Do you have a plan for your digital assets?

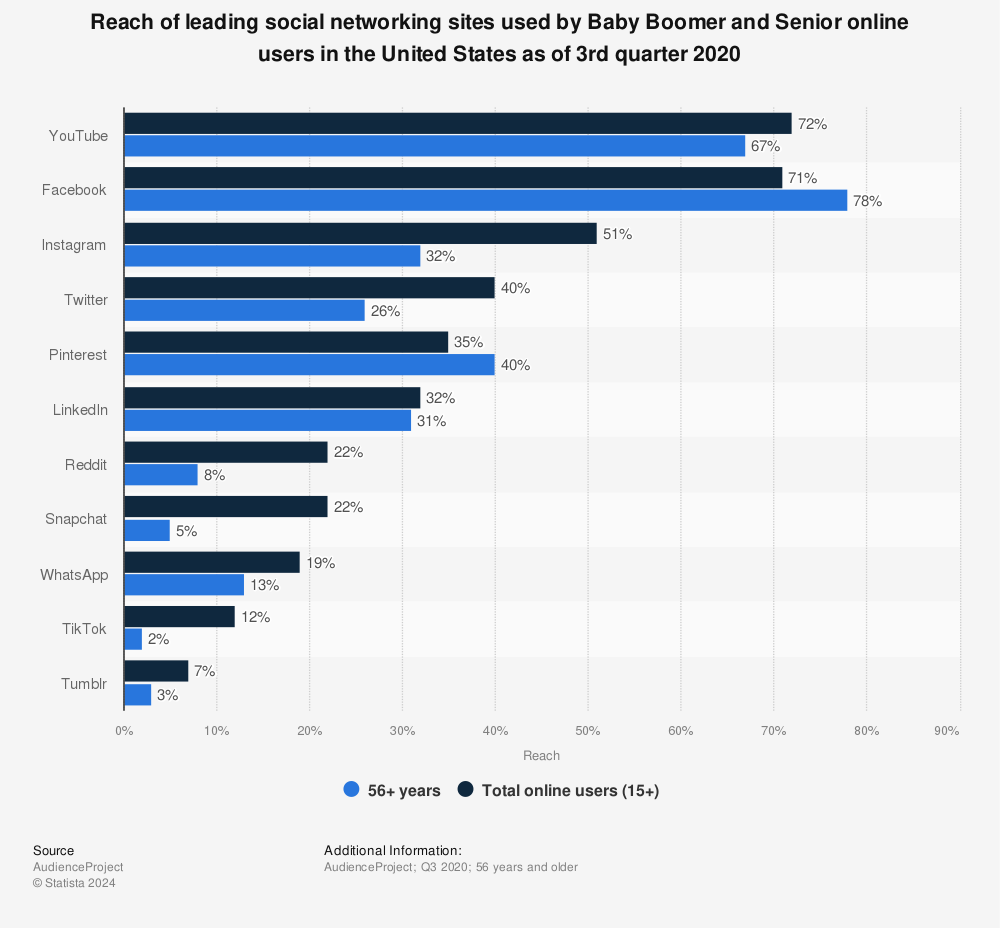

Having a plan for your loved ones to access your digital asset accounts is an important and often overlooked part of estate planning. As I wrote in my recent blog about the role social media plays in our lives, most people have picked up social media accounts whether it be TikTok for younger generations, Snapchat, Instagram or even the recent increase in the use of Facebook from the Baby Boomer generation. The following shows the reach of social networking used by Seniors and Baby Boomers in the US during 3rd quarter 2020.

Find more statistics at Statista.com.

Most clients have a number of online accounts for both the social and financial aspects of their lives. These accounts are protected with personal passwords which phones and computers require for access to control the stored information, pictures and/or emails. To keep track of these passwords, some people use a password protector software program like 1Password or LastPass or maybe even Google’s password storage software. While these online options are easy and probably the safest ways to store passwords, we don’t often have this information backed up anywhere. Rarely is a copy of a password book stored in a deposit box at the bank nor are spouses and children given access to the passwords stored in the cloud. This has problematic implications.

It is important to realize that if something were to happen to the individual owner of the account, and these backup options are not in place, it can be a difficult process for loved ones to unlock and gain access to online accounts. There can be some significant roadblocks that impede the process both in the short term and possibly permanently. Your stored information or pictures may be lost, as well as have a continued online presence on social media long after you have passed, which can be difficult for family and friends.

Nick Beis, Vice President of Advanced Planning at Fidelity, explains, “Attempting to gain access to a deceased person’s digital accounts without lawful consent may involve a court battle with an online account service provider, which has the potential to cost a lot of money.” This is due to criminal laws as well data privacy laws. From the criminal side, state and federal laws prohibit unauthorized user access to computer and other online personal data. While the intention of the law is good and helps protect consumers from identity theft and other issues, it creates problems for family when they want to logon to digital assets. The data privacy laws are also an issue because federal data privacy laws prohibit online account service providers from giving up information and access to accounts without the owner’s consent. We have seen a lot of this even on the news with Apple not releasing phone records of those deceased or even criminals as it violates certain rights. This is why it is important to have some type of strategy in place to allow those closest to you to have access to your digital accounts in the event they need access to them.

There are some key ways to prepare for this both individually and with an attorney. When preparing your will, an attorney should include language giving lawful consent for a few disclosed people to access your online information. Another method is to make a physical list of your digital assets along with the account passwords, and then let the people you trust know where to find them. A negative to this method is how often the password list may become outdated as you update certain passwords.

Estate planning can be both a complex issue and a morbid one that people procrastinate on or don’t want to address. However, even those who have thorough wills, power of attorneys, healthcare directives, or even trusts might not delve into the issue of digital assets. It is important to make sure that your estate planning is updated and that family members and loved ones know not only how you want your physical assets to be distributed, but also how to access your photos, emails, notes and other online information.

Matthews Barnett, CFP®, ChFC®, CLU®

Financial Planning Specialist

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.