College Savings Tips

On today’s podcast the team discusses college savings tips. College saving and planning is a big part of the financial planning process. Popular options are reviewed: 529 savings plan, Coverdell ESA, and UTMA/UGMA.

Listen on Apple Podcasts or watch on YouTube:

SUMMARY:

College saving and planning is a big part of the financial planning process. College tuition is increasing at an alarming rate of over 6% annually, significantly higher than the average inflation rate of 2.25%. According to the College Board, the average cost of a 4-year non-profit private university is $46,950 a year and a public 4-year out-of-state university is $36,420 a year. A public 4-year in-state university can even be $20,770 a year when accounting for tuition, fees, and room & board. Within the class of 2019, 69% of students took out loans and graduated with an average debt of over $29,900, while 14% of their parents took out an average of $27,200 in parent PLUS loans.

Based on the 6% inflation rate, for a child born in 2020, a public in-state 4-year school will cost around $259,347. That equates to putting $609 monthly into a moderate portfolio or $88,615 as a lump sum today. If that money was invested in a taxable brokerage account, the numbers are even higher as it would need $693 monthly and a $109,302 lump sum due to less tax advantages than other college saving vehicles.

These numbers can be daunting, but it is important to realize what can be accomplished when it gets broken down. Just like retirement, the key to saving for a child’s college education is starting as soon as possible. In the example below, for a child born today you could significantly reduce the amount you or child owes after college by setting aside monthly payments now. Setting aside just $484 monthly into a 529 savings plan would fully fund his or her education. Even $5,000 annually, increasing at 3% a year, would leave a more manageable shortfall of $38,999.

What then is the best way to save for college? As mentioned, there are many popular options to fund children’s educations including the 529 savings plan, Coverdell ESA and UTMA/UGMA.

529 savings plan

A 529 savings plan is one of the most popular investment vehicles for saving for college and the one most widely seen at Wiser Wealth Management. 529 plans are invested, grown and distributed tax free if used for certain qualifying expenses, such as tuition and certain fees. Families can also access up to $10,000 annually for K-12 school tuition. There are no contribution limits, but the maximum account size allowed for Georgia is currently $235,000. Parents, Grandparents or other relatives and family friends can gift up to the annual exclusion of $15,000 or up to 5 years prorated at once of $75,000 per filer or $150,000 for married filers. For 2020 contributions, Georgia has allowed an increased deductible contribution of up to $8,000 per year per beneficiary for joint filers, and $4,000 for single filers. 529 plans are invested in certain individual mutual funds or managed as age-based funds that move from conservative to aggressive by large investment companies.

However, a recurring and concerning theme we have heard about recently is college prep “counselors” and insurance agents pushing large cash value whole life insurance as the miracle college savings strategy. These so-called “counselors” are targeting high school parents by glorifying whole life insurance and highlighting pitfalls of the 529 savings plan.

If you are not familiar with this option, let me briefly explain. Whole life insurance is a type of permanent life insurance policy that has a cash value savings component built in. The cash value of whole life policies grows tax deferred based on interest rates, but the internal rate of return (IRR) is usually in the low single digits. Not to mention there is typically at least a 10-year breakeven on when the funds are put to work for you. This is due to the cost of the insurance, as well as the initial commissions for the agent. In order to access the funds, you can take a partial withdrawal, which will also reduce the death benefit, or you can take a loan out against your policy.

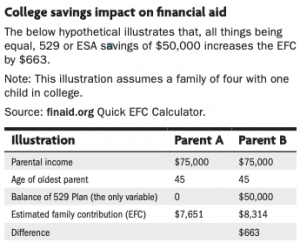

These “counselors” and life insurance agents are pushing that the cash value of life insurance is not disclosed on Free Application for Federal Student Aid (FAFSA) forms. Federal Financial Aid is based on the Expected Family Contribution (EFC) that is subtracted from the college costs to determine eligibility. However, the formula is primarily based on income and counts income more than savings. Based on the formula, 47% of the parent’s income can be included, and only up to 5.64% of their investments. 529 plan assets are included and can therefore reduce expected family contribution (EFC) by as much as 5.64% of the asset values. While this may be true, this reduction in benefits does not provide a substantial benefit based on the opportunity cost of socking away large sums of money and being locked into a whole life insurance policy.

For example, the illustration below is from the TIAA website on 529 plans and the savings impact on financial aid. It shows, all things being equal, 529 or ESA savings of $50,000 only increases the EFC by $663.

The whole life insurance strategy is often pushed towards parents whose income would not allow their children to apply for need-based grants in the first place, and it barely reduces eligibility for other loans as well. We have seen some life insurance illustrations presented that show the policy becoming a Modified Endowment Contract (MEC) due to the large initial premium payments. If a policy becomes a MEC, it will lose its preferential tax treatment and can be taxed as income and even have 10% penalties if withdrawn under age 59 ½.

While there may be certain cases where whole life insurance policies could be a good fit for clients, Wiser Wealth Management’s philosophy is more focused on 529 plans and the compound growth they provide for future increased college expenses.

Coverdell ESA

This is another popular college savings vehicle. ESAs are tax deferred trusts created by the U.S. government to assist minors under 18. The total maximum annual contribution limit for any single beneficiary is $2,000 and it must be made in cash, although the contributions can be invested. The Coverdell contributions are not deductible, but withdrawals can be used tax free for qualified expenses for K-12 as well as higher education. The funds must be used by age 30 or transferred to a member under 30, unless it is for a special-needs beneficiary. However, there are income limits and contributions are not allowed if the parents, or investor’s income, is above $220,000 or $110,000 for single filers.

UTMA or UGMA (Uniform Transfer/Gift to Minors Act)

These differ from 529 plans and ESAs in that they are not just used for education purposes. The child is the owner of the funds and the parents or grandparents are the custodians until age 21 (or 18 for UGMA). Once the child is of age, the beneficiary has access to and can use the funds for whatever purpose he or she sees fit.

While it is helpful to try and provide for some college expenses, a child’s college education does not have to be fully funded. After you decide on the best plan for your circumstances and the amount you are comfortable saving, your child can also apply for scholarships. Also, Financial Aid can be applied for in October of the year before college. Qualifications depend upon the previous two years of tax information. It is important to realize that although there are many grant and scholarship opportunities, only about half are received and they usually only cover a small portion, <15%, of the overall cost. Also, children and parents can also apply for student and parent PLUS loans. Unlike other Direct PLUS loans, Parent PLUS loans extend a line of credit directly to the parent. Direct PLUS loan for parents differs from cosigning on the child’s student loans. When cosigning, both agree for repayment, while Parent PLUS loans place the repayment responsibility on the parent.

If costs are a major concern, students can apply for community college classes in high school while also taking AP classes for college credits to reduce the number of hours needed to graduate college. Zippia provides information on choosing a major and return on investment estimates by degree type and occupation.

At Wiser, we want to plan within our clients’ budgets for whatever amount of support parents prefer to provide. However, it is important to realize that the best option is to always to avoid taking out excessive personal loans or pulling from retirement accounts to help fund college planning goals. Not only will there be taxation of benefits and possible penalties, but it can also jeopardize your retirement goals. You and your child can always take out loans for to pay for education, but this cannot be done to pay for retirement. The reduced retirement funds compounding over the years can significantly alter your retirement plans.

College planning is a big part of the financial planning process at Wiser Wealth Management. Should you have questions about college planning or want to discuss what would work best in light of your overall financial plan, please reach out and contact us for an appointment at 678-905-4450.

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.