Biggest Expenses in Retirement

Each week I sit down with our financial planners to review plan drafts prior to the client seeing them. Each week I hear the same set of advisor concerns that the client is in good shape based on our income assumptions but, the client is not sure exactly what their expenses will be in retirement. This creates the question, what are the biggest expenses in retirement and what can a retiree do about it?

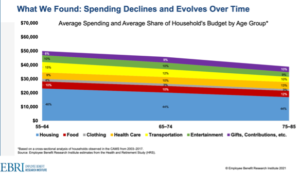

In a 2021 study by the Employee Benefit Research Group they outlined where most of retiree funds are going and also noted that spending does change through retirement.

In the study, for those just starting out in retirement, 44% of their expenses are related to housing, 15% transportation, 10% entertainment, 9% healthcare, 6% gifts and other, and 4% clothing. This shifts over time as seen in the chart below.

In our retirement planning process, we work hard to find a path for retirees to enter retirement debt free. Why is this so important? By not having a home or car payment, we are freeing up nearly 55% of the households cashflow. This free cashflow can be used in more fun ways, like entertainment, traveling, meals or helping others. For some it takes some dedication to get to be debt free and for others it is simply moving funds around to take a more conservative approach in retirement. Regardless of how you get there, it is very important.

When trying to determine you retirement expenses, look through the last three months of your credit card and bank statements. Use the budget worksheet link and enter in the items that you think will still be there in retirement. For many, they find retirement to be cheaper than working!

Download our printable budget worksheet.

Casey Smith

President

Click here to schedule a consultation with one of our financial planners.

Listen to Our Podcast:

Download our free guide: “Buyer Beware: Why do they keep trying to sell you that annuity?”

Have more questions? Contact Us

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.