What’s your Retirement Number?

A large insurance company, with an investment arm, was well known for their commercials that asked, “what’s your retirement number?” While this was catchy and had investors proactively thinking through their retirement, it did not accurately portray the correct question pre-retirees should be asking themselves.

How much money do you need during retirement?

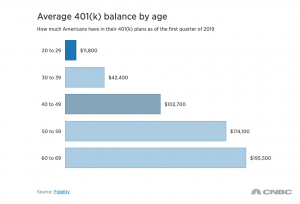

Retirement literature suggest that you should plan to live on 75-85% of your pre-retirement income. According to a recent Schwab study that looked at 1,000 401(k) participants, Americans think through that in terms of the endgame number and believe they need $1.7 million to retire. However, this number seems rather large in comparison to actual 401(k) balances. Averages from Fidelity, the largest 401(k) provider, show that most Americans’ 401(k)s are nowhere near that number.

Actually, it is less important to focus on one retirement number. For example, $1,000,000 at age 65 will feel completely different from $1,000,000 at age 55, and much of that depends on how you plan to live in retirement. Rather than shooting for a stock number, investors should ask themselves when they want to retire and how much they will want to live on in retirement.

So, consider your monthly budget and how much you would need to cover everyday living expenses like food, clothing, transportation, housing, bills, etc. Keep in mind that most people think in terms of present-day dollars, but it is essential to raise that amount throughout retirement to keep pace with inflation. Next, you would need to account for healthcare expenses which are increasing at an alarming rate of over 5% annually. Don’t forget that if you retire before age 65, you will need to find private health care (which can be extremely expensive) and qualifying for government healthcare subsidies means keeping your income below certain thresholds. Another key component to consider when planning a monthly budget in retirement is the existence of debt. All debts, including a mortgage, should ideally be paid in full by the time you retire to ensure that you are able to reach your financial goals.

How do you want to live during retirement?

When planning for retirement, it becomes less about what the final lump sum is and more about how you want to live in retirement. And this can change significantly throughout retirement. Some people can comfortably retire on social security and live at home while others want to take up hobbies and travel the world. As we have discussed in the past, during the go-go years, 60 to mid 70s, retirees usually spend the most money while they enjoy their time off, traveling more and spending time with family and friends. During the slow-go years of mid to late 70s, things start to slow down and time may be spent closer to home with less frequent travel and fewer expenses for activities. Next comes the no-go years or 80+, where travel drops off and most expenses are allocated to healthcare.

Retirement planning requires not only adequate planning in the years before retirement, but also thoughtful planning for what life could look like during retirement. At Wiser, we include social security optimization and tax efficient portfolio withdrawal strategies when developing retirement plans. We run not just linear projections of average portfolio returns, but Monte Carlo analyses of 1,000 scenarios of both good and bad stock market returns, aiming to increase the client’s probability of success in reaching their goals before and throughout retirement.

Therefore, the best question for retirement planning is not “what is your retirement number?” The best question is “what is your retirement monthly living expense number?”

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.