S&P 500 Valuations are High, Should Investors Be Concerned?

The Noise Around U.S. Equity Valuations: Should Investors Be Concerned?

Some financial press outlets have recently been shining a negative light on U.S. equity valuations indicating that they are “overvalued”. Well, U.S. equity valuations have indeed crept up to their highest level in recent history, which does make sense since the S&P 500 is up over a whopping 24% so far in 2024. Is this sustainable for equities looking forward and/or is this something that we should be concerned about? In my opinion, this is just noise and as investors, we should not be overly concerned with this news.

Our Long-Term Investment Approach

Wiser’s general investment philosophy is to invest in healthy asset classes and construct portfolios with a long-term mindset. While we may make tweaks to our portfolio model allocations along the way valuations hardly carry a significant influence behind our decision-making rationale. Valuations are a tool of many that we may look at it, but it is not the sole determining factor in our process primarily due to that they are difficult to time the top and bottom of a given valuation ranges. Therefore, making tactical allocation changes using this metric alone would be very challenging and most likely lead to underperformance.

Addressing Market Correction Concerns

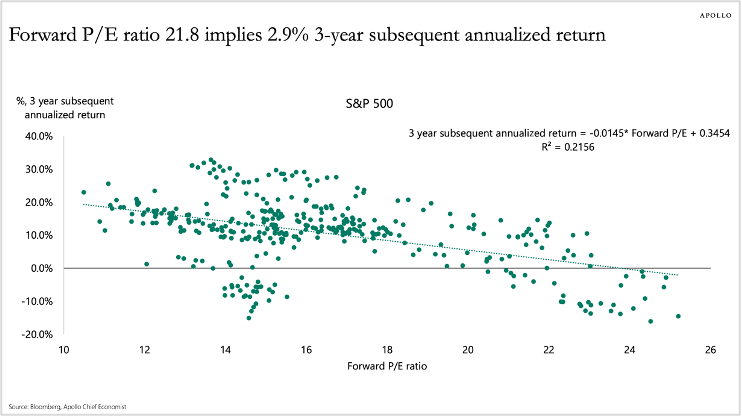

Some of you still may question that high valuations could mean a market correction in the short-to-medium term. This is indicated in a chart published by Apollo Global Management, which shows a historical relationship between the S&P 500 index’s forward price-to-earnings (“P/E”) valuation vs. its 3-year subsequent annualized return. Long story short, it indicates that stocks are trading at 21.8 times their future price-to-earnings ratio. This historically does not bode for the future performance of the S&P 500 over the next couple of years. However, I have a problem with this chart for a few reasons:

1. Robust Earnings Growth and Sound Profit Margins

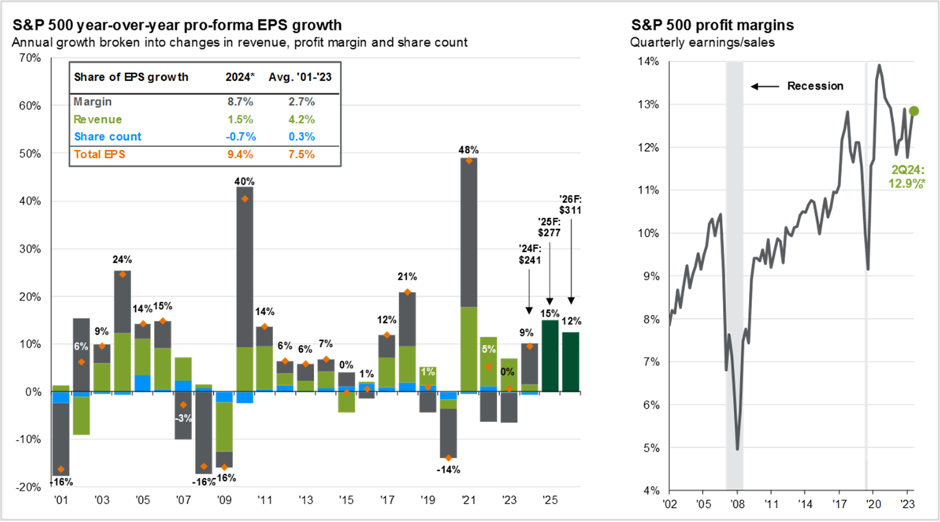

- Earnings growth has beat expectations in 2024 which has largely been fueled by the artificial intelligence boom. The image on the left in the chart below shows that 2024 total adjusted earnings per share growth is currently about 2% above the prior 22 years annualized average (9.4% vs. 7.5%). This implies that companies continue to have resilient earnings growth and are “growing into” their higher valuations

- Proft margins are not near all-time highs, close to a 3-year high, and have been trending positively in recent quarters (image on the right). Also if you look further back, the index’s current profit margin of 12.9% is significantly higher than where it was over the past 5, 10, 15, and 20 years.

Source: Compustat, FactSet, Standard & Poor’s, J.P. Morgan Asset Management.

2. Forward P/E is Elevated but Still Not Near their Highs Over the Past 5 Years

- The S&P 500’s forward P/E ratio peaked around 26.0x in January 2020, and also touched 23.0x for several months during this time period, so forward valuations are currently not near the top of the range

3. Momentum Begets Momentum

- There are a lot of studies that show that a lot of times higher valuations even lead to higher valuations. The S&P 500 started the year with a forward P/E of 21.0x and is now at 22.0x. What if you sat out and did not participate in the market this year? Imagine missing that +20% run-up in the index!

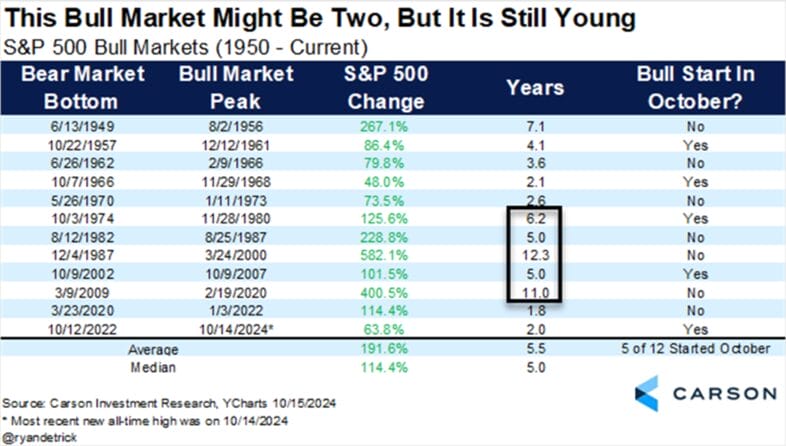

- Bull markets last for 5.5 years on average, and this bull market only just turned 2! The table below shows data for each bull market we have experienced over the past 75 years. Over this time frame, bull markets have averaged 5.5 years and returned 192%. The S&P 500 is currently in year 2 of this latest bull market and has returned about 64%, so we could potentially have some ways to go based on historical averages

Overall, I do think it is important to take note that U.S. equity valuations are high. However, I believe that as long as companies continue to grow into their valuations then I think the S&P 500’s higher valuation premium is justified. The bottom line is that as investors we just need to maintain proper cash reserves and keep investing for the long term.

Schedule a complimentary consultation and discover how our services can help you achieve financial success.

Andrew Pratt, CFA, CBDA

Investment Manager, Wiser Wealth Management

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.