6 Month Anniversary From Market Lows

Two weeks ago marked the 6-month anniversary of the March 23rd market lows. In March, many thought the world was ending and there was no way to keep the economy and the stock market intact, but a lot has happened since.

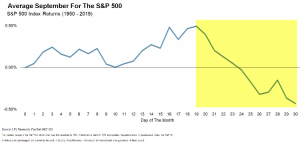

Due to the recent pullback this six-month stretch is no longer the strongest start to a bull market but the run has been impressive, nonetheless. The pullback may have to do with the recent cases of COVID, or political uncertainty heading into the election. Although, September is historically the worst performing month regardless of elections, recessions or pandemics.

The average September for the S&P500 since 1950 is down the last 11 days on average compared to the start.

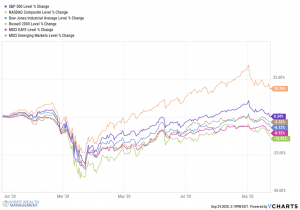

While some indexes like the S&P500 and the NASDAQ are recovering since the lows many are still off of their highs and also still lower on the year as shown below. The MSCI EAFE and the Russell 2000 index have struggled the most.

How the market is doing at any single time is a loaded question therefore framing and context are important when looking at investment returns. NASDAQ was recently up as much as 25% for the year with the S&P500 also up past 2%. If we looked at the market four weeks ago, the number would have been NASDAQ up 43% and SP 500 up 12% on the year. On March 23rd NASDAQ was down -20% and S&P 500 close to -30%. However, if history plays a part, we can say that markets are up over 70% of the time and up over 10 year rolling periods most of the time.

It is important to maintain a disciplined approach when looking at the market and stay invested. Do not try to time the market in order to get in and out at the right times. It is impossible to do this well over the long run and missing out on just a few of the best days can derail investment returns. There will always be noise from media or from neighbors and friends about what will be happening with the market especially in the midst of social unrest, pandemic, and an election. However, we plan for these down turns and unfavorable sequence of returns in our financial plans, therefore we should not change the investment philosophy or make significant portfolio changes unless there have been financial goal changes or major change in personal life events. At Wiser Wealth Management we seek to manage emotions and behaviors. We are focused on portfolios of healthy long-term assets classes through low cost ETTs that are rebalanced periodically based on risk tolerance bands.

Matthews Barnett, CFP®, ChFC®, CLU® Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.