4 Tips for Millennials to Successfully Retire

As a millennial, you may not be thinking too much about your retirement. You’re likely wrapped up in your career or caring for your family to put a lot of thought into your financial future. However, it is critical that you are taking the necessary measures now to set yourself up for a successful retirement. Here are 4 tips for millennials to be on the path to successfully retire one day:

Build a Diverse Portfolio

A great option to help you build wealth is by creating a diverse portfolio early on in your financial journey. You can consult with a fiduciary who can advise you in your interests and recommend investments that will best serve you. Financial planners can guide you to make investment choices that are aligned with your financial goals. For instance, you may want to look into investing in exchange traded funds, or ETFs, to help you build wealth. There are many low-cost ETFs out there that can provide you with a strong portfolio, as they distribute your investments across an array of companies.

Contribute to Your 401(k)

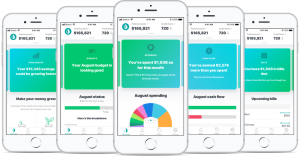

The days of generous pensions and the ability to rely on social security like generations past are long gone. Saving for retirement is on you. Your employer may offer you a 401k to help you save for retirement. And if they offer a company match, that is even better. However, it can be challenging to determine the contribution that works best for you in order to both put away enough money for retirement and still balance your current financial needs. To help you determine this number, you should know what your monthly spending habits are. You can use a budgeting app to help understand the breakdown of your spending habits and gain better control of your money. Ensure you are constantly balancing necessary expenses, but remember it is important to try your best to contribute and invest enough to give you adequate funds to draw from upon retirement.

Be Strategic About Major Purchases

You may find that you are at a point in life where you need to make major purchases or spend a large amount of money, whether it be continuing education, buying a car, or investing in property. Major purchases can eat into your finances significantly. For instance, buying a home is a longtime financial commitment that you will ultimately have to balance with other expenses that will emerge along the way. To position yourself well for retirement, it is ideal that you pay off your home by the time you retire. Getting preapproved for a mortgage can help you determine what you can afford and how to keep your monthly payments to a minimum. This way, you won’t be bogged down with a mortgage or other expensive payments during retirement.

Establish an IRA

An individual retirement account is an excellent addition to have alongside your 401(k). You can establish either a traditional or Roth IRA, as long as you are not over the income limit. By opening an IRA, you can make contributions toward your retirement by investing in stocks and bonds. Either way, an IRA can be a worthwhile decision toward your retirement to provide you with additional means you would not have had otherwise.

These 4 tips for millennials to successfully retire one day are key when planning for your retirement. Planning ahead is critical in order to live the comfortable lifestyle you envision for your retirement. Millennials are encountering unique retirement challenges not faced by earlier generations. Therefore, you must be proactive and educate yourself on strategies that best position you for the future.

If you want to learn more or need guidance in developing a financial plan, please schedule an appointment with our team. We would be happy to assist you.

President

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.