Bond Pricing in a Rising Interest Rate Environment

Bond Pricing in a Rising Interest Rate Environment

Recession. Inflation. Higher interest rates. Bear markets. These are not words we love to hear; unfortunately, we’ve been hearing them a lot lately. The economic changes this year might have you wondering how one piece of the economic puzzle fits with another. There is a large degree of interplay between various constituencies like different markets, the Fed, and investors that drive economic change. To help unpack these dynamics, I’ll be answering frequently asked questions to help you better understand the current economic situation and how it might impact your financial situation.

What do Interest Rates have to do with Inflation?

The US Federal Reserve (Fed) sets monetary policy to try to keep the economy humming along with full employment and stable prices. One item in its toolbox is the ability to adjust the federal funds rate, or the rate at which banks borrow money from each other. This baseline rate influences interest rates on everything from mortgages and car loans to the interest earned on savings accounts or certificates of deposit (CDs).

Low-interest rates can help spur economic growth by making it cheaper for consumers and businesses to borrow money; conversely, higher rates can be used to cool off an economy that’s too hot. Rates were near zero to support the economy during the COVID-19 pandemic, but with today’s high inflation, the Fed is increasing rates in an attempt to stabilize prices. But raising rates will have some other ripple effects, too.

How Might Rising Rates Impact Me?

As with many things, how rising rates might impact you depends on your situation. Higher interest rates hurt borrowers since it makes it more expensive to take out loans but tend to benefit savers since yields on savings accounts and CDs will eventually improve.

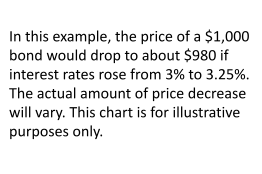

For investors, equities that typically do well in a growing economy could be well-positioned to withstand rising rates since the economy is in good shape. But since bonds have an inverse relationship with interest rates—as rates rise, bond prices fall—fixed-income investors are more likely to feel negative effects. Not all types of bonds will react the same way, but fixed-rate bonds with longer maturities are most sensitive to these changes.

But bond prices may not matter as much as you might think they do. While swift bond price declines can be upsetting, it’s important to remain focused on the long-term benefits of higher interest rates.

Bond total returns have two main components: price return and return from income. Changes to interest rates cause these two components to move in opposite directions. As a medium to the long-term investor, you should care more about bond total returns instead of the negative short-term impact on bond prices. The long-term performance of bond investments has come mostly from income return, not the price return.

Why Bond Bear Markets are Fundamentally Different from Stock Bear Markets

For bond investors, the price return component’s effect on total return decreases as time extends. For stock investors, the price return component of total return is much more significant. “The Lost Decade” is a great example of this: From January 2000 through December 2009, the total annualized return for the S&P 500 was -1%, inclusive of the reinvestment of dividends. The negative price returns caused by the bear markets of 2000-2002 and 2007-2009 had an immense impact on long-term returns.

Now take the bear market of the 1970s, which was seen as a terrible time to have been invested in bonds as both inflation and interest rates were soaring (sound familiar?). But consider this: long-term bond investors who reinvested their income returns, and remained patient as compounding took hold, nearly doubled their capital from 1976-1983. Over the longer term, bond total returns are driven much more by reinvestment of interest income and compounding than by price returns. Thereby making interest income and its reinvestment the largest portion of the total return in bond funds.

In light of these economic forces, here are a few takeaways to think through as you ride out the market downturns and rising interest rates.

Bond Math Holds up even During Interest Rate Shocks

Consider short-term Treasuries: interest-rate-sensitive securities whose total returns are extremely sensitive to central bank policy changes. As interest rates on the short end of the Treasury curve have risen due to expectations of further Federal Reserve policy adjustments, so too has the weighted average yield to maturity for funds that invest in these securities. That provides a better foundation to help you weather further rate shocks as starting yields are now much higher. Even if rates were to rise an additional 200 basis points (bps) from here, you would now recoup any lost principal within a year and benefit from higher yields moving forward-ultimately increasing the long-term value of your bond portfolio.

That means the time it takes to recoup your capital from an interest rate shock depends on your starting yield. A 200 bp interest rate shock from a 50 bp starting yield will take longer to break even when compared to a 200 bp rate shock from a 250 bp starting yield. The bottom line is that as rates move higher, bonds are more attractive for investors, not less.

A Dose of Perspective

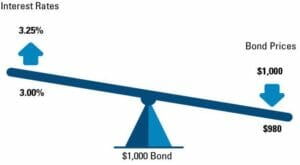

For context, the average federal funds rate since 1960 is just under 5%. It’s below that today, and the forecasted 4.0-4.5% by the end of 2023 would still be below average. In addition, the Fed has been forthcoming about its intentions, which gives investors time to work with their financial professionals to prepare their portfolios. Finally, bond and equity markets may react in the short term, but higher rates haven’t derailed market performance over the long term.

Current Federal Funds Rate Is Well Below the Long-Term Average

Average federal funds rates by decade (1960–Present)

Past Performance does not Guarantee Future Results

Average effective federal funds rate, not seasonally adjusted, as of 9/1/22. Stock returns are represented by the S&P 500 Index, which is a market capitalization-weighted price index composed of 500 widely held common stocks, using data calculated by Ibbotson Associates. Bond returns are represented by the IA SBBI US Long Term Corporate Index which measures the performance of US dollar-denominated bonds issued in the US investment-grade bond market, including US and non-US corporate securities that have at least 10 years to maturity and a credit rating of AAA/AA. Indices are unmanaged and not available for direct investment. The inflation rate, bond returns, and equity returns as of 12/31/21. Sources: St. Louis Fed

If you have any questions about your current financial situation and how it has been impacted by these larger economic dynamics, please give us a call to speak with one of our financial advisors.

Have more questions? Contact Us

Brad Lyons, CFP®

Investment Manager

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.