3rd Quarter 2020 Market Update

The Wiser Roundtable team provides a third-quarter 2020 market update, portfolio performance, and the economic outlook for the remainder of the year.

Listen on Apple Podcasts or watch on YouTube:

SUMMARY

In the final month of the 3rd quarter of the year, volatility picked up in the financial markets. In addition to the ongoing global coronavirus pandemic, the upcoming and contentious U.S. presidential election has also become a focal point. While volatility is expected to rise in the near term, it is critically important for investors to focus on the long term and not make knee-jerk changes in response to short-term events. A year from now, the elections will have been long over, and COVID-19 will presumably be under control. At the end of 2019, the U.S. economy was the strongest it had been in many years; this was derailed by the coronavirus pandemic, not by an underlying financial or economic problem. We are, therefore, likely to move in the direction of a more “normal world” as 2021 unfolds.

Detailed Analysis

Stocks: July kicked off Q3 with a bang as stocks surged throughout much of the month. Investors were encouraged by solid employment growth, a rise in personal income and consumer spending, a surge in the housing sector, and an increase in industrial production. All news was not positive, however. The second-quarter gross domestic product fell more than 31% (annualized) and many states saw an increase in the number of reported COVID-19 cases. Nevertheless, investors stayed with equities, pushing values higher for the fourth consecutive month. Tech stocks drove the Nasdaq to a 6.8% gain, followed by the S&P 500 rising 5.5% and the Dow gaining 2.4%. The positive run for stocks continued in August, as each of the benchmark indexes listed here advanced notably. The Nasdaq climbed nearly 9.6%, the Dow rose 7.6% and the S&P 500 advanced 7.0%.

September saw stocks fall as hopes of a second round of stimulus waned and an increase in COVID-19 cases was reported. Indexes also fell, led by the Nasdaq falling 5.2%, followed by the S&P 500 3.9% and the Dow down 2.3%. U.S. stocks posted their weakest September in almost 10 years; however, the weak month did not equate to a weak quarter. The S&P 500 finished Q3 with an 8.9% gain for the quarter, while the Dow posted a 7.6% increase. The strong performance followed a strong Q2, marking the best two-quarter performance for U.S. stocks since 2009. Both S&P and Dow indexes are up over 26% since March. Meanwhile, tech shares continue to be the darlings of the recovery, with the NASDAQ soaring 11% in Q3 to register a six-month gain of 45%. For the year, the tech-heavy index is up 24%.

International equity markets experienced gains in both Developed Markets and Emerging Markets 6% and 9% respectively, trimming their year-to-date losses of 6% and 2%. International stock markets have traded at a discount in 2020 to the US markets underperforming by 3% QTD and over 10% YTD. We would expect valuations in the international markets to catch up to U.S. markets.

If anyone had told us going into this year that, in the midst of a growing economy and booming stock market, bonds would be the best-performing asset class through Q3 in 2020, we would have thought they were crazy. But that is exactly what happened. Long-term Treasury bonds are up 14% YTD and 13% for the past 12 months. The broader U.S. Aggregate Bond Index is up half that at 7% YTD and 7% for the past 12 months. When the Aggregate is de-constructed into short-term, intermediate-term, and long-term securities, they are all positive for the quarter and YTD. Non-USD denominated bonds have also performed well returning just over 1% for the quarter and 4% YTD. Interest rates have dropped significantly this year and as mentioned earlier, are not expected to rise anytime soon. As prices of bonds increase, yields decrease. In lieu of higher income from bonds, investors should focus on how well their bonds provide stability to their portfolios in the event of further price volatility in equities.

The Economy

Employment: Unemployment fell to 7.9% by the end of September as an additional 661,000 workers returned to work. July and August payrolls were revised upwards by an additional 145,000 bringing the total job gains in Q3 to 3.91 million jobs added in the quarter. However, 12.6 million workers remain unemployed from the economic shutdown induced by the COVID-19 virus.

Inflation: The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in August on a seasonally adjusted basis after rising 0.6 percent in July. Over the last 12 months, the all-items index increased 1.3 percent before seasonal adjustment. September’s CPI-U has not been announced at this time.

Consumer confidence: The Index of Consumer Sentiment published by the University of Michigan increased for the third straight month in September. The index stands at 80.4, up from 71.8 in April. It is now at the highest reading since March, mainly due to a more optimistic outlook for the national economy. Nonetheless, two non-economic issues represent a source of uncertainty and could cause a shift in consumer confidence: when and how the election is decided, and delays in obtaining a vaccine and its widespread availability.

FOMC/interest rates: The Federal Open Market Committee held meetings in July and September and voted to hold the target range for the federal funds rate at its current 0.00%-0.25%. According to Chairman Powell, the Committee isn’t even thinking about raising rates. However, the September meeting wasn’t without any controversy as it stated its new goal for inflation is to rise above 2%, its historic target rate. In addition, the Fed announced that it will continue its accommodation by purchasing Treasuries and mortgage-backed securities at the current pace of $120 billion per month in aggregate. In their September press release, the Committee noted the ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and pose considerable risks over the medium term. Additionally, overall financial conditions have improved, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses. Suggesting additional stimulus is needed for the economy to continue growing.

Global/International Central Banks: Markets around the world continue dealing with the coronavirus pandemic. The world’s major Central Banks returned to accommodative with the ECB, BOE, BOJ and our Federal Reserve Bank have all lowered interest rates to at or near 0% in an attempt to stimulate economic activity, promote effective transmission of monetary policy, and maintain efficient markets. To add additional accommodation, the Federal Reserve had increased the size of its balance sheet to just under $7 trillion from $4.3 trillion in mid-March and Global Central Banks’ balance sheets have risen to almost $22 trillion.

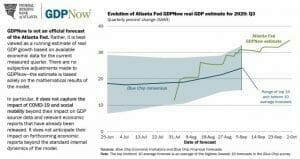

GDP/Economic Forecast: The second quarter of 2020 was the mother of all economic contractions. Real GDP shrank at a 31.4% annual rate, the largest drop for any quarter since the Great Depression.

The GDPNow tracking model, created by the Atlanta Federal Reserve, is forecasting that real GDP will have grown at a 34.6% annual rate in Q3. The actual GDP figure will be announced later this month on October 29th. The surge in growth in the third quarter is largely related to many businesses going from a total lockdown to a new COVID-19 normal operation. Meanwhile, many businesses have simply disappeared. This suggests that although growth should continue in Q4, it’s not going to be nearly as fast. Businesses can only re-open and resume business operations once, not again and again.

COVID-19: The key to ending this global economic crisis is a medical solution to the COVID-19 coronavirus. On that front, there are hundreds of vaccines globally in various stages of development. Of the 58 vaccines that are in human trials, 5 are approved for early or limited use, and 11 more are in final Phase 3 large-scale efficacy tests. Given the fast progress that has been made, there is a reasonable probability that one or more vaccines may receive approval by year-end. The pace of vaccine development for COVID-19 is unprecedented. To provide a context of the rapidity of the COVID-19 vaccine development efforts, the previous record from development to final approval was for the mumps vaccine which took 4 years.

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.