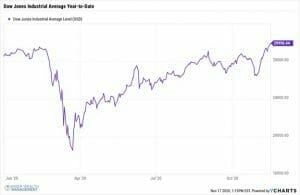

Dow Hits Record High

While most people are still experiencing at least some of the negative effects of the COVID-19 virus outbreak, the US equity markets seem to have shaken off any residual effects and moved completely past it. The Dow Jones Industrial Average recorded a new high on November 16, 2020 after Moderna surprised the world by announcing that their clinical trials for a virus vaccine have a 94.5% efficacy rate for preventing people from getting COVID-19. This came just one week after Pfizer announced its vaccine candidate tested over 90% effective against the virus.

The news sent the market soaring 470 points to close at a record level 29,950 points; this was its first record since February and within striking distance of 30,000 points.

It was only 7 ½ months ago, on March 23rd, when the index closed at 18,591, which was a level not seen by investors in the past 3 ½ years at the time. Investors that held the course and remained invested throughout the turbulence have been rewarded for their patience and perseverance. Much of their portfolios’ pre-pandemic account balances have returned, but it hasn’t been easy nor have the investment returns been evenly attributed. Growth investors and Large cap investors in particular have fared the best. Year-to-date large cap growth investors have benefited more than value investors due to the appreciation in large cap technology companies found in the Russell 1000 Growth Index. It has added 73% since March 23rd while the Russell 1000 Value Index added has 65%.

The Dow Jones Industrial Averages is a stock market index that measures the stock performance of 30 large companies listed on stock exchanges in the United States. Although it is one of the most commonly followed equity indices, it is not considered to be fully representative of the overall U.S. stock market compared to broader market indices such as the S&P 500 Index or Russell 3000 because it only includes 30 large cap companies. But records are records and The Dow setting a post-pandemic record is certainly one worth acknowledging.

Investors are clearly betting on a robust return to economic activity given the vaccine announcements. We remain optimistic of the chances for a more robust economy in 2021, but caution against an “irrational exuberance” approach to portfolio management or going all-in on the stock market. Public health officials still have to triage the population by health risk, distribute the vaccine and arrange for its administration to hundreds of millions of people in the US and billions more around the world. It is going to take some time and we shouldn’t expect a full economic recovery until late 2021 or early 2022 at the earliest.

Brad Lyons, CFP®

Investment Manager

Share This Story, Choose Your Platform!

Wiser Wealth Management, Inc (“Wiser Wealth”) is a registered investment adviser with the U.S. Securities and Exchange Commission (SEC). As a registered investment adviser, Wiser Wealth and its employees are subject to various rules, filings, and requirements. You can visit the SEC’s website here to obtain further information on our firm or investment adviser’s registration.

Wiser Wealth’s website provides general information regarding our business along with access to additional investment related information, various financial calculators, and external / third party links. Material presented on this website is believed to be from reliable sources and is meant for informational purposes only. Wiser Wealth does not endorse or accept responsibility for the content of any third-party website and is not affiliated with any third-party website or social media page. Wiser Wealth does not expressly or implicitly adopt or endorse any of the expressions, opinions or content posted by third party websites or on social media pages. While Wiser Wealth uses reasonable efforts to obtain information from sources it believes to be reliable, we make no representation that the information or opinions contained in our publications are accurate, reliable, or complete.

To the extent that you utilize any financial calculators or links in our website, you acknowledge and understand that the information provided to you should not be construed as personal investment advice from Wiser Wealth or any of its investment professionals. Advice provided by Wiser Wealth is given only within the context of our contractual agreement with the client. Wiser Wealth does not offer legal, accounting or tax advice. Consult your own attorney, accountant, and other professionals for these services.