What is My Risk Tolerance Number?

What exactly is risk tolerance? In short, it is the measure of an investor’s willingness to accept risk. Understanding your risk tolerance is essential to understanding how much loss you can stomach during a stock market downturn. Typically, a person feels more pain from losses than they feel joy from capital gains. Understanding your risk tolerance helps determine the type of allocation you should maintain in your portfolio.

What is my risk tolerance number?

Advisors attempt to understand an investor’s tolerance through certain risk questionnaires. The questionnaires ask various questions. For example, “if an investment drops below 20% in your portfolio, how would you react?” The answer choices are usually: “stay invested, sell your investments to get out of the market or invest more.” They can also include some questions about your motivations such as, “when you make financial decisions to invest, what are you concerned with?” The answers could be: “growth, income, or just maintaining principal.” One of the final questions is typically about your stage of life: “When you will need the investments, or what is your time horizon?” As a rule of thumb, a younger investor would have a more aggressive allocation because they have a longer time to invest, and more time to recover should the market drop. Usually, a retiree will have a more conservative portfolio because they will depend on their portfolio more in retirement.

An example of an aggressive portfolio may be 90/10, or 90% equities and 10% fixed income while a conservative portfolio may be 30/70, or 30% stocks and 70% fixed income. However, sometimes there is a difference between the risk tolerance of the individual and the actual risk capacity they are able to withstand.

Assessing Client Risk Tolerance

At Wiser Wealth Management, we assess client risk tolerance through a risk profile software called Riskalyze. After the initial Discovery meeting where we have gathered necessary background information, we send clients a questionnaire. We also resend the questionnaire annually before each review meeting to help identify and maintain individual risk tolerance ranges. For example, if an investor’s risk number is in a higher risk range, they will usually be allocated toward a more aggressive portfolio meaning more stocks or growth assets, than bonds or fixed income assets.

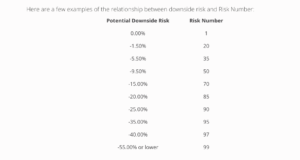

With Riskalyze once the client completes the assessment, Riskalyze generates their Risk Number on scale of 1-99. It is based on a Nobel Prize winning formula for Economics. The 95% Historical Range illustrates the risk in your client’s portfolio, representing the potential gains or losses it may experience over a six-month period.

The outputs looks something similar to the chart below tracking a hypothetical client. In the example, the client’s score is a 51, meaning a conservative portfolio of about 60% stocks/ 40% bonds. However, their current portfolio is a score of 72 because they have allocated 80% stocks. It would be important to discuss these numbers with client to help them understand whether or not they are comfortable taking on the excess risk.

A Diversified Portfolio

It is important to realize that investors do not usually fully participate in the market. Investors may watch CNBC and see red tickers flash across the screen showing the S&P or “market” losses for the day, current quarter or year-to-date. However, most portfolios are not invested 100% into the S&P 500. A well-diversified portfolio will consist of a blend of equities, both domestic and international, as well as bonds, whether they are corporate, international, emerging market or even U.S Treasury. At Wiser Wealth Management, we use a tactical approach to portfolio management developed through low-cost ETFs.

Risk Tolerance in Retirement

Risk tolerance is only the first part of the overall risk picture. For example, a 30-year-old might consider themselves conservative, but with their time horizon to and through retirement they still need to be heavily equity oriented to grow their money and participate in the compound interest. Same thing might go for a retiree who wants to move to an all-fixed income but, that could erode their purchasing power. What they actually need is a balance portfolio of stocks to bonds. Also, for the client in retirement who may want to be aggressive, they may not be able to take on excessive risks. They should still have a balanced portfolio growing at higher rate than their withdrawal.

We are a fee-only financial planning firm, and we focus not just on the investments, but how they fit into your overall financial plan. We stress test portfolios and financial plans to prepare for both the good and bad periods that markets experience. We plan for not if, but when, there are volatile times. Unless a client’s financial goals or life priorities have changed, we maintain the course and remain invested as planned. If you would like a second opinion on your portfolio and how it incorporates into your overall financial plan, please feel free to reach out to us.

Click here to schedule a consultation with one of our financial planners.

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Advisor

Listen to Our Podcast:

Download our free guide: “Your Pre-Retirement Checklist”

Have more questions? Contact Us

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.