Year-End Planning Strategies

2020 has been a year for the record books and one that many may want to forget but never will. As the year winds down, it is important to assess whether or not you are executing some healthy year-end planning strategies to help with tax efficiency and also help increase the probability of success for future retirement goals. There are a multitude of ways do this, but the team focuses on a few of the more common strategies in this week’s podcast.

Listen on Apple Podcasts or watch on YouTube:

SUMMARY:

Rebalancing

Many investment accounts have drifted from their optimal allocations based on their individual risk tolerance because of the ups and down of the year. For example, if a client going into 2020 was invested for a 60/40 portfolio, meaning 60 percent in risk assets or equities and 40 percent in fixed income, the account might have drifted somewhere closer to 70/30 due to the gains in the stock market. This is a great example of “Investing 101”, where we “buy low and sell high.” The investor should sell a portion of the stocks that have over performed relative to equities and buy more bonds at the lower valuations.

But investors don’t have to go through these turbulent times alone. If you handle your own investments, now can be a good time to speak with an advisor or get a second opinion on how to help incorporate investments into your overall financial plan. We are advising our clients that as long as their goals have not changed, we will continue to monitor accounts while keeping a long-term diversified strategy. Use this time to re-assess your risk tolerance and consider how much market volatility you can stomach in your portfolio.

Roth Conversions

As I wrote back in April, in a blog on bear market strategies, if a client is nearing retirement, or in a lower tax bracket than they will be once in retirement, this could be a good time to discuss Roth conversions. It is the process that allows clients the opportunity to convert an IRA into a Roth IRA. The investor pays taxes on the initial transfer, but would then have access to the funds tax free later in retirement.

In addition to the preferential tax treatment a Roth provides, there are no Required Minimum Distributions (RMD) required. This can also be an efficient and beneficial estate transfer strategy if investors are interested in legacy planning. Due to the recent SECURE Act (Setting Every Community Up for Retirement Enhancement), non-spousal beneficiaries will need to withdraw the funds from a retirement account during a 10-year period following the death of the investor. This could cause a significant tax bill for the beneficiary. However, if taxes have been paid on a ROTH IRA, the beneficiary would be able to receive the funds tax free.

Tax Loss Harvesting

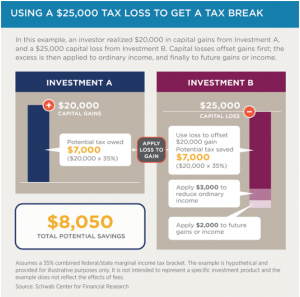

Another strategy where an advisor can add value is by selling a security, or a fund, at a loss and “harvesting” it to offset potential gains. The investor can then repurchase one that is similar, but not substantially identical in order to avoid the wash sale rule and maintain preferential tax treatment. After offsetting the capital gains due to the losses, the investor can even use up to $3,000 annually against their ordinary income with the extra losses carried over into future years indefinitely. It is important to note that in this strategy we are not getting out of the market or changing our allocations. Rather, we take some losses and then reinvest them back into similar funds for at least 30 days.

In the example below from Charles Schwab, an investor in the 35% combined federal/state tax bracket might take advantage of a $25,000 loss of a security or fund on an account with a $20,000 capital gain. They could apply $20,000 at their tax rate for $7,000 in potential taxes on the capital gains and then use $3,000 against ordinary income for the potential $8,050 in savings. The remaining money could be applied to offset future gains.

(Source: Charles Schwab article “Reap the Benefits of Tax Loss Harvesting to Lower Your Tax Bill”, Schwab Center for Financial Research)

Year-End Charitable giving

Now that the time of giving is upon us, there are some charitable year-end planning opportunities. Due to the last change in tax law on standard deductions, the amount has increased to $12,400 for individuals and $24,8000 for married couple therefore many investors do not itemize. However, if you do itemize then you can usually deduct up to 60% of AGI on cash donations. In 2020, due to the CARES act, individuals are allowed to deduct cash contributions to qualified charities up to 100% of AGI with certain income limitations. Donations of stocks are still 30% of AGI.

If you do not itemize and instead take the standard deduction, again due to the CARES act, you are allowed to take a $300 above the line deduction for cash, credit card, or checks paid directly to a charity.

Qualified Charitable Distributions (QCD’s)

QCDs are also a good year-end way to minimize tax bills. This is a direct transfer of funds from an IRA to a qualified charity. These satisfy the RMD requirement, but it also allows the money to be excluded from taxable income. And it does not require an investor to itemize. In order to qualify, the investor must be at least 70 1/2 and the max that can be distributed is up to $100,000. The receiving charity must be a 501(c)(3) organization and contributions cannot be made to private foundations or transferred into a donor advised fund.

Maximize HSA and 401k contributions

Besides giving to charity, it also important to fully contribute to your own accounts. Health Savings Accounts are a great way to plan for increased health care in the future and they are allowed $7,100 or $3,550 in contributions for this year while also getting deductions on contributions. It is also a good time to consider maxing out retirement contributions for deductions or at least getting your full employer match for your 401k’s.

Gifting & 529 Account Contributions

In 2020, individuals can gift up to $15,000 or $30,000 for married couples per individual. If you are contributing to a 529 college savings account, you can also make a lump sum contribution of up to $75,000 and elect to treat the contribution as if it was made evenly over 5 years ($150,000 for married couples filing jointly).

Update Wills, Beneficiary Designations, Insurance Coverage

Be sure that your will is up to date and that beneficiary designations on insurance and retirement accounts are in proper alignment to your wishes. Dec 7th was also the cutoff for Medicare open enrollment, but this would still be a good time for retirees to check on updates and look at other more beneficial Part D coverages.

The financial planning strategies mentioned should be reviewed by an advisor throughout the year and not just at the year’s end in December. However, going through this check list before 2020 wraps up can help you head into 2021 with a plan for financial freedom.

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.