Volatile markets: Don’t rely on headlines

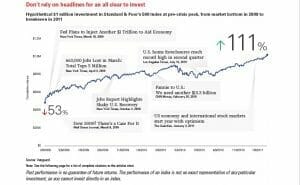

Falling and volatile markets and drastic headlines can tempt individuals to abandon their long-term investing plans. Their thinking might go something like, let’s wait until it’s over, hoping to catch the market at its lowest point before buying in. Or in rising markets, maybe they seek to sell most of their holdings near the peak. However, timing a volatile market is essentially an impossible task, as the chart on this page illustrates. It’s good to remember:

- Headlines shouldn’t dictate when you invest; they may not reflect what’s actually happening in the market.

- A recovery typically involves many episodes of gains and losses that can obscure an overall upward trend.

- Just a few trading days can be responsible for the largest gains during a recovery; being out of the market can mean missing out on the most profitable periods.

It’s understandable to have concerns about market volatility and its effect on your portfolio. The situation in the markets is certainly different this time. However, so far, it follows a pattern we’ve seen many times before and have successfully navigated over the years. Bottom line: The “right time” to invest is usually now, whatever the markets’ performance or news headlines might be. By all means, if you have questions or concerns about the plan we created to help you reach your financial goals, please get in touch.

Casey Smith

Posted 4/9/2020

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.