund’s managers, research and certain record keeping.

Mutual Funds vs ETFs

While mutual funds are a great way to diversify your portfolio through a basket of securities rather than selecting individual stocks and bonds, there are now other options offered through index funds or ETFs diversified across various long term healthy asset classes. Some funds are more cost efficient than others, but this allows the portfolios to have overall expense ratios of around 0.06% rather than the 0.70% found in most mutual fund accounts. ETFs are also more tax efficient and rarely distribute any additional capital gains tax to the consumer at year end as opposed to mutual funds.

Don’t Pick a Fund Based Off Performance

The latest report from S&P Dow Jones Indices shows that picking a fund purely based on performance is statistically a losing game as very few funds can consistently stay on top. Out of the funds that were top performers as of June 2021, only 4.80% managed to stay on top over three consecutive 24-month periods. Looking longer term, only 3.08% of large cap, 0% mid cap and 2.94% of small cap funds were able to stay in the top half of their peers over five consecutive years.

Fund Managers

So, what is an investor to do? When picking a mutual fund, you are really picking a fund manager. This fund manager is usually actively trading your money to beat his or her assigned index. They will have good years and bad years but statistically they will not beat their assigned benchmark over the long-term. I recommend that investors look at investing differently.

ETFs in Your Portfolio

At Wiser Wealth Management, we believe you should have a portfolio with ETFs across various asset classes that is managed based on your risk tolerance. That portfolio should be rebalanced throughout the year for tax loss harvesting or other tax efficient and market efficient opportunities to provide alpha.

Have more questions? Contact Us

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Advisor

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.