5 Reasons Roth Contributions May Not Be the Best Decision for Your Situation

When it comes to saving in retirement accounts, the Roth contribution option is often touted as the silver bullet for retirement. The allure of tax-free growth can make Roth accounts seem like a no-brainer compared to Pre-Tax contributions. However, deciding whether to contribute solely to a Roth account requires careful consideration of the pros and cons. Here are some important reasons why contributing exclusively to a Roth might not be the best choice for everyone:

1. Opportunity Costs

Contributing to a Roth involves significant opportunity costs. By opting for Roth contributions, you miss out on the tax savings from Pre-Tax contributions that could otherwise be invested or saved. In other words, Roth contributions leave you with less money in your pocket today. In effect, your investment is starting out (for lack of a better term) “behind” the Pre-Tax option. After all, one of the benefits to the federal government from Roth contributions is that they receive the tax revenue from your contribution now instead of later, when you take money from a Pre-Tax account.

A Real-Life Example

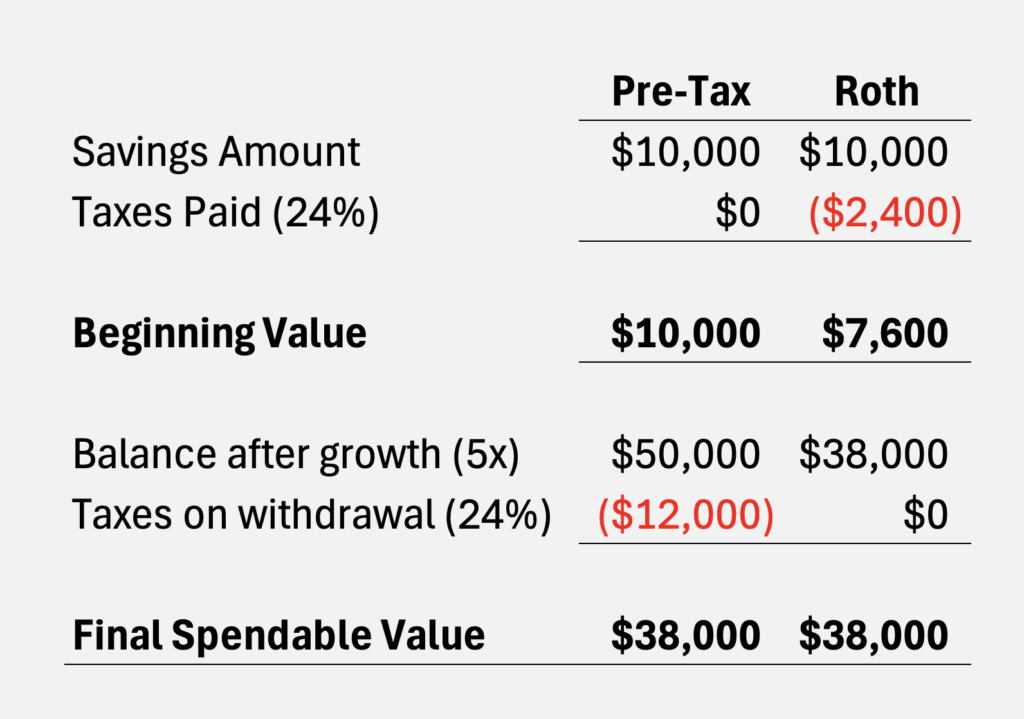

Let’s break it down with an example. Suppose you’re in the 24% tax bracket. The main difference between Roth and Pre-Tax contributions lies in when you pay taxes.

- Roth Contributions: If you contribute $10,000 to a Roth account, you’ve already paid taxes on that amount. With a 24% tax rate, you’ve paid $2,400 in taxes, so the effective value of your contribution is $7,600.

- Pre-Tax Contributions: A $10,000 Pre-Tax contribution, on the other hand, is made before taxes, meaning the entire $10,000 can grow tax-deferred. When you withdraw the money in retirement, taxes will apply.

If your tax bracket remains the same in retirement (24%) and the investment grows at the same rate in both scenarios, the final spendable amount after taxes will be identical. The graphic below shows how Roth and Pre-Tax contributions compare over time.

The current savings today from contributing Pre-Tax—$2,400 tax deduction—if invested in a taxable brokerage account, could grow over time, compounding into a sizable addition to your retirement nest egg. While Roth contributions offer the benefit of tax-free growth, they may not always be the optimal choice depending on your current and future tax brackets, as well as how you plan to use your tax savings today. A balanced approach—contributing to both Roth and Pre-Tax accounts—might offer more flexibility and tax advantages over time.

2. Peak Earning Years

If you’re in your peak earning years, contributing to a Roth account may mean paying taxes at a higher rate today. This can be less than ideal, as you miss out on the immediate tax deduction offered by Pre-Tax contributions.

Even if you are not in a top tax bracket, if you are earning the highest amount of income you expect to earn over the duration of your career, you are “locking in” paying the highest amount of tax during your career to make a Roth contribution. Opting for Pre-Tax contributions instead could reduce your taxable income today, potentially saving you thousands of dollars in taxes.

3. Less Flexibility

Roth contributions are “locked in” once made—they cannot be reversed or reclassified. On the other hand, Pre-Tax contributions offer a unique advantage: the option to convert them to Roth later. This flexibility allows you to take advantage of lower-tax years, such as during a career break or partial retirement, to perform Roth conversions at a reduced tax cost. This strategy is one of the most valuable perks of Pre-Tax contributions, enabling you to maximize tax savings over time.

4. Current Cash Flow

As illustrated in the example above, the actual cost of a $10,000 Roth contribution is $12,400 when you include the taxes you’ve already paid ($2,400). Roth contributions inherently have a higher upfront cost. If maintaining strong cash flow is a priority—for example, to save for a home, pay off debt, or fund other financial goals—Pre-Tax contributions may be the better choice. They reduce your taxable income and allow you to keep more of your take-home pay while still growing your retirement savings.

5. Multiple Tax Buckets

Diversification doesn’t just apply to investments—it also applies to the tax status of your savings. At Wiser Wealth Management, we recommend having a mix of Roth, Pre-Tax, and taxable brokerage accounts. This balanced approach gives you flexibility in retirement, allowing you to strategically withdraw funds in a way that minimizes taxes and maximizes financial freedom.

Deciding Between Pre-Tax vs Roth

At the end of the day, the decision to contribute Pre-Tax or Roth is not one-size-fits-all. It depends on a variety of factors, including your current income, projected future income, tax situation, and overall financial goals.

If you’d like guidance in making this decision, reach out to Wiser Wealth Management. Our team has helped many clients navigate these choices and develop a personalized strategy tailored to their unique circumstances.

Click here to schedule a complimentary consultation to discover how we can help you achieve financial success.

William Medcalf

Financial Planning Associate, Wiser Wealth Management

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.