What does it mean to diversify my portfolio?

You’ve probably heard the old saying, “Don’t put all your eggs in one basket.” But what happens when an investor does exactly that, putting all of their money into one or a few stocks? The result is a portfolio that’s not properly diversified and is exposed to concentrated asset risk. This saying reminds us of the importance of spreading your investments across a wide range of assets. Diversification helps protect your portfolio if one investment significantly declines in value. By holding multiple “baskets,” you reduce your exposure to any single asset and help safeguard your retirement nest egg.

Understanding Concentrated Asset Risk

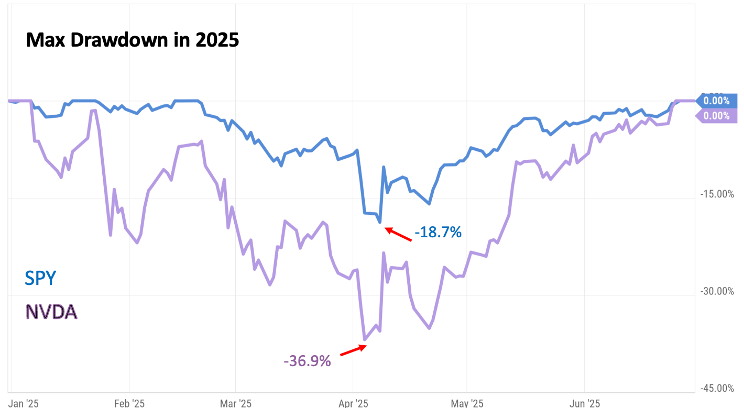

Concentrated asset risk can significantly hinder long-term portfolio performance. It can result in large losses and disrupt your long-term growth trajectory. Fortunately, diversification offers a powerful solution. Also known as unsystematic risk or idiosyncratic risk, concentrated asset risk can be minimized by spreading investments across a variety of assets. To illustrate this, consider two hypothetical portfolios: one invested entirely in NVIDIA Corporation (NVDA) and another invested in the S&P 500 ETF (SPY). The chart below shows the maximum drawdown each experienced in 2025.

While NVDA has delivered an impressive 32,000% return over the past decade, even it wasn’t immune to volatility. In early April, NVDA experienced a sharp -36.9% drop. By comparison, the diversified SPY declined by just -18.7% during the same period. Yes, a nearly 19% drop is still significant, but it’s about half the loss NVDA investors endured. And this was an unusually sharp pullback. Imagine the impact if you were concentrated in a speculative or lower-quality stock. Most investors would struggle emotionally with a -37% drop, leading to panic-driven decisions. This example highlights the value of broad diversification, even when investing in high-performing stocks. Index funds like the S&P 500 can offer more stability and a stronger defense against market shocks.

Market Risk Can’t Be Diversified Away

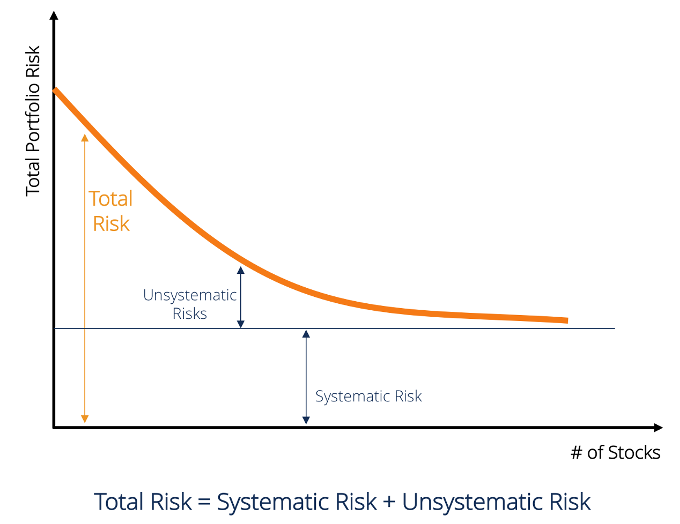

While unsystematic risk can be reduced through diversification, market risk, or systematic risk, cannot. If your portfolio includes equities, you’re exposed to market risk, which comes with the potential for both higher returns and greater volatility. Investors seeking higher long-term returns typically allocate a portion of their portfolio to equities. But with that allocation comes the “volatility toll”, a natural part of investing in the stock market. The chart below demonstrates how unsystematic risk decreases as the number of holdings in a portfolio increases. However, systematic risk remains constant regardless of how many positions are added.

Efficient Diversification: A Smarter Strategy

Modern Portfolio Theory (MPT), introduced by Harry Markowitz in 1952, provides a framework for building optimal portfolios. The goal is to maximize expected return for each level of risk, commonly referred to as improving risk-adjusted return. A key principle of MPT is including uncorrelated assets in a portfolio. This strategy applies to investors across the risk spectrum, from conservative to aggressive.

If you’re a conservative investor with a fixed income portfolio, diversifying your portfolio can include exposure to international bonds, varying maturities, and credit quality. If you’re an aggressive investor with a 100% equity allocation, diversification could include U.S. large-cap, small-cap, and international equities. Applying these principles allows you to construct a portfolio aligned with your risk tolerance while maximizing potential return relative to that risk.

Wiser’s Investment Philosophy

At Wiser Wealth Management, we incorporate Modern Portfolio Theory into the construction of our investment models. We believe that a well-diversified, risk-optimized portfolio is essential to helping our clients reach their long-term financial goals. We go beyond just investing, we help build a strategy designed for your unique financial journey.

Ready to Diversify Your Portfolio?

Whether you’re nearing retirement, running a business, or simply want to better align your investments with your goals, we’re here to help. Schedule a complimentary consultation with one of our advisors today and start gaining clarity and confidence in your financial future.

Andrew Pratt, CFA, CBDA

Investment Manager, Wiser Wealth Management

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.