Why the Presidential Election Outcome Shouldn’t Influence Your Portfolio Allocation

Presidential Election Outcome Concerns and Market Timing

During Presidential election years, clients often ask whether they should adjust their investment portfolio allocations based on concerns about a particular candidate winning. As advisors, we remind them that, from a long-term investment perspective, making such changes doesn’t make sense. Timing the market is challenging, and much of the noise surrounding elections tends to subside without causing significant disruptions to the growth trajectory of the U.S. equity market.

Post-Election Returns: A Positive Trend

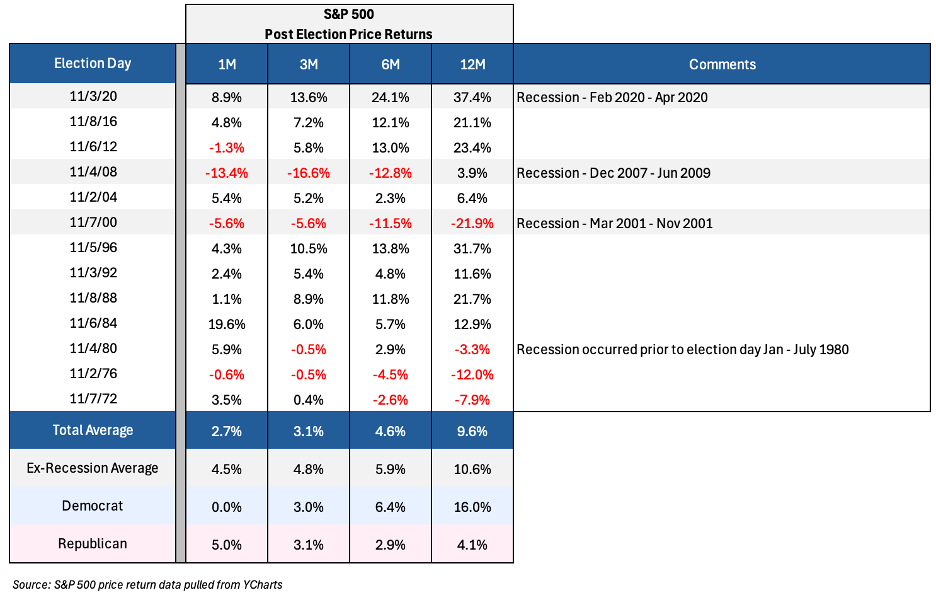

A closer look at historical data reveals that post-election returns are typically positive over the short-to-medium term timeframes. The table below presents data from the last 13 elections, covering nearly 50 years, showing the S&P 500’s price returns 1, 3, 6, and 12 months after each presidential election. The data indicates that the S&P 500’s average returns increase as time progresses: +2.7% after 1 month, up to +9.6% after 12 months. If we exclude recession years from the analysis, these returns improve further, ranging from +4.5% after 1 month to +10.6% after 12 months.

Returns by Political Party: A Cautionary Note

The table also shows average returns by political party; however, these figures should be viewed with caution. Recessions can skew the data, and the timing of these economic cycles does not always perfectly align with the post-election timeframes analyzed.

The Long-Term Perspective

Historical trends indicate that markets, on average, have responded positively following election day. We will continue to monitor if this trend holds in the coming months.

Schedule a complimentary consultation and discover how our services can help you achieve financial success.

Andrew Pratt, CFA, CBDA

Investment Manager, Wiser Wealth Management

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.