Dollar Cost Averaging Explained

When the market fluctuates, investors often want to rethink their investment strategy. Perhaps you’re one of them because you feel nervous about your portfolio after Russia’s invasion of Ukraine or the Fed’s recent announcement about interest rates. Let’s say you are and you start researching various investment strategies. You might come across the term “dollar cost averaging.”

What is Dollar Cost Averaging?

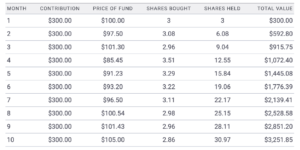

If you have a 401k, you are most likely already using this strategy to some degree. By contributing to your retirement account at set intervals, you are sometimes buying assets at a higher valuation and sometimes at a lower valuation. In the example below, the investor contributes $300 monthly to one such account. The price of the funds vary so some months their contribution might buy more shares and some months less. This can result in a lower average cost per share. Setting up regular purchase times like the beginning of the month or week takes the focus off of the performance of the market at a particular moment, and puts it on the convenience of consistent contributions. In this way, the overall effect is less about the value of the market each month and more about the cumulative impact of contributing to your account over and over and over again.

This can be a more lucrative strategy because trying to time the markets can be tough. Most of the great market returns occur after they bottom out. As shown below in a chart from Capital Group, missing out on the best days of the market can have a huge impact on the recovery of your portfolio values. From 1/1/10 to 12/31/19, missing out on the 10 best days causes this portfolio to miss 33% of possible growth, and missing out on the 20 best days caused a 50% reduction. Even the most successful analyst does not have a crystal ball to magically predict the bottom. Long-term investing is about staying the course and remaining invested during both the good and the bad times.

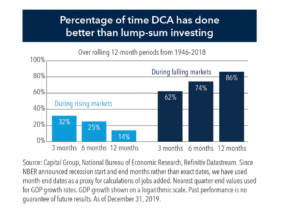

How Dollar Cost Averaging Can Help Your Portfolio

Dollar cost averaging can help your portfolio perform better during falling markets. The strategy is not quite as helpful during bull markets. But, if you are primarily concerned with lowering your downside risk and the potential regret if the market took a downturn after you invested a lump sum, then dollar cost averaging may be best for you. However, any emotionally based concerns should be weighed carefully against both the lower expected long-run returns of cash compared with stocks and bonds, and the fact that delaying investment is itself a form of market-timing, something few investors succeed at.

When looking at risk-adjusted returns and investor behavior, Vanguard still concludes that on average, lump sum investing has better returns and risk adjusted returns.

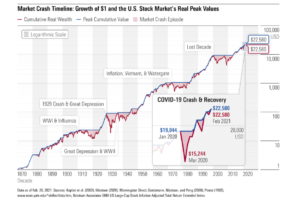

Invest in the Market Long-Term

It is most important to be invested in the market for the long term. Eventually, the market will trend upwards again. In conclusion, if markets are trending upward, it’s logical to implement your asset allocation as soon as possible to maximize returns. But if you are concerned with reducing your short-term downside risk and the potential for regret, then dollar cost averaging may be a good strategy for you. If you have 401k and other investment accounts, continue to use dollar cost averaging because it can eliminate the emotional weight of trying to time the market. In other words, pay yourself first by consistently investing for the long term.

Have more questions? Contact Us

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Advisor

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.