401k Saving Stress on the Rise

A recent survey conducted by Schwab finds that 401k savings goals and stress levels are on the rise. Participants in the survey now believe they need to save $1.9 million to be prepared for retirement.

The survey of 401k plan participants finds that saving enough for a comfortable retirement continues to be their leading source of significant financial stress. On average, these 401k participants believe they need to save $1.9 million for retirement, an increase of 12% from the $1.7 million reported in last year’s survey. Two in five participants, or 41%, also say they made a change to their 401k account due to COVID-19, citing rebalancing and increasing contribution rates as the most common changes. The top action steps taken by these individuals were a combination of defensive and potentially opportunistic moves. Of the 41% who acted, 14% rebalanced their portfolio and 12% increased their contribution rate. These individuals also indicated that they either increased (8%) or decreased (7%) their exposure to stock funds/equity.

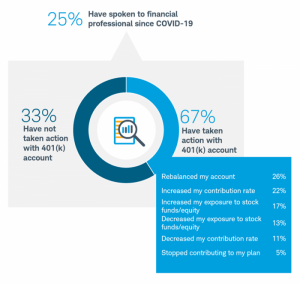

Notably, there was a higher rate of action among the one in four (25%) of survey respondents who consulted a financial professional. Of those who sought guidance, 67% made changes in their 401k. The top three actions steps were the same as the broader group but at a higher rate: rebalancing (26%), increasing the contribution rate (22%) and increasing exposure to stock funds/equity (17%).

Survey respondents anticipate COVID-19 will have an impact on their retirement savings. Thirty-seven percent feel they are ‘very likely’ to achieve their retirement savings goals, nearly half (49%) report they are ‘somewhat likely’ to achieve their retirement savings goals and 14% say it is ‘not likely’ that they will achieve their goals. One in five (21%) expect to retire later than originally planned because of the current situation.

If you have questions regarding your 401k contributions, rebalancing or your exposure to stock funds/equity, please reach out to our team by calling 678-905-4450 or scheduling an appointment online at wiserinvestor.com.

Posted 8/13/2020

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.